Doubling your money is always challenging, but it's certainly possible with enough time and the right strategy.

$20,000 is a significant amount of money – so you need to invest wisely to avoid losing money.

In this post, I'll explore the best ways to double $20k quickly, some investing tips to build wealth, and much more.

Some of these methods will require more work than others, but they're all proven methods to double your money.

How to Double $20k Quickly

1. Invest in Rental Properties

Real estate has been one of the most popular and reliable methods to invest your money and generate compound interest for years to come.

But not everyone has the capital to purchase a rental property outright.

That's where platforms like Arrived come into play.

With Arrived, you can invest in individual rental properties with just $100

Investors typically see annual returns of 5% to 20%, which can help you reach your goal of doubling your money relatively quickly.

Real estate is a great way to double $20k because it is a tangible asset that has a proven track record of delivering strong returns to investors.

Create your Arrived account below to get started!

2. Index Funds

Investing your money in the stock market is another great way to double $20k and make passive income without much effort.

However, picking individual stocks can be very risky, and it's hard to know which companies will perform well in the decades to come.

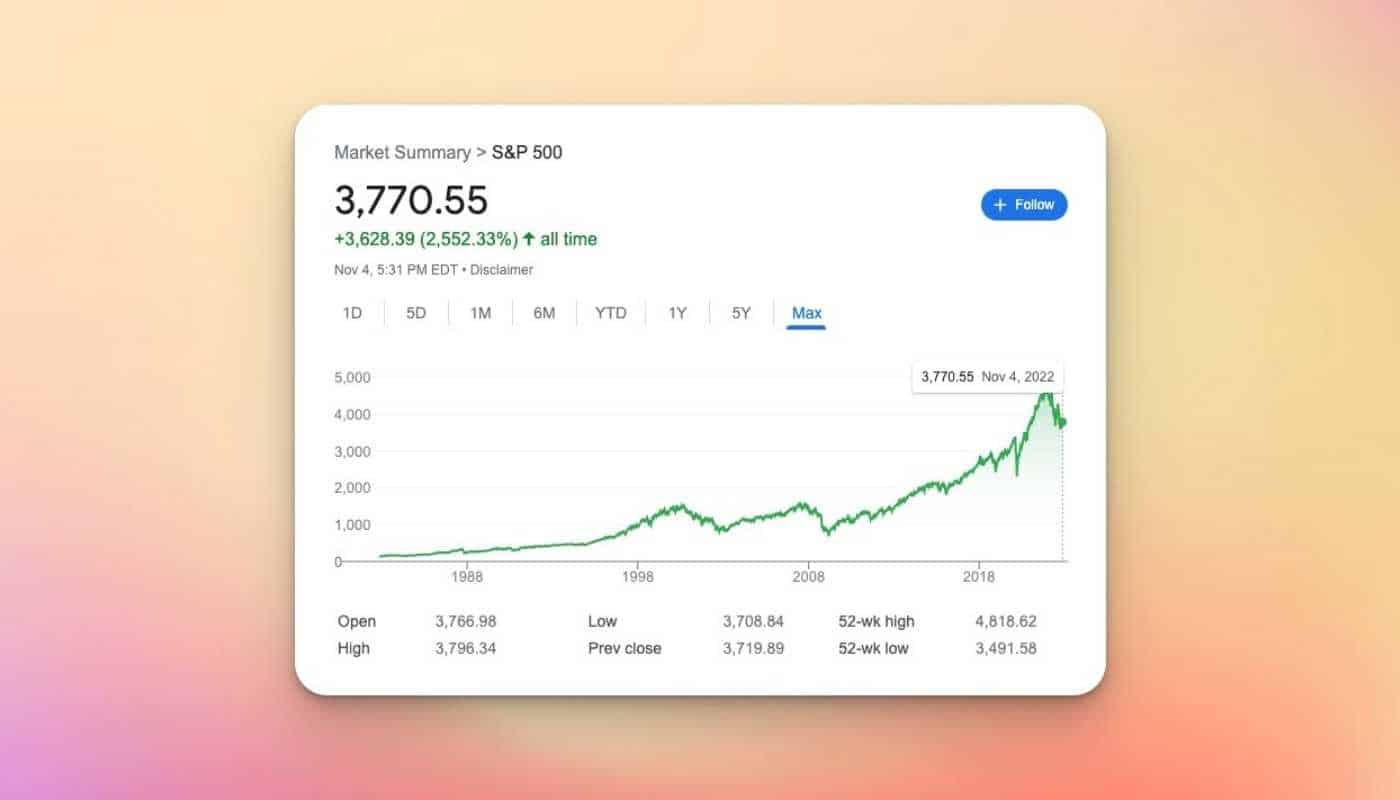

A safer and simpler option is to invest in index funds, which essentially are a massive group of stocks. For example, there are S&P500 index funds that contain all of the companies in the S&P500.

