If you're in your 20s, owning assets is key to reaching financial freedom.

While you might be tempted to purchase a new car, a nicer home, or spend money on luxurious clothes – this can lead you down a terrible path on your financial journey.

So which assets are the best to invest in and are worth your money?

In this post, I'll help you uncover the absolute best assets to buy in your 20s so you can make wise financial decisions and reach your financial goals. Let's dig in!

Best Assets to Buy in your 20s

1. Index Funds

Index funds are hands down one of the best assets to buy in your 20s.

Anytime you invest in the stock market you'll want to diversify you investments and that's exactly what an index fund does.

An index fund is essentially a group of stocks that are packaged together so you can easily buy and sell them all at once. If you wanted to do this on your own, you'd have to purchase hundreds of stocks individually, which would be a massive pain.

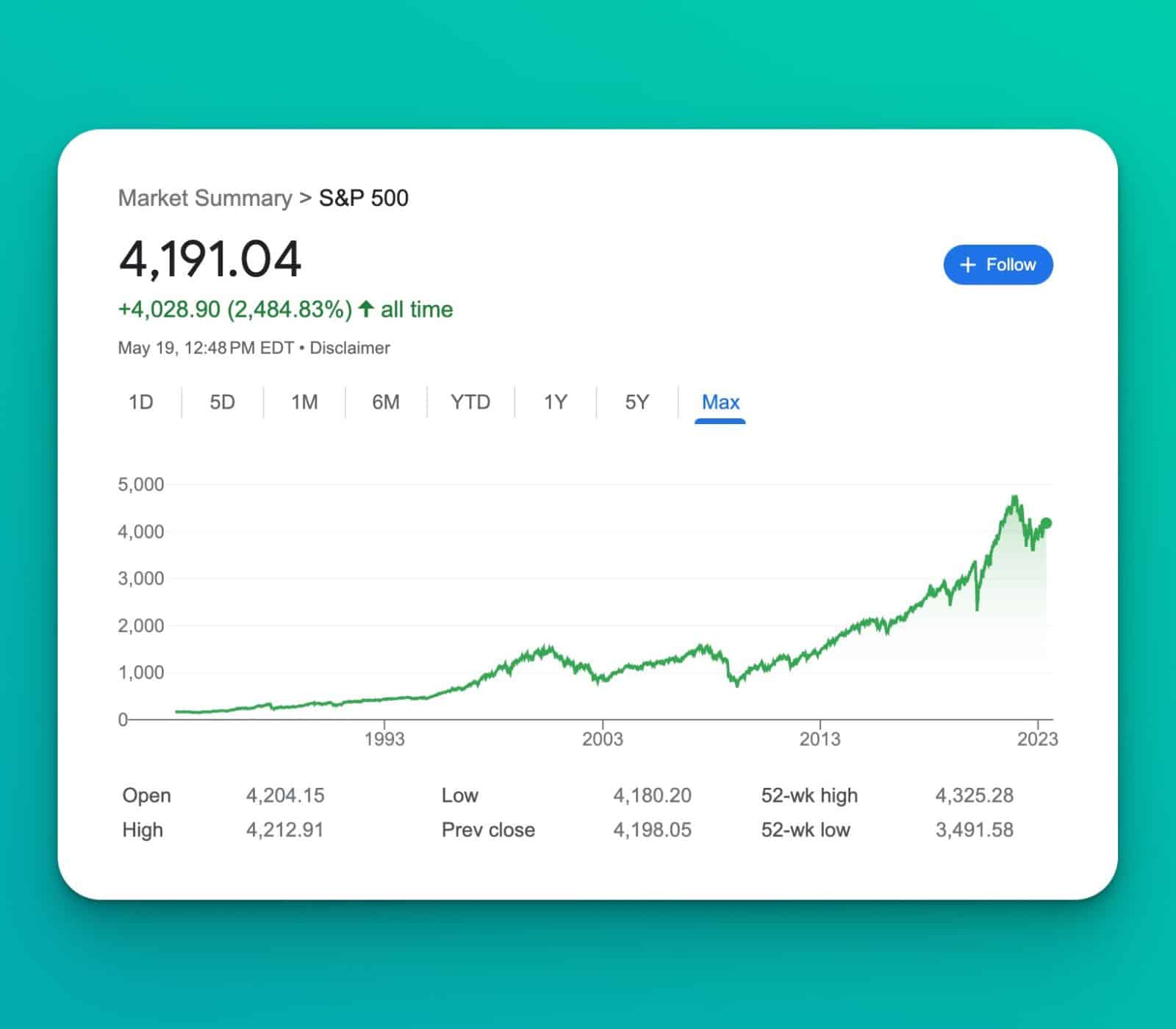

Past performance of index funds are quite strong. It's common to receive anywhere from 7% to 10% annually from your investments with an index fund.

Check out the returns of the S&P 500 since it's inception. It's hard to argue against that!

If you're looking to start investing and don't want to do a ton of research, investing in a simple index fund is a tremendous option that I would highly recommend.

Need another reason to invest in index funds? The fees are extremely low, meaning you'll keep more of your profits.

If you're ready to get started, I highly recommend giving Acorns a try. By using Acorns, you can easily purchase your favorite index funds, ETFs, mutual funds, individual stocks, and much more. Plus, when you register with the link below you'll get $10 for completely free. Who doesn't want free money!?

2. Crowdfunded Real Estate

Real estate is another terrific asset to buy in your 20s because of how stable and profitable it can be.

When you think of real estate, you might not think of it as being a profit machine – but it certainly can be!

I've been investing in real estate for over 5 years now and it's been an amazing investment.

Best of all, there are many different ways you can get started whether you have $100 or a few thousand to invest.

