Apartment investing can be one of the best ways to build wealth and grow your net worth.

But if you don't have a fortune to invest, can you still get started?

Absolutely!

Investing in apartments is great for any investor, whether you have $5,000 or $150,000 to invest.

In this post, I'll explain how to start apartment investing, how much money you can make investing in apartment complexes, and some easy methods to invest in multifamily properties. Let's get started.

- Investing in crowdfunding platforms like Realty Mogul

- Investing in private syndications or deals

- Invest in REITs with Acorns

How to Make Money Investing in Apartment Complexes

1. Invest in Apartments Through Crowdfunded Real Estate

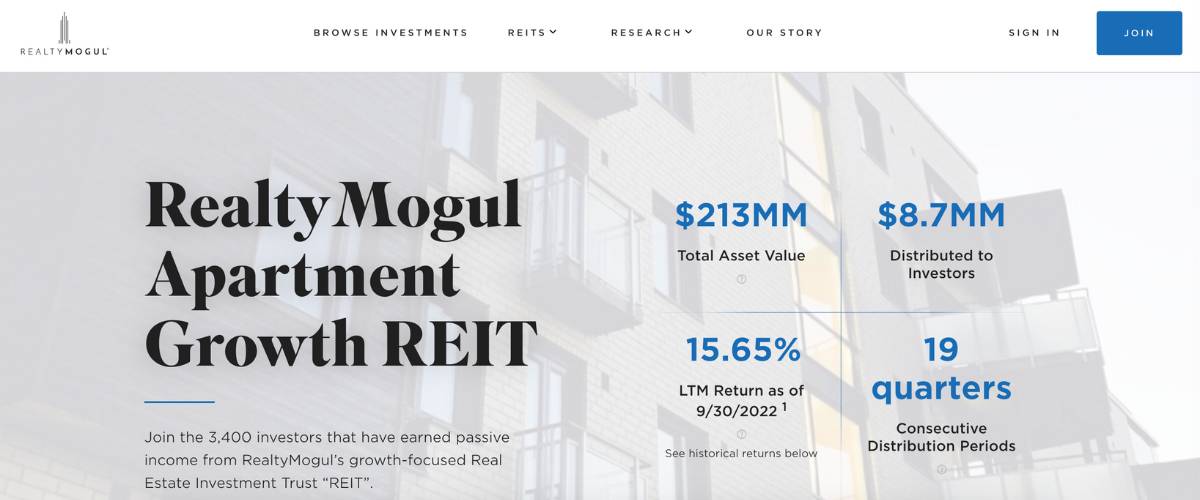

The easiest way to start investing in apartment buildings is through crowdfunded real estate investing. By using platforms like Realty Mogul – you can get started investing in multifamily properties without massive sums of cash.

Managing a multifamily property like an apartment complex is not easy work.

By using real estate investing apps like Realty Mogul you can ditch the headache that many apartment owners routinely face.

But that's not the only advantage of this form of investing. If you choose to purchase an apartment complex outright, you'll likely need to raise capital for a down payment, do due diligence, and detail what expenses might be forthcoming. One mistake can cost you thousands of dollars if you aren't careful.

With Realty Mogul, you won't need to worry about any of this. With as little as $5,000 you can starting investing in residential and commercial real estate meaning you won't need to raise money to get started.