Index funds are a great way to diversify your portfolio and reduce risk because you're investing in hundreds or even thousands of different companies at once.

They also have lower fees than other stock market investments like mutual funds, which makes them attractive to many investors.

The average return of index funds is around 7%, but it can be higher or lower depending on the specific index fund you're investing in and the current market conditions. For example, some years tech stocks might outperform classic dividend stocks. During these years, there are some index funds that are heavily weighted with technology companies so you could outperform others.

Investing in the stock market isn't the fastest way to double your money, but it's reliable and proven.

To get started, you can use an investing app like Acorns to invest with as little as $5. As a bonus, you'll get $10 completely free to invest when you create a new account.

3. Invest in Small Businesses

Small businesses can make great money, but not everyone has the time or money (or energy!) to start a business.

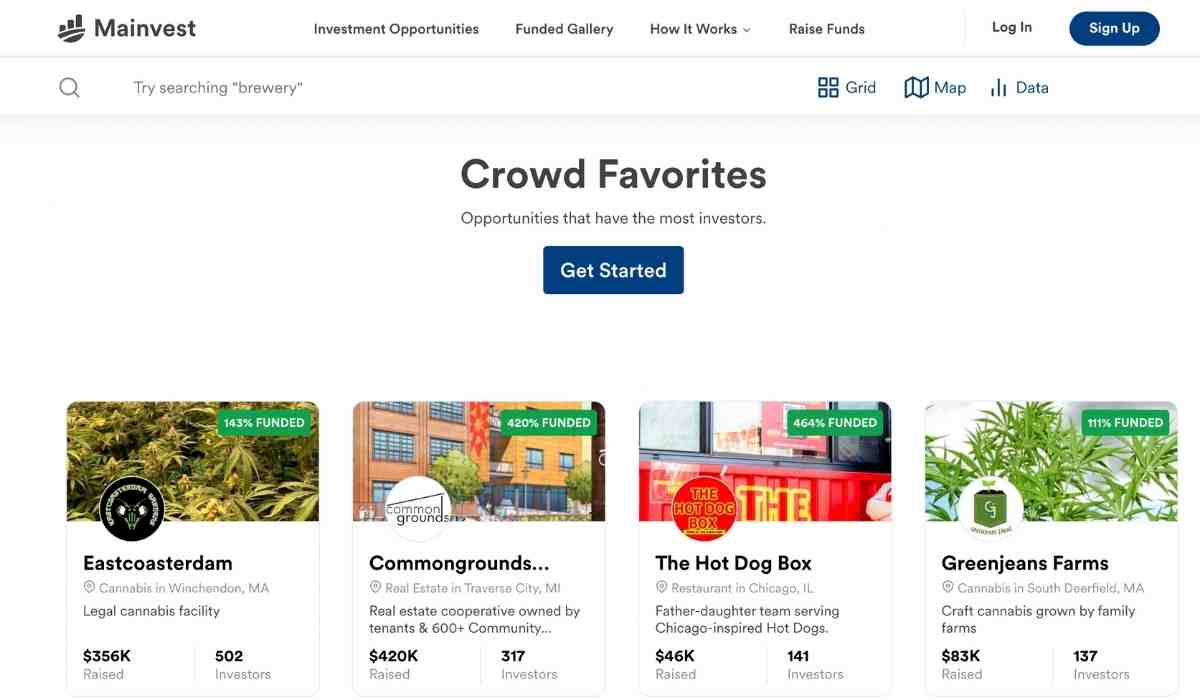

That's where Mainvest comes into play.

This investing platform allows you to invest in small business across the country with as little as $100. Yep, just $100. They don't charge any fees – which allows you to keep more of your money and generate stronger returns.

You can invest in a variety of businesses like restaurants, breweries, and other brick and mortar businesses depending on what's currently available on the platform.

And because they only accept around 5% of businesses that apply, you can be confident that you're investing in high quality businesses.

The returns on your investment can be very lucrative with target returns between 10% and 25% annually but some can make much more (or less).

While this type of investing is more risky than some of the other options on this list, it can be extremely rewarding if you pick the right business to invest in.