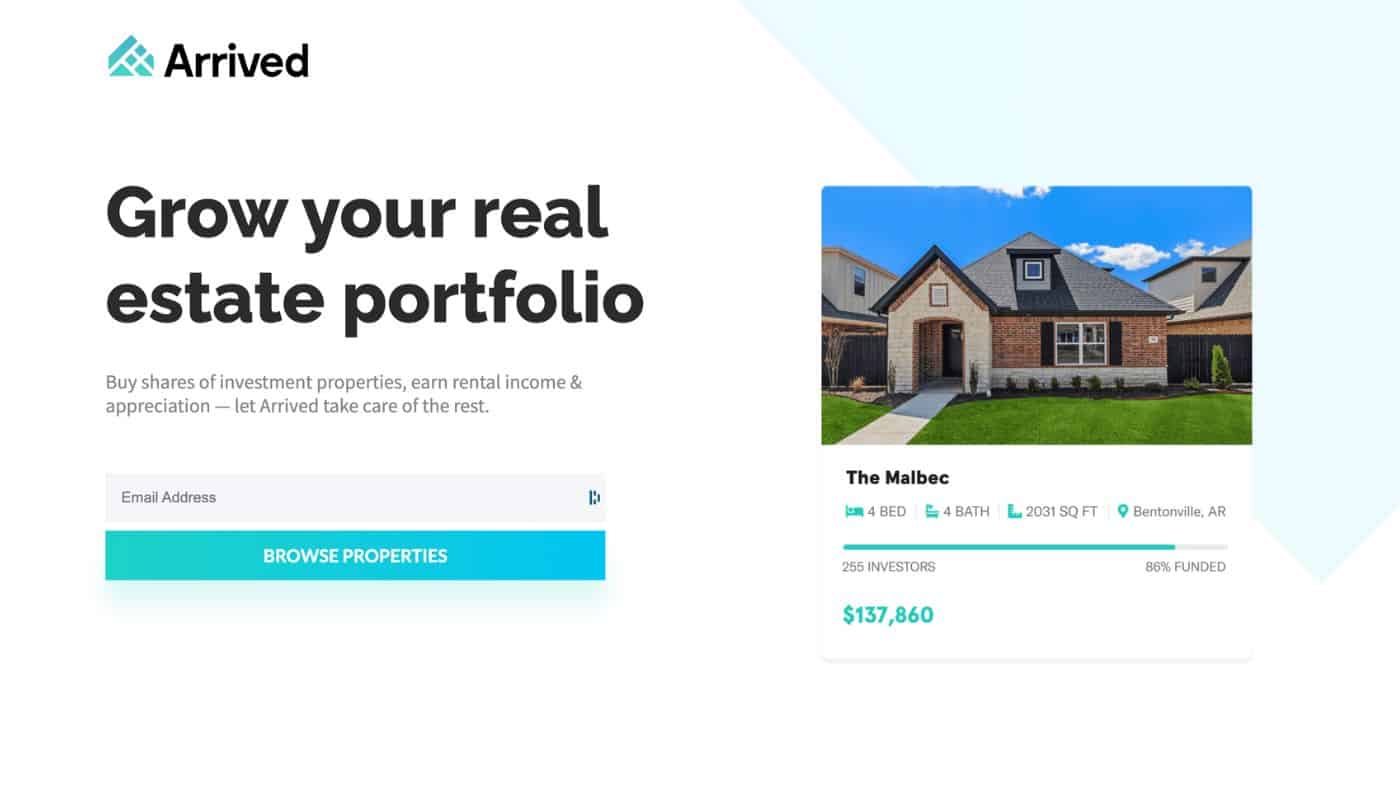

The easiest method is to use a crowdfunding platform like Arrived.

Arrived allows you to invest in individual rental properties across the country with as little as $100. You can pick exactly which homes you want to invest in, which I'm a huge fan of and you'll get paid out quarterly based on the performance of your rental which is nice.

-

$100 minimum investment so anyone can get started

- Access to individual properties so you can pick and choose which properties to fund

- Quarterly payouts depending on your properties performance

- Open to both accredited and non accredited investors

- Minimal 1% management fee

- Some offerings are funded quickly

3. Rental Properties

If you're not afraid of more work, purchasing your own rental property can be even more profitable than crowdfunded real estate assets.

Real estate can make money and increase in value through a few main methods: rental income, appreciation, rental appreciation, and equity pay down.

To start investing in rental properties, you'll need to have your finances in a solid place. If you're planning on getting a mortgage for your investment property, you'll need to have 20% of your loan for a down payment and also have the income to afford the rental home when it's not being rented.

Don't forget about the expenses a rental home can cost, however. Whenever you analyze a potential deal, you'll want to think about costs like property management, repairs, vacancy costs, and other expenses that come with owning a home.

For example, if you find a home that will cost you $1,000 a month and you believe you can rent it for $1,300 a month – you might be lucky to break even after the costs listed above. However, if your home costs $750 a month and you can rent it out for $1,300 you should have no problem cash flowing each month.