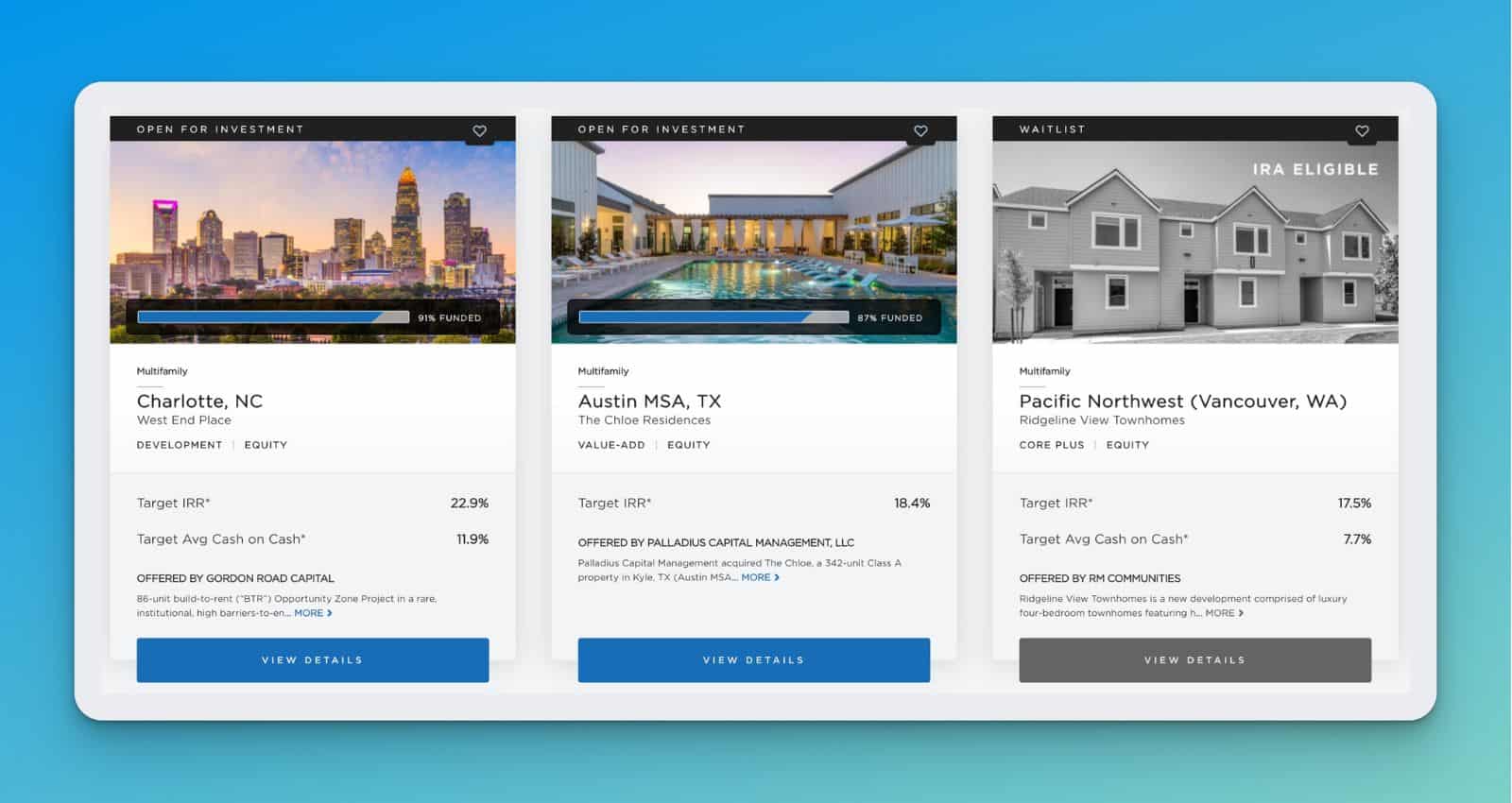

Another benefit of using Realty Mogul is that you can choose to invest in an apartment investing fund, or individual deals. For example, here are some of the current deals that you can invest in.

Realty Mogul has been around since 2012 and is a trusted real estate investing platform with over $1 billion of assets. With low fees, Realty Mogul is a cost effective way to grow your money.

2. Purchase an Apartment Complex to Rent

Purchasing an apartment building outright can be one of the more difficult methods to start apartment investing – but it can be done.

When investing in any multifamily property you'll want to consider a multitude of factors such as the location of the property, the current monthly rental income, the average vacancy rate, any property improvements that have been completed recently, the property value, and much more.

Finding a rental property to invest in can be difficult and take some time. You shouldn't purchase the first apartment building you see just to get started.