This is also a great way to keep your portfolio diversified – which is always a smart move when investing. Additionally, you'll be supporting small and local businesses, so what's not to like about that?

Register with Mainvest below to start investing!

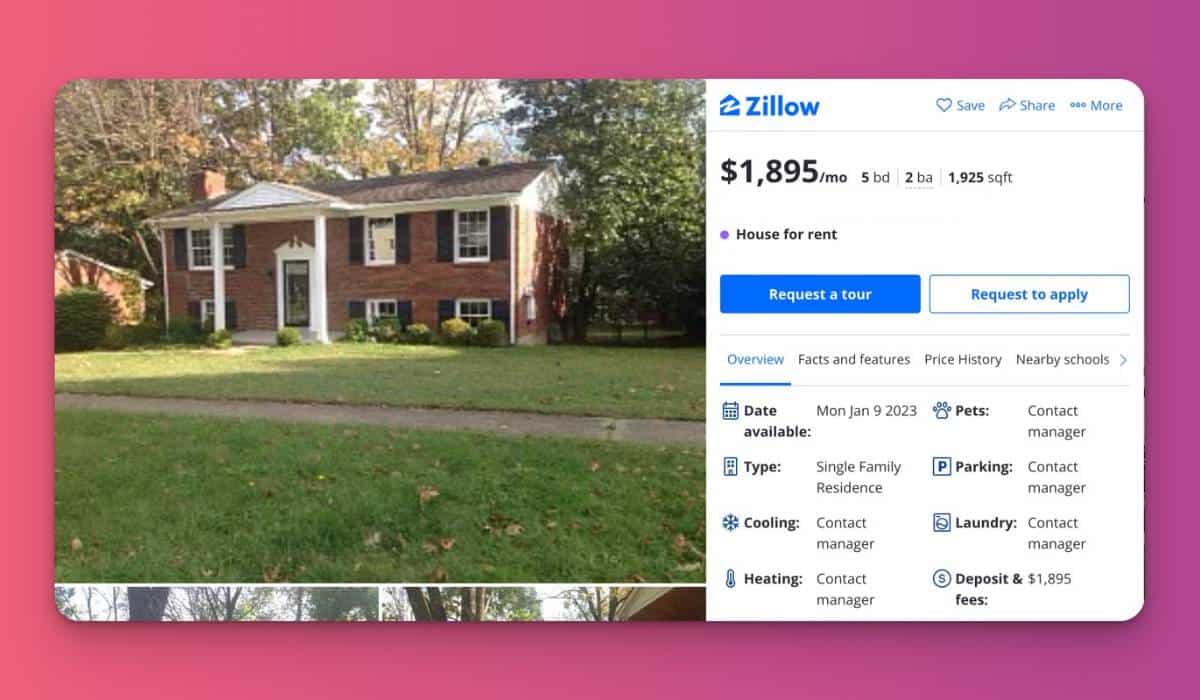

4. Rental Properties

If you have enough money to start investing in rental properties – this can be one of the most effective ways to double $20,000 and produce passive income from your money.

When investing in a rental property, you'll need enough money to fund a down payment for a home, which is usually 20% (but sometimes it can be more or less).

For example, a $100,000 property would require $20,000 for your down payment. This is the major deterrent for most people.

Rental properties are great investments for several reasons:

- First, you're able to collect rent from tenants every month, which can help you cover your mortgage payments and other expenses associated with owning a rental property.

- Second, over time, the value of your property is likely to increase, which can provide you with a large return on investment when you eventually sell the property.

- Third, as your property increases in value – you can charge more money for rent, which will further increase your income.

- And fourth, you can take advantage of tax incentives like depreciation that can help to offset some of your income.

Check out a rental property on the market in my area. It's listed for almost $1,900 a month. Assuming you get a mortgage of around $1,200 – this could produce a nice chunk of income each month.

Rental Property Investing

However, it's worth also noting the risks that can come with a rental property investment.

Some of the main risks include:

- Missed rent payments – tenants can miss a payment and force you to pay your mortgage out of pocket

- Damage to your property – some tenants might damage your property more than the value of their security deposit in which case you will have to cover the costs to get it in living condition again.

Rental properties are also more work than other types of investments.

For example, you'll need to find and vet tenants, collect rent, handle repairs and maintenance, and deal with other issues that might come up.

If you don't want to do the work yourself, you can always opt to hire a property management firm – but this will eat into your profits.

It's also important to do your due diligence when searching for a property to invest in otherwise you could be stuck with a poor investment.

There's no doubt that rental properties are more profitable than other forms of real estate investing – but it comes at the cost of risk and work.