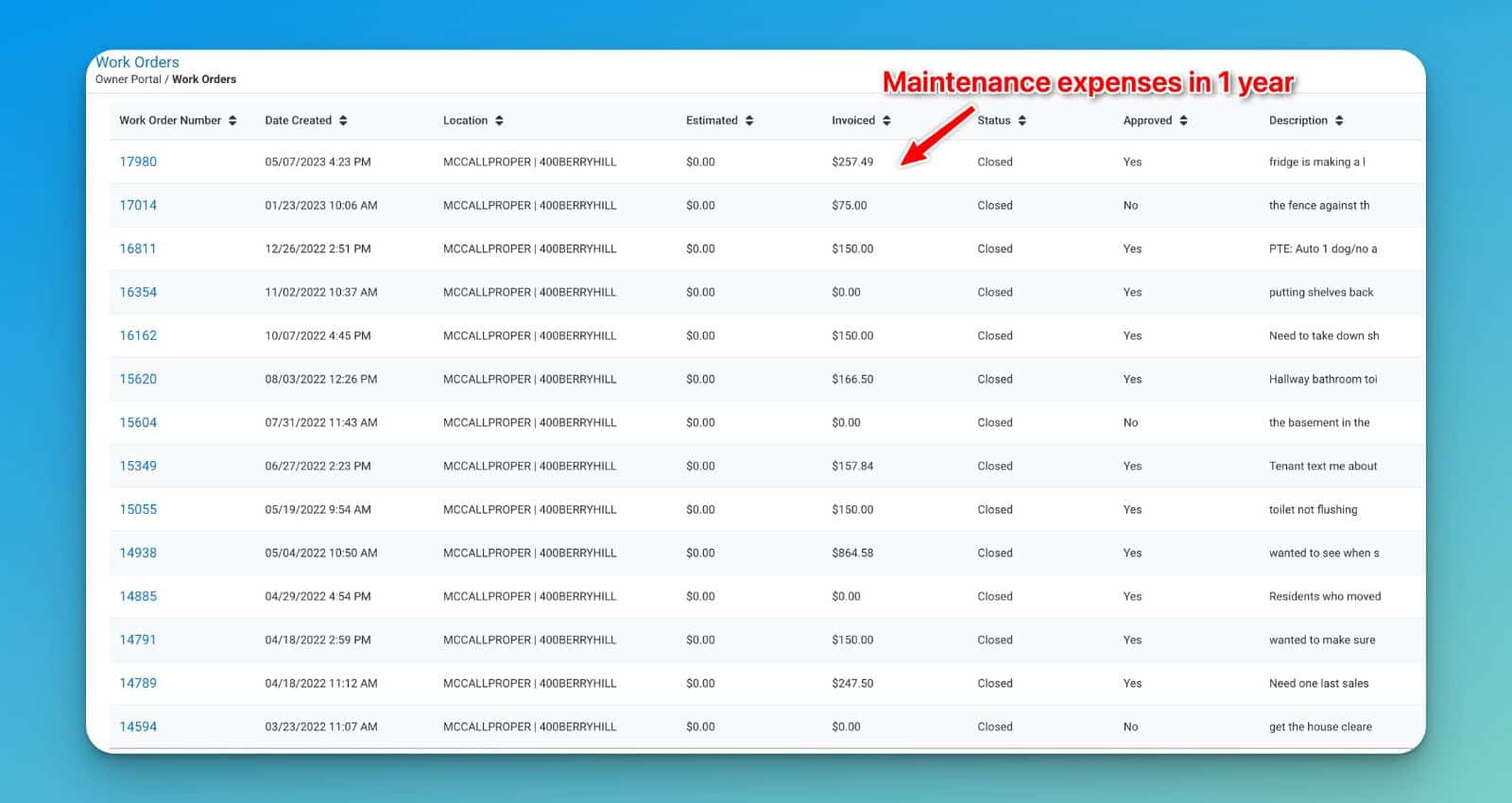

I've owned my rental property for just under 2 years and so far it's been a mixed bag in terms of ROI. I have a property management company doing all of the work, but this really eats into your profits. They take a 10% cut in addition to charging you for any maintenance (which is not cheap!).

Here's a list of the maintenance expenses I paid in a single year.

Overall though, this is a long term investment. In a few more years I have no doubt it will be a tremendous investment that I'm glad I was able to make.

4. Dividend Stocks

Dividend stocks can be a great investment for young investors looking to build wealth. These investments have a strong track record of returns and they are great assets to buy at any age.

I love the income predictability of dividend stocks. Most of these stocks have a history of paying dividends that is easy to track and predict. This can help you to understand your future income from your investments.

Most investors fail to realize the amount of money you can make with dividend stocks.

Want to invest in dividend stocks? I recommend using Acorns to get started. Plus, you'll get $10 free!

5. Websites

This alternative investment often gets overlooked by most investors for one main reason: they don't know enough about it!