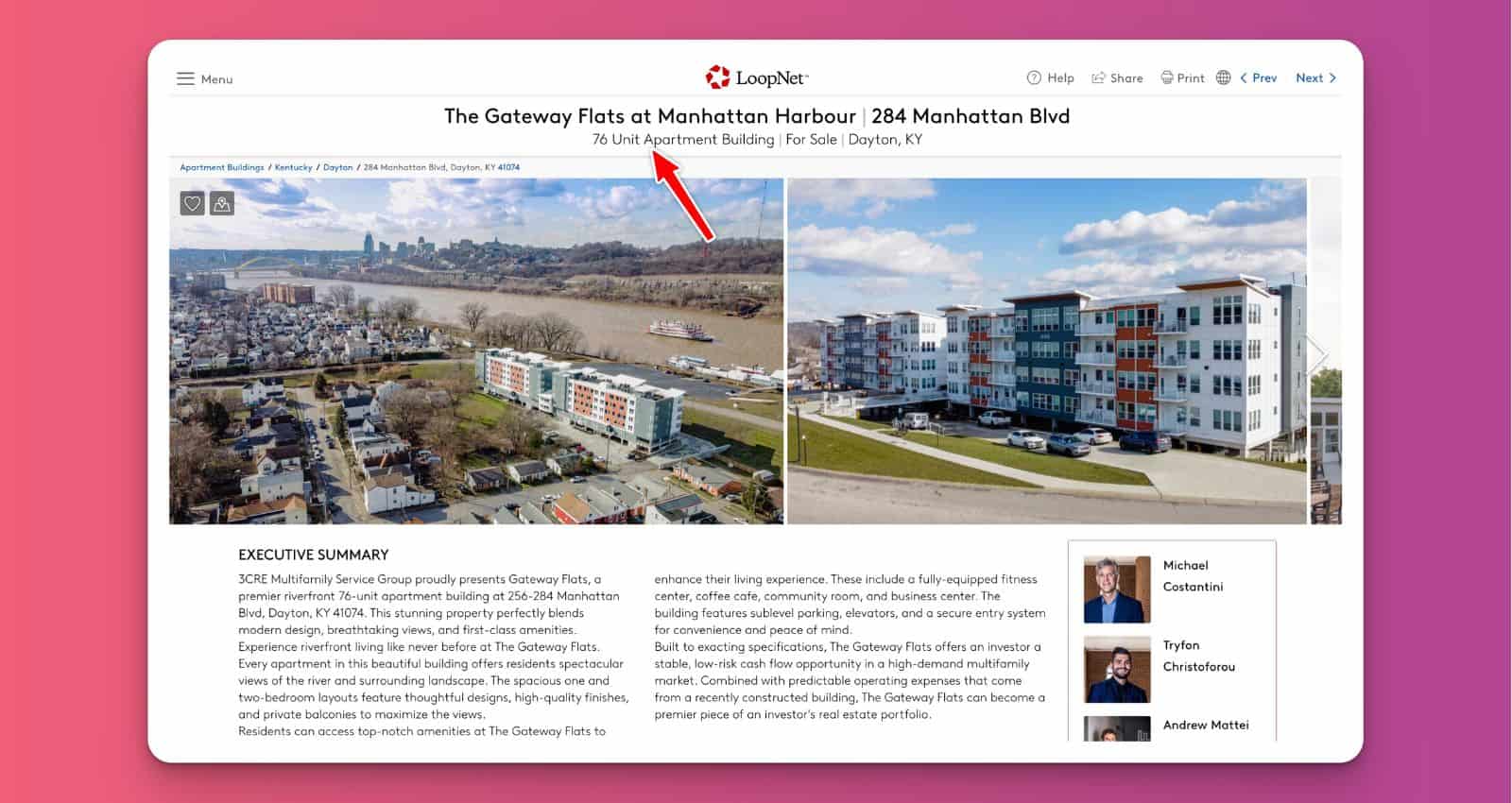

For example, check out this apartment complex for sale in my area. With 76 units, this is a large complex that could have great potential if managed correctly.

One of the frustrating parts of shopping for large real estate assets like apartments is that it's very difficult to find the asking price without picking up the phone and speaking to the realtor.

I've tried to find the asking price for this complex and it's nowhere to be found – which means you're going to have to give them a call to get more details. However, you can find tax assessments that can help to give you a baseline price. This property was last assessed at just over $14 million – so it's probably selling for upwards of $20 million.

You'll want to create a business plan, check the cash flow from the property, and analyze other expenses that might be coming before making your purchase.

New investors will often make the mistake of just purchasing an apartment complex just to start. Investment opportunities will come and go. There will always be another one – so don't rush the process to get started.

If you want more income – it's all about the number of rental units in the property. Most apartment buildings will have over 10 rental units. This usually leads to stronger cash flow but will raise the purchase price of the property.