If you don't mind the addition work and risk, it's one of the best ways to double $20k.

Check out the video below for more info on starting a rental property business!

5. Fund Real Estate Debts

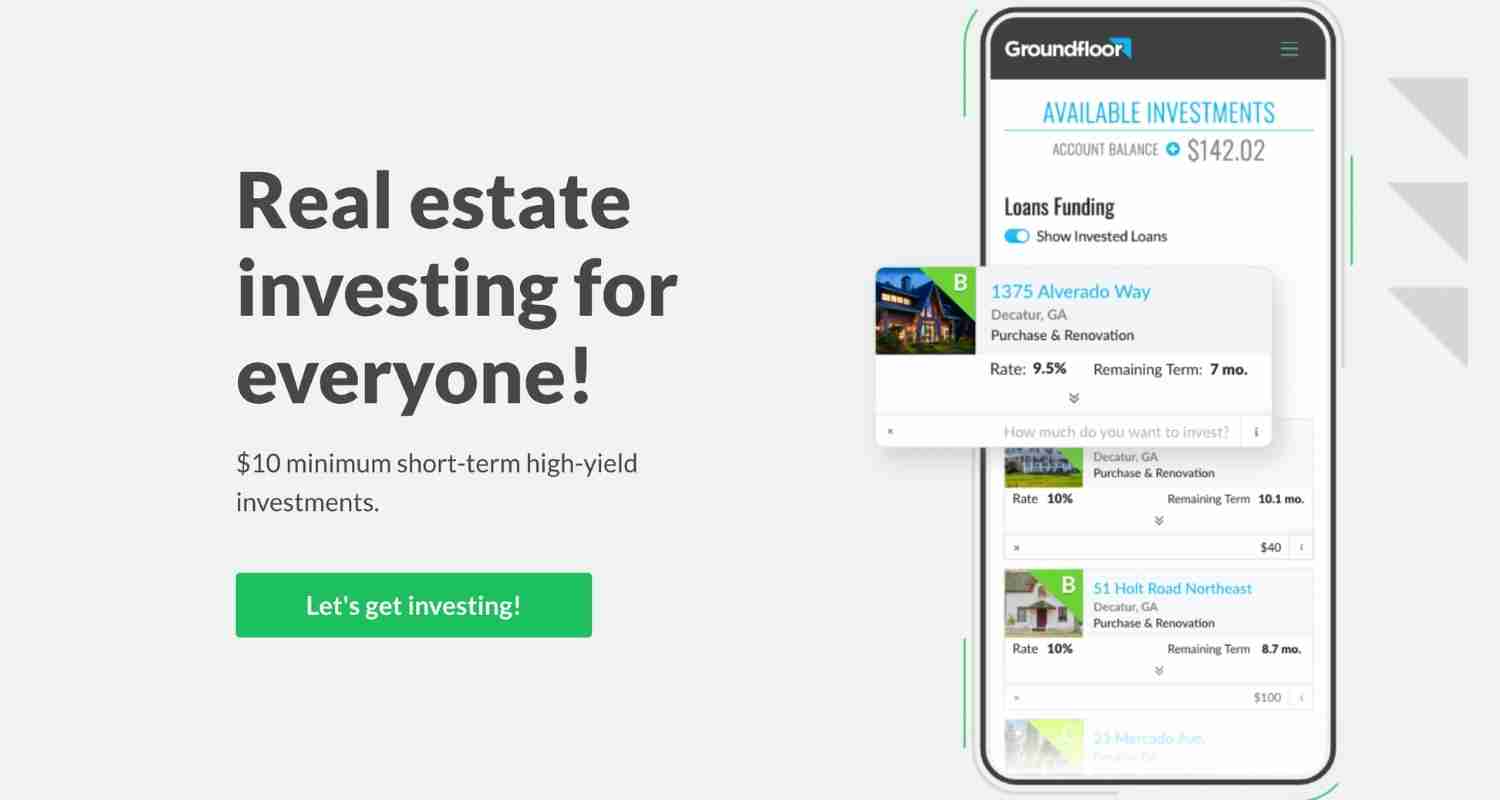

Another unique and non-traditional way to invest in real estate without owning any property is to invest in real estate debt.

You can think of yourself as a hard money lender to other real estate investors in this case.

In essence, you'll lend your money to investors who need capital to complete a project like flipping a home or developing a new property in exchange for interest.

These tend to be short term loans, usually less than 6 months but you might be able to find longer term deals.

The benefit of this approach is that you can expect high returns – typically between 10-12%.