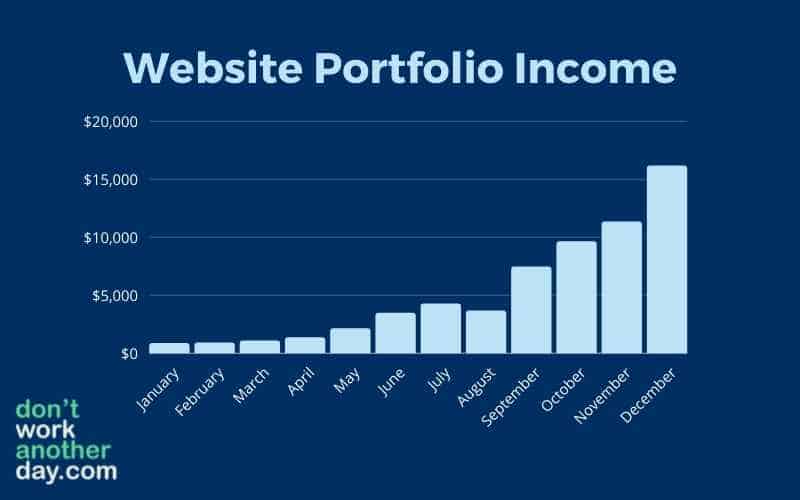

Websites can make a significant amount of money each month and become an amazing stream of passive income over time.

Another benefits of investing in websites is the ability for almost anyone with an internet connection and computer to make money online. You don't need any special skills or equipment to get started!

Many websites can earn over $3k a month, but some can earn much more. Outside of the monthly income they can make, they will also gain value based on their income. This means that you can potentially sell your websites for a nice profit in the future (but remember the capital gains that come with it!).

For example, it's common for websites to sell for 40 times their monthly profit. So if a website earns $1,000 a month – it could be worth as much as $40,000!

My portfolio of websites consistently earns over $10k a month. This means if I wanted to sell them I could likely get $400k from them!

Now, it can take some time to make this much money from your sites, but it is possible.

Ready to get started with website investing? Check out the video below!

6. Real Estate Investment Trusts

One of the easiest assets to buy in your 20s is a real estate investment trust, or REIT. Just like with crowdfunded real estate – this method of investing allows you to grow your money without the headache and stress of owning a rental property yourself.

REITs are some of the best assets you can own because of their stability and I highly recommend them.

These are publicly traded companies that you can invest in through the stock market by using an app like Acorns making it super easy to get started without needing a fortune.

They can own many different residential and commercial properties which offers more security than investing in a single property which is just one reason so many people love them.

The returns will be similar to those of an index fund, but this gives you more exposure to real estate assets.

7. Social Media Accounts

Another alternative investment that I think will be a strong investment for the future is social media accounts.

As the internet continues to evolve and brands look for ways to connect with their audience, social media can become more and more valuable and a great way to make money online.

Some social media accounts can make millions each year from their content, but it doesn't mean it will be easy.

For example, check out Sahil's Twitter account. He's amassed almost 1 million followers and has claimed he makes a fortune from his account.

You'll need to spend time growing a dedicated audience online if you want to be successful with this asset. But if you manage to do so, the income can be life changing.