If you're like me, you don't have $20 million laying around. So how do you get started?

Your best option is to start smaller and find investors to fund the deal.

By starting with a complex that's just a under a couple of million dollars you can then gain confidence from your investors to fund a larger deal.

Now, you're going to lose out on some of the profits by using an external investors, but if you want to get off the bench and play – this is a wise step in the right direction.

3. Invest in Real Estate Investment Trusts

A real estate investment trust (or REIT for short) can be another way to invest in apartment buildings and grow your passive income.

REITs are publicly traded companies that are traded on the stock exchange just like other companies. The difference is that their main business is owning and managing real estate assets.

The main difference is that with a REIT, you are likely investing in a company that owns more properties than just a single apartment building.

If you want even more diversity, you can invest in REIT ETFs – basically a group of REITs packaged into a single investment.

REITs can be great investments that pay monthly because they tend to offer steady dividends with large returns and they tend to be less volatile than other stock market investments.

Another benefit of investing in a REIT is the low barrier to entry. You can get started with just $10 by using a platform like Acorns, meaning anyone can get started – even if you're looking to invest $20. Create your account below to get started!

Here's a great video to help you understand how REITs work.

4. Consider Apartment Syndication Companies

Apartment syndications are similar to other forms of apartment investing. In short, you can think of it as a group of wealthy investors putting their cash together to purchase an investment property.

The money that the apartment building makes will then be split between the investors.

Real estate funds that use syndication are a great way to invest in scale because they can easily invest in more than one property. While you won't get to make your own decisions with this method, it's a great stress free way to make money while you sleep.

If you don't want to deal with tenants but want the advantages that apartment buildings offer – syndication is an excellent choice.

Want to learn more? Check out the video below!

How to Invest in Apartment Buildings with No Money

Most of the time, investing in apartment building will require some money. But not always. Below I'll explore a few ways you might be capable of investing in apartment complexes with no money.

1. Use Other Investors Money

The most likely way to invest in apartment buildings with no money is by partnering with other investors and using their money to fund your venture.

You'll need to make the deal attractive to them if you want to ensure them invest in your deal. For example, if you have strong property management skills or you have a strong track record of delivering results – this could entice investors to give you the money you need to invest in apartment complexes.

When using an investors money, they will give you a set amount of funds and in return, you will offer them interest payments.

For example, depending on the purchase price of your building, if an investor loans you $500,000 to fund your complex, they might request a 10% return each year in interest alone. They will also specify when payments must be made. If the investor give you a simple interest loan for 2 years at 10% interest, you would owe the investor $600,000 in two years time.

2. Partner with Investors

Sometimes an investor might want more involvement than just loaning you cash. This will often give them higher returns, but is more work for them.

Both partners will take on the risk of growing the properties.

This situation is ideal for investors who might not have significant real estate experience but still desire large returns.

Finding investors to parter with can be challenging and you'll need to navigate how you want to handle the relationship – so do your research before getting started.

Don't worry – we hate spam too. Unsubscribe at any time.

How Much Can You Make Investing in Apartment Complexes?

Investing in apartment buildings and other real estate properties can bring strong returns for investors.

Unlike stocks, apartment ownership can be a better investment in that you'll get several tax advantages (more on this below) as well as multiple methods of income appreciation.

It's very possible to see annual returns of 15% or more with real estate assets.

As with any form of investing, these are never guaranteed so you should never invest more than you can afford to lose.

Benefits of Investing in Apartments

1. Tax Benefits

There are many tax advantages that come with rental properties and other forms of real estate.

While you will have to pay property taxes – many of the expenses like maintenance issues can be deducted to lower your tax bill.

Any debt payments you make (like a mortgage) will be deducted from your income, helping you to save money even more on your taxes.

Finally, you can depreciate your property to lower your taxes even further.

Always check with a tax professional when analyzing the tax advantages of real estate because they can be very complex and vary depending on your situation.

2. Income Potential

By owning multiple properties you can exponentially increase your earnings and rental income.

Rental real estate is a profound way to grow your monthly income and overall wealth.

Whether you choose to invest in a single family property or commercial real estate – it's hard to go wrong.

Let's consider an apartment building with 50 units. Each unit brings in $1,000 a month. After all expenses are paid, we'll assume your costs are $600 a month per unit. This is a net profit of $400 per unit. For 50 units, this is a $20,000 cash flow each month. That's right – each month!!