There's one main caveat to this form of investing, it's slightly more risky than options like an index fund. But it's not in the same ballpark as something like crypto, either. I'd say it's a pretty balanced risk to reward.

You can use a platform like GroundFloor to get started with as little as $10.

6. Commercial Real Estate

Whenever you think about real estate, you're probably thinking of renting out homes or apartment buildings – but there's more to the industry than that.

Commercial real estate investing is another tremendous opportunity to double $20k and generate passive income.

Commercial real estate includes office buildings, warehouses, retail space, and more.

You might be thinking to yourself “But I don't have millions to invest!”

The good news is that you don't have to thanks to platforms like Realty Mogul.

With Realty Mogul, you can invest in real estate assets with just $5,000.

Another bonus is that you can spread your $5,000 across multiple real estate projects to further diversify your investment.

Commercial real estate can be an outstanding way to diversify your investment portfolio and generate passive income.

7. Cryptocurrency

Cryptocurrency has been one of the hottest investments in the past decade, and for good reason.

Some people have made fortunes investing in crypto, while others have lost everything they put in.

This means you need to be careful, and I certainly wouldn't recommend investing all $20k into this volatile asset. Experts recommend allocating anywhere from 2% to 8% of your entire portfolio to these digital assets.

You can get started with a platform like Binance if you're ready to grow your money.

8. ETFs

ETFs, or exchange traded funds, are great stock market investments worth considering to grow your money and double $20,000.

You can think of this investment similar to how an index fund works. They have low fees and are not actively managed (like mutual funds are). This means you can grow your money faster than you would assuming the same return.

The average ETF return over the last 10 years has been around 7% – which is a solid return from your investment.

You can use a platform like Acorns to get started with as little as $5!

9. Starting a Blog

Starting an online business or blog is a unique way to start investing in digital assets to generate income.

Blogs and websites are great examples of digital real estate that you can leverage to turn your money into more money.

Building a blog can take a serious amount of time, but luckily that's not your only option.

You can use online brokers like EmpireFlippers or Flippa to buy online businesses that generate cash flow.

There are a few main reasons why I recommend online businesses to double $20k.

- Extremely high income potential

- Recurring revenue – once you have a site set-up it can generate income for months or even years to come without much work

- Ability to work from anywhere and anytime

- Costs little to get started

While starting a blog or online business won't make you a millionaire overnight – it can be a great way to start generating passive income and is an awesome high paying side hustle for anyone.

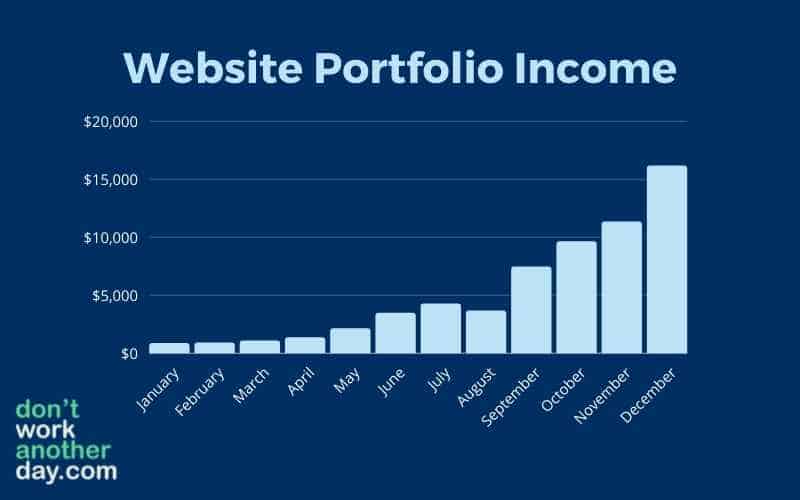

How much can you really make?

It's possible to make $20k a month or more for some bloggers. While it can take some time to reach these levels of income, it's definitely possible.

It took me about 2 years to make $10k a month from my portfolio of blogs and online businesses.

Of course, I wasn't just focused on making money – I was also building a business that I enjoyed and that gave me the freedom to work from anywhere in the world.

If you're looking for a way to double your money and make some serious profits, starting an online business is one of the best options out there.

10. Flipping

Are you searching for a side hustle you can start with little money?

Flipping could be for you!

The amount of money you can make from flipping depends on how hard you work and the amount of effort you put in.

Flipping is also an easier side hustle in that it doesn't require a college degree to understand how it works. Your goal is to find things at a discount and sell them for a profit.