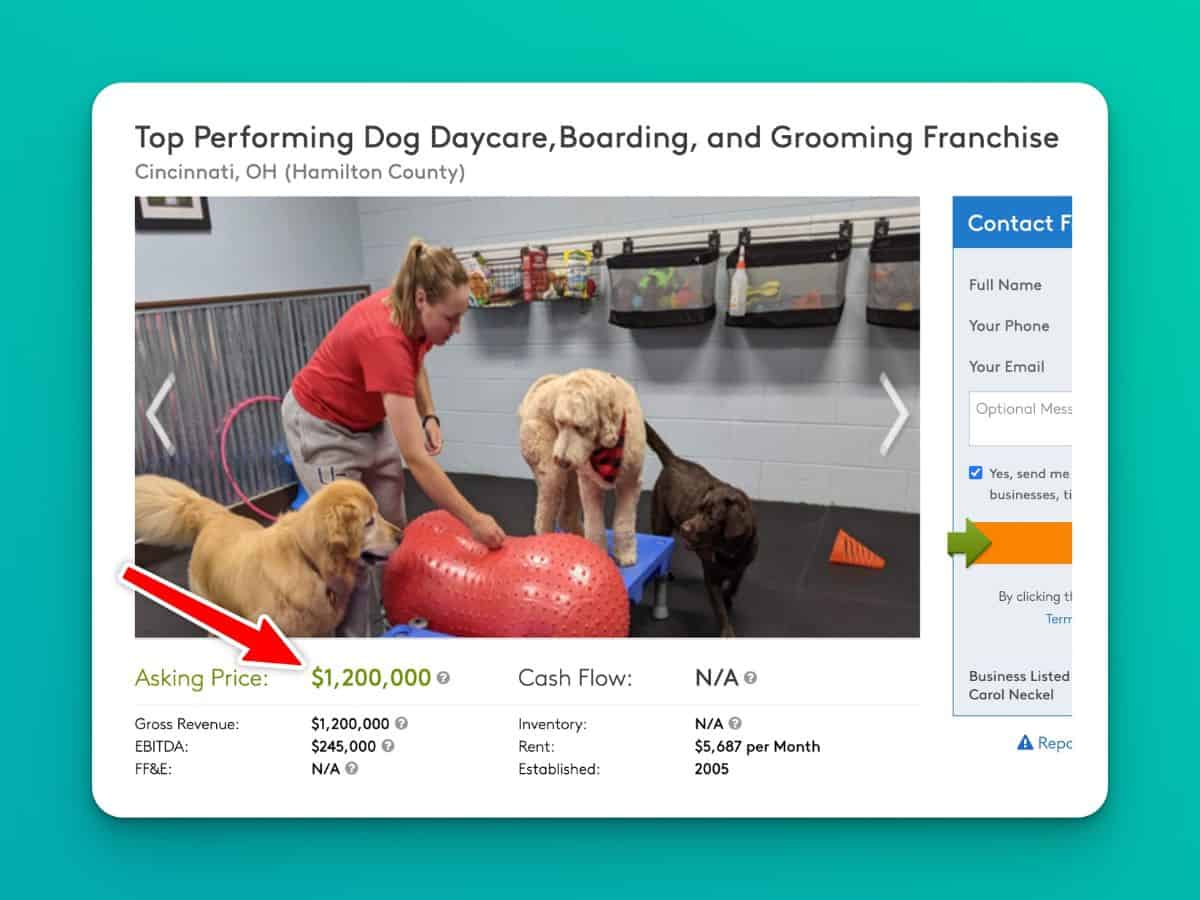

8. Own a Business

While there are many assets to buy in your 20s that can be easily bought or sold, a business is slightly more unique.

While you can purchase a business that is for sale, it can be quite expensive.

Instead, starting a business can be a better investment of your time and money – but it's not always easy and it can require a large time commitment.

Starting and growing a successful business will require a unique combination of skills and hard work – and there are no guarantees.

On the bright side, businesses can make millions of dollars each year and make you a millionaire. Depending on the size of your business, it can easily replace your typical job.

Additionally, if you're capable of growing a business, you can eventually sell it for a nice profit.

Check out this business for sale in my area. It's listed for $1.2 million!

You might be thinking to yourself “But I don't have a great idea!”

But you don't need to have the next big idea to start a successful business. There are many small businesses that can make a fortune by completing basic tasks and services that people need.

Think about a service business like lawn care. While the competition is stiff, it's possible to make well over 6 figures from your business by completing weekly mowings, landscape work, and much more.

You won't find starting a business in most pieces of investment advice, but I believe it can be one of the best assets to buy in your 20s and beyond.

9. Retirement Accounts

Retirement accounts like a 401k or IRA can be some of the best investments you can make early on in your career. If you work for a company that offers a retirement plan it's wise to start investing into these tax advantaged accounts as soon as possible.

If the company you work for offers any kind of match – by not investing in it, you will be leaving free money on the table.

A tax advantaged retirement account like a Roth IRA or 401k can be one of the best assets to own and it's a great low risk investment over the long haul.

There's one thing worth mentioning when it comes to retirement accounts, however.

Because these are designed for your retirement, you can face hefty taxes and penalties if you need to withdrawal money before retirement age. For this reason, many people will also have a traditional brokerage account that they can access more freely if needed.

10. Education and Knowledge

At a younger age, your education and knowledge is more valuable as it can compound your earnings over time.

Becoming more educated typically means you'll have a higher income job.

For example, learning how to code can bring a plethora of opportunities to make money like building websites for others or teaching others to code.

Growing your knowledge is a great way to make more money – but it comes at a cost.

You'll typically have to pay for your education (and sometimes it can be extremely expensive), but you don't always have to.

