If you're just getting started investing, you might be curious what returns you can make. After all, that's the whole reason to invest your money – to turn your money into more money.

The stock market can be an excellent choice to build wealth and grow your money – and ETFs are some of the best investments to generate compound interest.

In this post, I'll explore the average ETF return, how you can invest in ETFs, and much more. Let's get started!

What is an ETF?

An ETF, or exchange-traded fund, is a pooled investment that works like a mutual fund. It typically tracks an asset or commodity and can be sold on the stock market just like a regular stock.

With an EFT, you can structure it to track anything you want. They can even work to track investment strategies. The first EFT was the SPDR S&P 500 ETF. This one work to keep track of the S&P 500 Index. It's still being traded around the market today.

An ETF is a unique investment that can generate tremendous monthly returns for your portfolio.

What Can You Expect in Stock Market Returns?

Before we talk about ETF returns, it's critical to cover the average annual return of the stock market as a whole. What can you expect in stock market returns? What are some of the average returns at play?

It's critical to remember the stock market is a world of ups and downs. Nothing is set in stone, ever. Over the years, a 10% average return has proven to be a number most investors can count on with their funds.

Just because an ETF isn't doing well doesn't mean it will never do well.

When working in the stock market, it's critical to:

- Stay cool when it's going well: Don't get too excited when things are looking up. A lowered guard can result in lost money.

- Look on the upside when it's bad: When results are poor, use this as an opportunity to invest more.

These will keep you on track as the stock market continues to grow.

EFTs are a small part of the world investors work in today. The more risk you take, the more you could lose. However, you could also see an excellent return in time.

Don't worry – we hate spam too. Unsubscribe at any time.

How Are Annual Returns Calculated?

There is a particular way an average annual return is calculated with stocks and the ETF market. For example, if you note a 10% annualized return over ten years, the average return for that particular fund is 10%. Although it can vary, you will often see average returns calculated in 1, 5, and 10 years for the ideal viewing experience.

How are annual returns calculated? Let's take a look at the average returns of the S&P 500:

- 2010: 12.78%

- 2011: 0%

- 2012: 13.41%

- 2013: 29.6%

- 2014: 11.39%

- 2015: -.73%

- 2016: 9.54%

- 2017: 19.42%

- 2018: -6.24%

- 2019: 28.88%

- 2020: 16.26%

- 2021: 26.89%

If we look at these numbers, how can we find the average annual return for your account?

First, you will need to add everything together. For this case, that will look like (12.78+0+13.41+29.6+11.39-.73+9.54+19.42-6.24+28.88+16.26+26.89), which comes out to 161.2. Then, divide everything by 12. When we take 161.2 and divide it by 12 (the number of years), we get 13.43. For this spread example, the average return over ten years is 13.43%.

It's critical to note that this number won't be consistent every year. There will still be years with high yearly returns and years where it falls well below the average.

How Can You Find the Average ETF Return?

Every ETF has a different average annual return. If you want to find how much your ETF is expected to bring back this year, there are two methods you can take advantage of for your exchange-traded funds. Both of these will help you improve your average annual returns and predict future performance for your investments.

To find the average ETF return, you can check the fund's performance with:

- A DRIP calculator

- The ETF performance page

These are equally beneficial.

Let's dive into each of these techniques to give you a better idea of how you can stay on top of your total return. A good return on an ETF can mean the world to your investing portfolio.

Utilize a DRIP Calculator

A DRIP calculator works to tell you about the rate of return you'll receive if you reinvest dividends or take them as payment. It's a calculator that helps plan for dividend reinvestments, and it can be helpful when it comes to the average ETF return.

A good DRIP calculator will help you estimate the average return for an ETF over a certain period. It will inform you of the value you will get back if you reinvest your dividends. You can also use a comparison tool to see which ETF will give you the best return.

If you're never used a DRIP calendar before, it's never too late. Take advantage of one to see what your investments will look like in the future.

Look at the ETF Performance Page

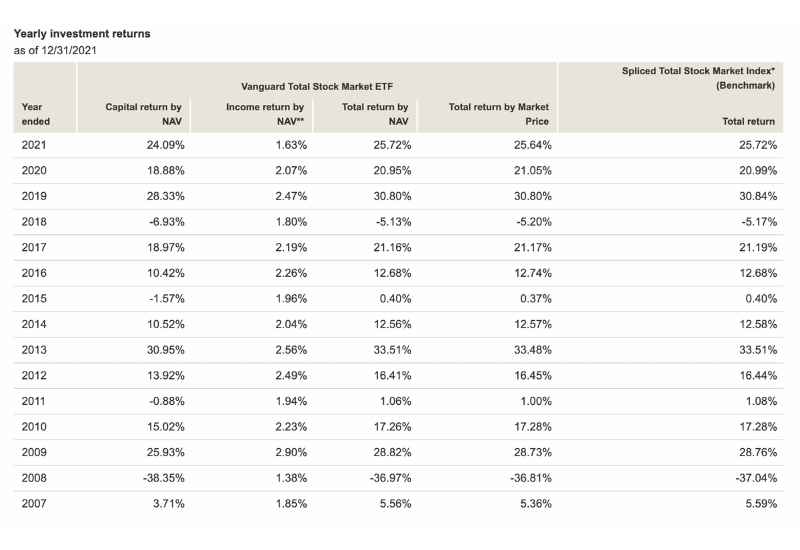

The next way to look for the average EFT return is to look at the ETF performance page. This page can be found with a quick Google search. By looking up the average return of your fund, you should be able to locate a table that will provide all the information you need.

When looking at an ETF performance page, there's a lot of information to understand.

The fund will typically be on the left of the table. The ETF performance will be on the right side of the table. You can see items like the annualized return, how they've performed since they came into existence, and performance over a 1, 5, and 10-year period.