By owning more apartment buildings you can boost this number even further.

If you want to make $50k a month, apartment investing is a great option.

3. Hedge Against Inflation

Real estate investing of any kind can be a great hedge against inflation.

What exactly does this mean?

Inflation can have a direct impact on the prices of both residential and commercial real estate. If you own a single family home you can easily see the impact of high inflation on home prices.

Additionally, because real estate typically out paces inflation, your home value will rise quicker than inflation – meaning the value of your home will increase more than the relative cost of everyday goods and services.

As inflation occurs, you can charge more and more for rent – which will even further increase the earnings from your assets.

4. Passive Income

Many investors crave passive income. This form of income is made without having to actively work for it like you would with a typical job. Who wouldn't want that!?

By hiring a property management company to complete the day to day work for you, your work will be limited with rental real estate – meaning you'll get that sweet passive income.

Another passive option is to invest in a real estate fund like Realty Mogul. This will limit the amount of work you will have to complete to make money.

5. Investing with Other Peoples Money

Many forms of real estate allow you to borrow money to invest. This is a very interesting proposition that is typically avoided. But for real estate – it makes sense.

Just think, a bank will allow you to borrow around 80% of the buildings value. This mean's if you're looking to purchase a $1 million apartment building, you can finance $800,000 of it and only pay a down payment of $200,000. The bank will routinely fund this venture because they know how likely it will be to succeed.

But that's not it. Not only do they allow you to finance it, but the rates are extremely favorable and there are tax advantages that come with it. Purchasing an investment property with a mortgage interest rate of only 4% is a no brainer. It can be easy to get much higher returns than the 4% you're paying.

Compare this to other forms of investing. For example, investing in stocks – you'll need to have the cash upfront to invest. Sometimes you might be capable of borrowing on margin, but the interest rates on this can be unfavorable and costly.

I love real estate investing because you can leverage other peoples money in order to turn a profit.

But there's one key warning – you must be careful when using other peoples money.

For example, relying on appreciation in order to make money can be a risky proposition that isn't guaranteed. You should always look for properties that can cash flow so you don't have to rely on appreciation – but if it does appreciate, that's a bonus!

Should You Invest in Houses or Apartments?

One of the largest debates in the real estate community is whether you should invest in houses or apartment buildings.

Here's the deal – there isn't one right answer. You can only make this decisions by considering all of your financial situations and circumstances.

Both houses and apartment complexes have advantages and disadvantages.

When it comes to deciding between the two, you'll want to consider your goals and situation.

Single family homes are a solid investment for many investors looking to grow their rental income each month. However, this does come with the cost of scalability. Purchasing and managing many single family homes can be more difficult and costly that an apartment building.

I've owned a single family rental for a few years now and while it's a strong investment, it can be a pain to manage.

Owning an apartment building gives you much more diversity than a traditional residential property, but it usually will cost your more money to get started.

Either way, you can't go wrong by investing in apartment buildings or a single house.

Final Thoughts on Apartment Investing

Investing in apartments can be an excellent way to grow your income and reach financial freedom.

If you're currently working a job you hate or you just want to make money on autopilot, using apartment buildings and other rental properties can be a great way to reach your goals.

There are many benefits of investing in apartment buildings and other real estate assets. Whether you're searching for multifamily real estate or a single family property – getting started is the first step.

While you might be thinking you need a massive down payment or upfront capital to get started – sometimes it's possible to invest in real estate assets without money.

If you haven't already, I highly recommend investing in apartments with a platform like Realty Mogul to get started investing in apartment complexes and more.

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

13+ Best Tangible Investments to Build Wealth (2024 Guide)

Looking to grow your wealth and make more money? Consider these tangible investments to build wealth and boost your income.

How to Invest and Make Money Daily + Fast (21 Legit Ways in 2024)

Looking for places to invest to make money daily? Give these easy options a try to make money investing today!

Are Investing Apps Worth It (2024 Guide)

Looking to start investing but aren't sure if it's worth it? Read to learn if investing apps are worth it or not!

How to Make $500 a Month in Dividends (2024 Guide)

Want to make $500 a month in dividends? Check out this guide to determine how to get started making money with dividend stocks!