There are many online platforms like YouTube and SkillShare you can use to learn skills completely free of charge. While you won't receive a diploma or certificate, it can give you all of the skills you need to thrive in the gig economy and beyond.

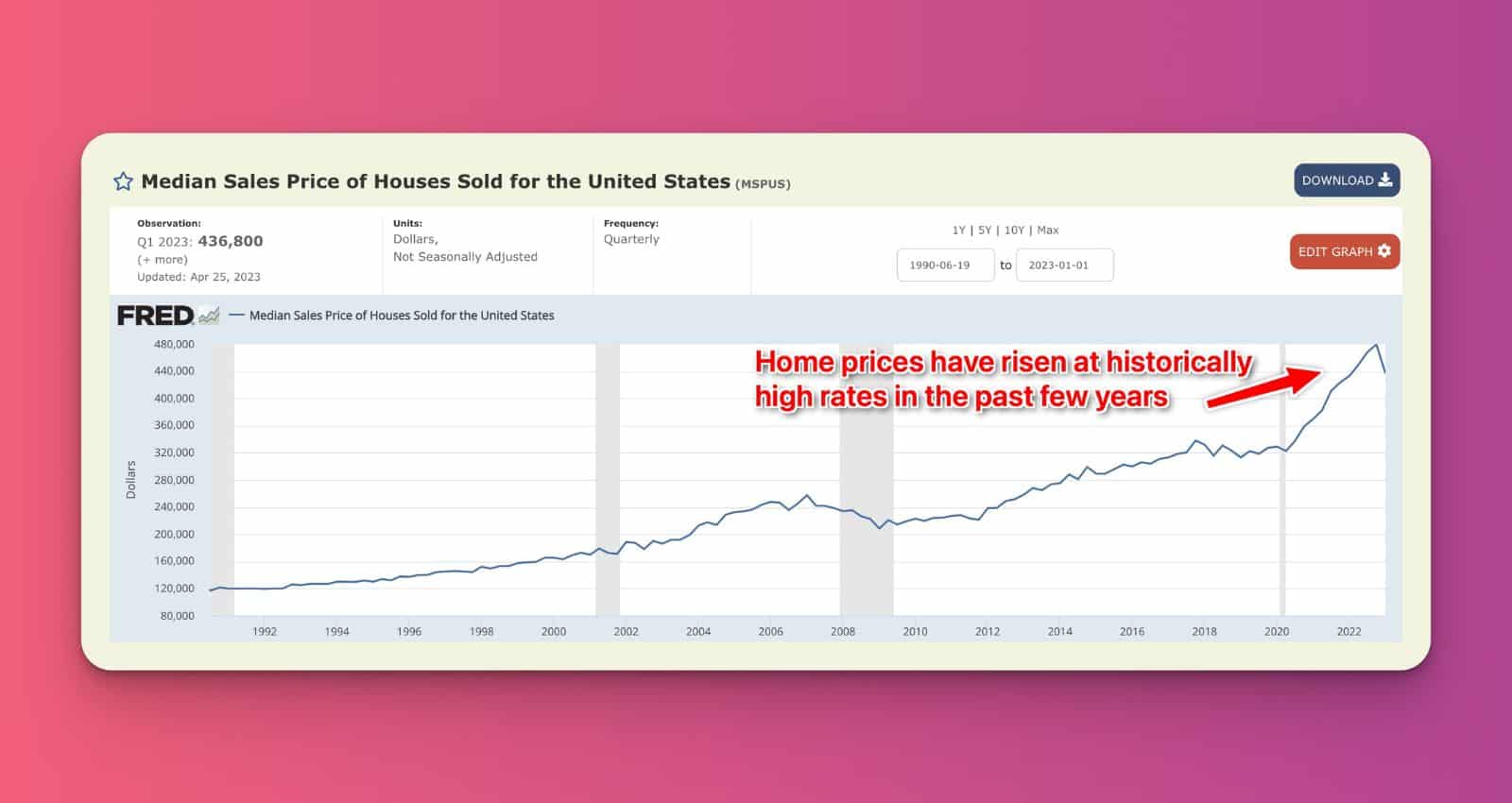

11. Primary Home

A home is likely the first piece of real estate you'll own – and it can be one of the most powerful, also.