Taking a look at past performance can be helpful when making future decisions based on the predicted performance of your ETF.

Here is an example of the Vanguard Total Market ETF (VTI) where you can easily see the returns.

What is the Average ETF Return?

The benchmark standard for the ETF is the S&P 500. Most often, the average has fallen to be around 10%. Thus, the average is around 10%. Still, it depends on the index that the ETF is tracking.

It's critical to understand what the ETF is tracking before investing in it. For instance, a sector-specific ETF is only a portion of the market. Because of this, your returns might be greater or less than most of the other markets.

Compare and contrast the various performances of ETFs on the market before you select one for your portfolio. An average ETF return should be close to the S&P 500 benchmark.

What Return is Considered Ideal?

An ideal return is around 10%, which will match that of the S&P 500 index standard.

Consider this possibility before investing. Will your fund make it close to the 10% set forth? If not, you might be better off putting your funds right into the S&P 500 Index Fund.

Because ETFs are such a passive form of investment, it's critical to do your research ahead of time.

You don't want to make less money on a minimal amount of work. If you're only getting a return on 5% of your money, why not up your game and pick the fund that will bring in 10%? It's always better to select an index fund that will bring in a large return with fewer expenses and less time wasted on your end.

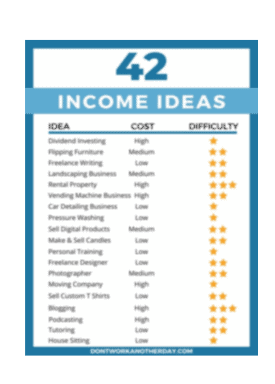

What Are the Best Index Funds to Invest In?

There are many excellent index funds available on the market to invest in for your portfolio. They all track various items, so you can anticipate a different return on each. Let's talk about a few of the best index funds to invest in on the market today.

A few of the best ETFs to invest in include:

- Fidelity ZERO Large Cap Index

- Shelton NASDAQ-100 Index Direct

- Vanguard S&P 500 ETF

- SPDR S&P 500 ETF Trust

- Vanguard Russell 2000 ETF

These have extremely low fees while providing an excellent return.

It's vital to do your research before selecting an index fund investing option. There are many factors to consider, and not every person will have the same priorities when choosing an index fund or ETF.

Pros and Cons of ETFs

If you're considering an ETF, some good and bad things come with them. These are critical to understand before you go all-in with the investment. There is no guarantee with any money, so it's vital to weigh your options first.

Here are a few of the pros that come with ETFs:

- There is risk management through diversification

- There are fewer broker commissions and lower expense ratio options

- There are some ETFs that focus on targeted industries

- There is access to stocks across a variety of industries in the world

Of course, there are also poor qualities to consider. These include:

- Higher fees for actively managed ETFs

- Not much liquidity, which hurts transactions

- There are a few ETFs that limit diversification by focusing solely on one industry

What's the Difference Between ETFs and Mutual Funds?

The main difference between an exchange traded fund and a mutual fund is the way they are managed and the fees associated with them.

Exchanged traded funds are a more passive investment that don't require much analysis and tweaking to reach their optimal performance because they are so diversified.

Because exchange traded funds don't require much work to maintain, they offer extremely low fees that make many investors happy.

Mutual funds aim for a higher average return than the typical stock market performance. Instead of shooting for a 10% return, some mutual funds will aim for 12% to 15% or even higher.

To do this, they must constantly tweak their portfolio to only hold stocks they believe are on the rise and have strong potential.

Because of this more active approach to investing, mutual funds have a fund manager that they must pay to complete the analysis and make investing decisions for the fund. Therefore, they tend to have much higher fees when investing which can eat into some of your profits.

Ultimately, both mutual funds and ETFs are great investments you can use to start making money with the stock market.

By investing your money into a low cost ETF, mutual fund, or index fund – you can easily turn your money into more money and build long term wealth.

What's the Difference Between an ETF and Index Fund?

Index funds and ETFs are extremely similar and only have a few small differences.

Both of these options have low fees and are a great investment option for both novice and experienced investors looking to diversify their portfolio.

Index funds can only be traded at the end of the day whereas ETFs can be traded similar to stocks throughout the day.

This means if you place an order for an index fund at 10AM, it will not get processed until the end of the day.

If you were to place an order for an ETF, it would get processed immediately.

Another common difference is the amount needed to invest. ETFs tend to have lower prices than index funds making them an attractive option for new investors.

Both index funds and ETFs are a great way to generate gains in the market and diversify your portfolio through a variety of sectors.

How Do You Invest in an ETF?

What if you've never invested in an ETF before? How do you invest in an ETF? There's a process you should be familiar with before diving into this fund world for the first time.

Here is the typical process you will need to follow if you want to invest in an ETF:

- Open a brokerage account or robo advisor: Find a brokerage to help you buy and sell EFTs without too many complications. I recommend Acorns. You'll get $10 free to invest when you open your account!

- Find ETFs and compare them with screening tools: Look at the available options and utilize screening tools to compare the benefits and disadvantages.

- Pick a trading option: Choose the location you want to trade and the market you want to target for your trading. Then, place the trade.

- Sit back and wait for a return: Wait and see how well your EFT performs. You don't need to check it as often as a traditional stock.

Final Thoughts on ETF Returns in the Stock Market

As with any investment, it's critical to consider all aspects of EFTs before deciding what to invest in for your portfolio.

An EFT return should at least have an average of 7% to 10% to match the S&P 500 benchmark.

An EFT is great for diversification, fewer broker commissions, and lower expense ratios compared to other stock market options.

Don't worry – we hate spam too. Unsubscribe at any time.