There are many different things you can flip – from houses to furniture to clothes and much more.

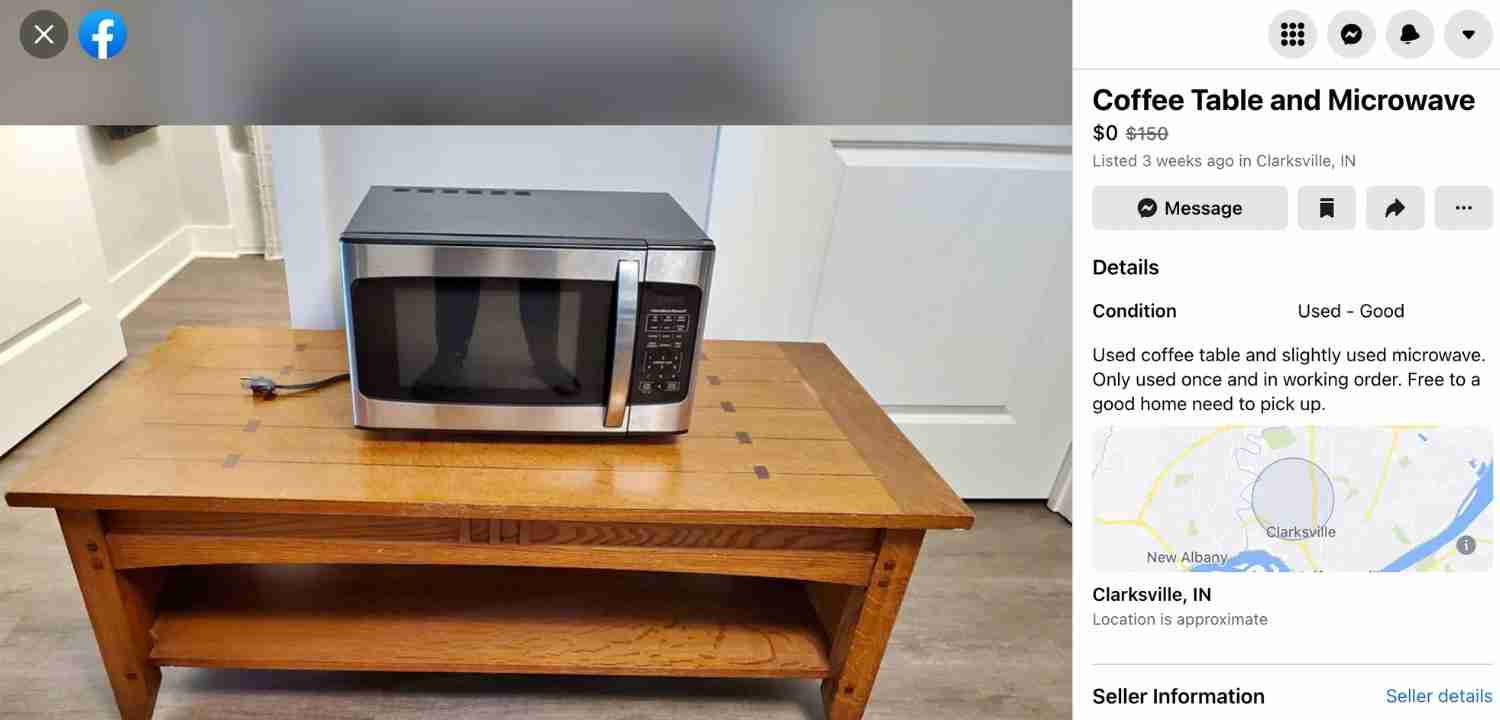

To find products to flip, you can check Facebook Marketplace, Craigslist, garage sales, and thrift stores.

For example, check out this coffee table I found that's completely free. This should be an easy flip to make $50 or $100.

Once you find an item to flip, it's time to sell it!

You can sell your items online on platforms like eBay, Facebook Marketplace, and Craigslist.

If you want to maximize your earnings when flipping, there are a few things you can do:

- Refurbish items – Not all items will need to be refurbished before you sell them, but if they do – this will make all the difference.

- Take quality photos – High quality photos will make your items look more appealing to buyers and help you sell them faster.

- Write quality descriptions – Just like with photos, quality descriptions will help your items sell more quickly. Include any specs or details about the products, but refrain from pointing out the negatives.

- Provide transportation – If you're selling large items, offer to transport them to the buyer's house. This will help you sell your items faster and for a higher price. Most buyers are willing to pay a bit more if you can transport the item.

