If you want to get rich without a large inheritance or winning the lottery, it’ll take some planning and strategy, but it’s certainly possible.

Now, there’s an extremely small chance you’ll get rich overnight, but with time, discipline, and effort, you can still get rich by following a plan and putting it to work.

You'll likely run into many get-rich-quick schemes when trying to figure out how you can get rich from nothing, but I'll put those to bed in this post. Whether you're currently making $30,000 per year or 6 figures, everyone has the ability to get rich with the right circumstances.

In this post, I’ll explore what being rich means, a few examples of self-made billionaires, how to get rich from nothing, and more. Let’s get started!

What Does Being Rich Mean?

Being rich is relative to your mindset. For some, being rich might mean making over $1,000,000 while others might think that making $10,000,000 or more per year makes you rich.

It’s all about your mindset and your goals. There is no real definition of being rich.

We usually tie being rich to purchasing items. Perhaps a large home or a fancy car.

But does this mean you’re rich?

Absolutely not. Lenders will give people more money than they can afford to allow people to purchase these items even though it is a poor financial decision.

Being rich can mean different things for different people. I believe that being rich means you have financial security and the time freedom to do whatever you want whenever you want.

Net Worth and Being Rich

While some people will define being rich as how much money they make each year, others argue that your net worth is more important.

I tend to agree with the second form of logic. Here’s why.

Let’s assume Person 1 makes $100,000 annually and has a net worth of $650,000 and Person 2 makes $75,000 annually but has a net worth of over $2 million. Who would you rather be?

While Person 1 has the potential to make more money in the future through his active income, Person 2 has the potential to liquidate some of his appreciating assets and invest in passive income streams to build his income. Person 2 can grow his income exponentially, while Person 1 will only steadily grow his income.

Geographics

Where you live will also play a role in determining if you consider yourself rich.

For example, if Person 1 lives in Los Angels, California and has an income of $100,000 but Person 2 lives in Cincinnati, Ohio, and has an income of $85,000, Person 2 is likely way better off than Person 1. Why?

The cost of living in California is significantly higher than in Ohio. Even though your income is greater in California, many times it will not offset that higher living expenses.

If you want to reach financial freedom and reach your goals, living in an area with a low cost of living can be a great way to save money.

How to Get Rich from Nothing

Start a Business to Get Rich

Starting a business is the most achievable way to get rich from nothing.

You might get overwhelmed with this idea but many businesses are simpler than you think.

You don’t need the next big idea to start a business. In fact, I’d argue that starting a business with a proven model of profitability is a better option for most people.

Step by Step Guide to Starting a Business

There are a few steps you’ll need to take to start your business.

First, you'll need to define your business idea. Think of a business that you want to start and try to poke holes in it. Perhaps there is a similar business that has a better product or service? You'll want to try to find any reasons why your business may not succeed.

Next, you’ll need to create a business plan. This will outline your plan on how to operate your business.

Then you’ll need to think of a name for your business. This name should not already be registered. As a bonus, if you can find a business with the domain name available, this can be helpful for your marketing efforts.

Next, you'll want to obtain funding for your business. Whether it's from your savings, friends and family, or a lender, finding the money you need to get started is critical.

Then it’s time to register your business. This process will require you to communicate with state and local authorities to obtain your business registration.

The final steps include obtaining any permits and licenses as well as opening a business bank account. Then, it’s time to start your business!

Simple Businesses to Start

There are many profitable businesses you can start to get rich. Some of my favorites include:

- Starting a lawn care business

- Starting a pressure washing business

- Starting a self-storage business

- Starting a car detailing business

- Start a car wrapping business

- Start a painting business

- Starting a candle making business

- Opening a restaurant

These are just a few of my top business ideas for people who don’t have the next big idea. There are hundreds (if not thousands) of other options you can think of.

How to Get Money to Start a Business

One of the biggest reasons my businesses never get started is because of a lack of funding. Depending on the type of business you’re starting, you have a few options worth trying including:

- Take out a business loan

- Ask friends or family for money

- Use savings

- Ask investors to loan money

- Complete a cash-out refinance on a mortgage

There isn’t a right answer when it comes to getting money for your business but you’ll want to ensure you have a plan to pay back the money you borrow to get started.

Invest Wisely to Get Rich

There’s no denying that making your money work for you is essential to getting rich.

The most wealthy people in the world have invested throughout their lifetime to grow their money.

When it comes to investing, you might get overwhelmed with the number of options you have. I'll explore some of the best ways to invest your money to get rich below.

Invest in the Stock Marketing to Get Rich

Investing in the stock market is one of the easiest ways to grow your money. Depending on how you invest in the stock market, it can be a completed passive way to grow your money.

If you’re looking to become a millionaire by investing in the stock market, you’re going to have to contribute a large amount of money or give it a while to grow.

Because your money will compound when invested in stocks, you can start building wealth at an exponential pace.

My favorite investing platform is Acorns. When you register below, you'll get $10 free to invest!

To better understand this, let's analyze the rule of 72 in investing. This rule states that by dividing an investment's expected annual return by 72, you will be left with how long it will take your investment to double. For example, if you assume a 10% annual return, your investment will double in 7.2 years. To further the example, let's say that you invest $150,000 into the stock market and expect a 10% return annually. On average, after 7.2 years your investment would be worth $300,000. This example assumes no additional contributions, either. If you want to grow your money even more, making regular contributions can expedite the process.

The longer you invest your money, the better chance you have to get rich from it. For those in their 20s or early 30s, this is the prime time to help you grow your wealth.

Invest in Real Estate to Get Rich

Real estate can be an excellent way to make money and get rich if you prefer a more hands-on approach.