By purchasing a primary residence that isn't overly expensive, you can start to gain the value that real estate provides.

As you pay down your mortgage you will build equity in the home and it will likely also appreciate in value.

For example, if you purchase a home for $200,000 – a few years later it might be worth $210,000. By that time, your mortgage might only be $195,000. You just built $15,000 of equity in just a few years time. Not too bad!

Check out home prices since 1990. That's some pretty solid growth!

But there are plenty of expenses that come with owning a home. Between home repairs like a new roof, HVAC unit, landscaping, and other random expenses, it can be somewhat expensive to own a home. It's still arguably a strong investment to grow your money, however.

But your home is more than an investment. It is also a place to live and grow your personal life. Even if your home decreased in value, many people would still want to own it because of the memories made in the house.

Purchasing a home can be one of the best assets to buy in your 20s as long as you don't over spend!

Finance Tips for People in Their 20s

Avoid Lifestyle Creep

In your 20s you're likely to get a higher paying job and start making a high income. It's important not to let your living expenses rise at the same rate as your income.

While there are many unexpected expenses that will pop up – controlling your normal expenses is vital. Even if your minimum payments might seem low on your expenses, think about the total costs.

Establish an Emergency Fund

Having an emergency savings is a great staple for any family. While you might think your job security is high, it's possible to lose your job for almost any reason.

Having an emergency fund as a backup source of cash can help to mitigate any financial pressures you might be facing when losing an income.

Saving early is one of the best steps you can take to enhance your financial future.

Be sure to keep your emergency savings separate from your other accounts and only use it when it is truly an emergency.

I recommend storing your emergency fund in a high yield savings account. My favorite is through CIT Bank. It's completely free and interest rates on these accounts are around 10 times that of a traditional savings account.

Open your free account below to get started!

Invest for the Future

Investing is essential for wealth creation and financial success. If you are able to take advantage of an employer sponsored retirement plan or another investment account, this can be a great way to pave a stronger financial future.

Investing works by giving your money time to grow. While a 7% return might not be attractive immediately, over time it will compound and grow exponentially.

Eventually your brokerage account might amount to more than a child's college tuition!

Increase Your Income

Increasing your income can be a financial hack to build wealth and become independently wealthy.

Whether you get a new job, ask for a raise, or start a side hustle – increasing your income and making more money can be a great way to strengthen your financial future.

There are many side hustles you can start to grow your income. For example, making stickers to sell, flipping on eBay, or pet sitting with Rover are all great options.

Even if your side hustle only makes a couple of hundred dollars each month – this income can be invested into compound interest accounts to make even more in the future.

Ready to start a side hustle? Check out these side hustles you can do from your phone!

Don't worry – we hate spam too. Unsubscribe at any time.

How Much Money Can Your Assets Make?

The amount of money you can make with the best assets to buy in your 20s will vary depending on the type of asset and the amount of assets you buy.

For example, making retirement plan contributions and using other tax advantaged accounts can have stronger returns than other assets because you'll receive a tax credit or tax deferral.

Other assets, like investing in the stock market or investing in real estate can make you much more money although you might not benefit from tax deferred investment accounts.

It's very possible to make over 6 figures annually from your investments and income producing assets depending on the amount of money you have to grow.

For index funds and other investments made into the stock market, a normal return will be around 7% to 10% annually – hence the reason many personal finance experts rave about them being a reliable way to grow wealth.

By making equal dollar purchases routinely you can help to mitigate risk and maximize your returns. This will help you to achieve a lower average purchase price no matter what the market is doing.

Final Thoughts

There are many options to consider when you're looking to purchase an asset in your 20s. Between index funds, real estate assets, and other asset classes – the options seem to be endless.

The key is to get started purchasing appreciating assets that grow in value and build wealth.

For example, investing in real estate with Arrived or investing in index funds with Acorns are two amazing assets to buy in your 20s.

Remember, the sooner you start, the more you can earn thanks to the power of compound interest. So what are you waiting for!?

Don't worry – we hate spam too. Unsubscribe at any time.