While flipping won't make you a millionaire, it's a great way to make some extra money on the side and you can get started with $20k or much less.

11. High Yield Savings Account

If you're looking for the safest way to grow your money, putting your money in a high yield savings account can be an easy way to make money while you sleep.

With this method, you'll earn interest on your money without having to worry about it. Because banks are FDIC insured, your money is safe and sound sitting in a bank. Most bank accounts are insured for up to $250,000 so you won't have to worry with just $20k.

While you won't make a fortune from these accounts, they're a safe and reliable way to build wealth over time.

There are many different banks that offer high yield savings accounts, but I recommend using CIT Bank because they offer some of the highest interest rates available and you only need $100 to open a new account.

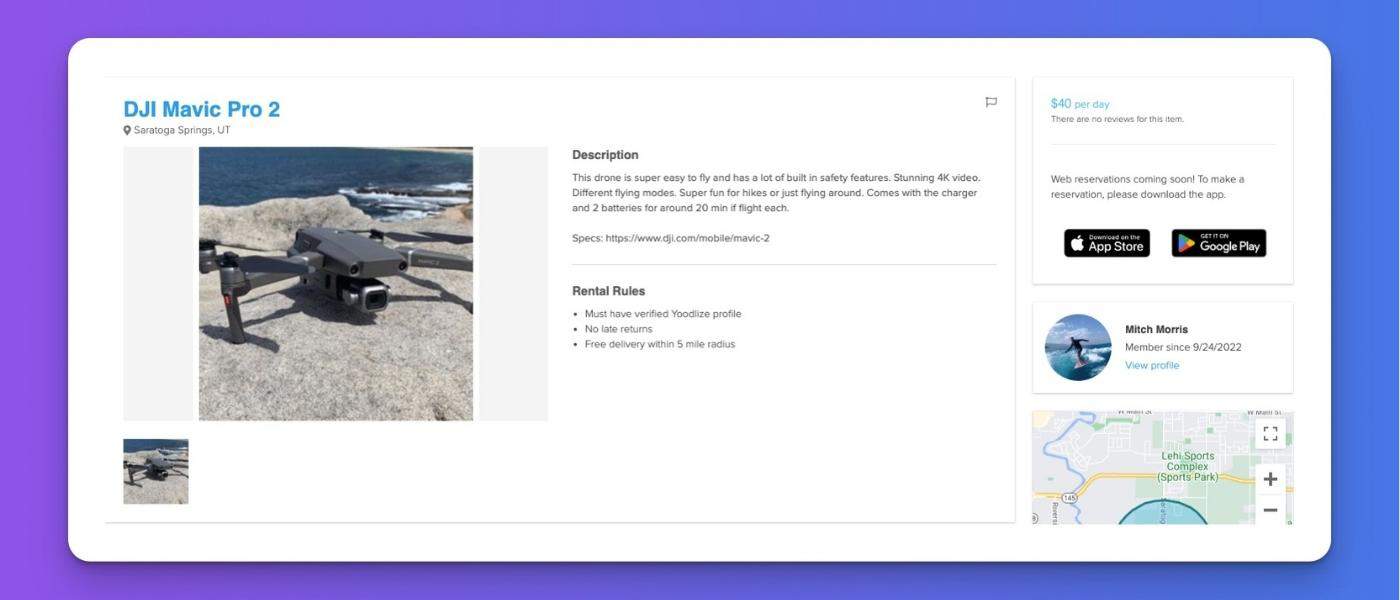

12. Start a Rental Business

Want to earn passive income and double your money faster than other methods?

Starting a rental business is a tremendous way to reach your goals.

There are tons of different things you can rent, ranging from vehicles, to drones, and even 3D printers.

All you need to do is purchase a few things and list them for rent. You'll be surprised how much you can make by renting things out.

For example, you can rent this drone for $40 a day! Considering it probably cost less than $500, this is a good income.

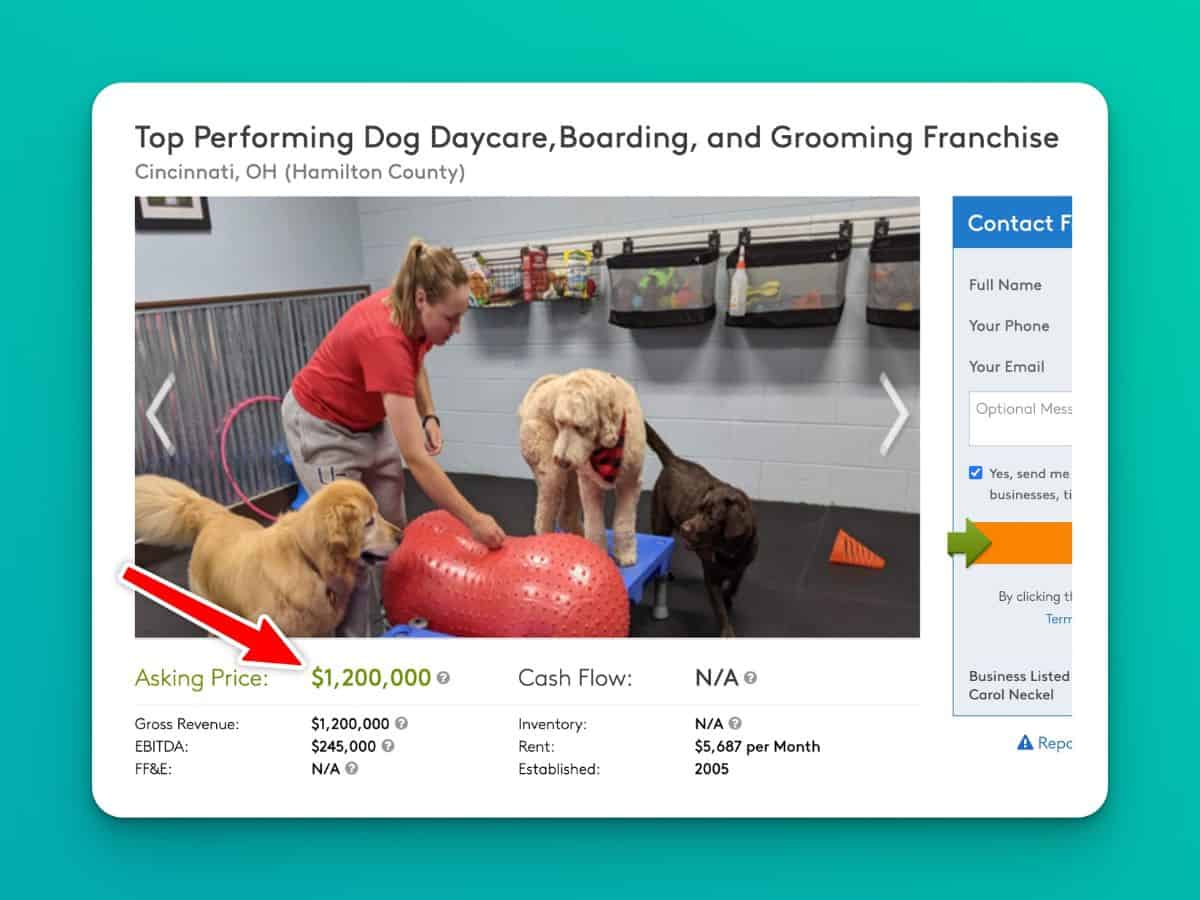

13. Start a Business

Earlier I mentioned investing in small businesses, but if you're willing to put in the time and effort, starting your own business is the better way to go.

There are tons of profitable business ideas you can start to make money and they don't often require tons of skills.

For example, starting a pressure washing business can be extremely simple, and it doesn't cost more than $20k to get started.

While it can be helpful to have some business knowledge, anyone can start and grow a profitable service based business if you're will to work hard and lear along the way.

Another benefit of becoming an entrepreneur is that you won't have a boss telling you what to do. Less stress? Sign me up!

Finally, if your business is making money, you can eventually sell it for a large pay off. Some businesses can sell for millions, so it's definitely worth your time.

Check out this business I found for sale in my area. Talk about a nice exit!

How to Flip $20k

Flipping $20k is essentially the same as investing $20k. I recommend investing in real estate with Arrived, investing in the stock market with Acorns, or investing in small business with Mainvest to flip $20k.

Don't worry – we hate spam too. Unsubscribe at any time.

Final Thoughts on How to Double $20k

There's certainly no shortage of ways you can double $20k, but you need to balance risk and reward to ensure you reach your goal.

For example, sure, you could go to the casino with the goal of doubling your money – but the chances are you'll leave with nothing.

You should invest your money in proven assets that produce income and make money in order to build wealth and successfully grow your money.

Looking for more helpful tips to build wealth? Check out these posts:

- How to Build Wealth from Nothing

- How to Flip 1000 Dollars (Proven Methods)

- How to Double your Money in a Day (24 Hours or Less!)

Don't worry – we hate spam too. Unsubscribe at any time.