There are several types of real estate investing including:

- Residential Real Estate Investing

- Commercial Real Estate Investing

- REITs

- Crowdfunded Real Estate Investing

Each type of investing has advantages and disadvantages. For example, invest in a REIT will provide less risk than other types of real estate but the returns will also be lower.

If you’re aiming to get rich, the two types of real estate investments you’ll likely want to consider are residential and commercial rental properties.

This involves purchasing properties and renting them out to tenants for a profit.

The advantages of renting residential and commercial properties include:

- Larger cash-on-cash returns

- Building equity in the property

- Tax advantages

- Some people enjoy working on properties themselves

To help you understand why investing in a rental property can help your wealth explode, let's do some math. Let's consider purchasing a $175,000 single-family home with a rental price of $1,500 per month. Using a mortgage payment calculator assuming a minimal down payment of $15,000 with an interest rate of 4% and adding additional costs like taxes and insurance, it's safe to assume a monthly payment of around $1,000. This means that our property will cashflow $500 each month. If you reduce your profits to account for a vacancy, maintenance, and major repairs, it's safe to assume a monthly profit of around $300. This is predominantly passive money!

But that’s not the only way your property will make money. In addition to the rental income, your property will likely increase in value over time. While these gains won’t be as lucrative as your rental income, it’s safe to assume a 1% to 2% gain on the value of your property each year. This means that your $175,000 home would be worth around $178,000 the next year. If you add this to your rental income, you can add an additional $200 to your income each month even though it is not realized.

$500 each month is great, but the IRS makes this method of getting rich even sweeter. Because you can deduct mortgage interest, expenses, and depreciation on your taxes, you likely won’t pay any taxes on your earnings until it comes time to sell the property. When the time comes, you’ll be forced to pay capital gains and pay back your depreciation expenses previously deducted.

However, investing in residential and commercials properties does come with some risk including:

- More work required to manage the property

- More money and qualifications required to get started

- Risk of evictions and missed payments

- Risk of property damage

As with any investing strategy, the key is to stay diversified to help mitigate some of these risks.

To invest in residential real estate, I recommend using a platform like Arrived. They offer great returns and an easy to use platform with just a $100 minimum investment.

For commercial real estate investing, I recommend using EquityMutliple or Crowdstreet. Both platforms are great ways to become self made millionaires over time but they'll require more money to get started.

Invest in Cryptocurrency

While many investors baulk at cryptocurrency as an investment option, it has started to become more mainstream as time goes on.

For the uninitiated, cryptocurrency is a digital or virtual currency that operates on blockchain technology to facilitate secure and anonymous peer-to-peer transactions.

Cryptocurrency is decentralized, meaning it is not subject to government or financial institution control – which has both advantages and disadvantages.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Since then, numerous other cryptocurrencies have been created leading to a massive industry.

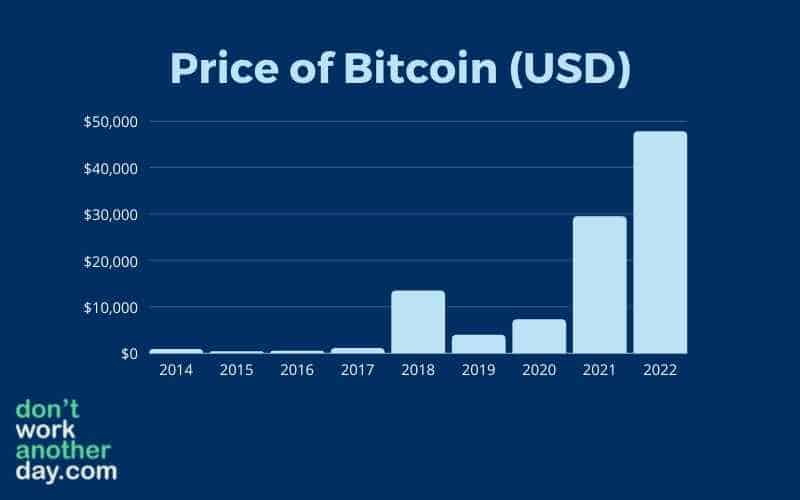

Check out the chart below of the price of 1 Bitcoin since 2014. It's hard to argue against that performance!

To invest in Bitcoin, I recommend using a platform like Coinbase. It's completely free to use and you can trade all of the most popular coins.

Invest in Wine

Investing in rare wines is another alternative investment you can use to reach financial independence.

You can use a platform like Vint to start investing in rare bottles of wine to diversify your portfolio and reach your financial goals.

Climb the Corporate Ladder

While this isn’t my preferred method of getting rich, it’s certainly possible and many people choose to take this route.

Not only can it take a lifetime, but it also requires a little bit of luck. Getting promoted is often performance-based, but there are some scenarios in which promotions are based on friendships and trust.

Climbing the corporate ladder involves being promoted through a typical job at a large company. Depending on how much money you need to get rich, you’ll need to work at a larger company that is publicly owned.

Positions such as CEO, President, and other chief officers will have the highest pay with your best chance of getting rich off of them. CEOs of publicly traded companies will often make millions of dollars each year for their work.

It’ll take some time to get there, however. The average age of CEOs and CFOs in 2018 was 54.1 years old. This means you'll need to work hard and excel in your position for a while to get rich and make a significant income.

If you want to escape the rat race or you don't want to work anymore, I recommend creating multiple streams of income outside of your day job to reach millionaire status.

Don't worry – we hate spam too. Unsubscribe at any time.

Examples of People Who Got Rich from Nothing

Below are some examples of people who have become rich from nothing.

Bill Gates

Bill Gates is one of the richest people in the world and a self-made billionaire. He started the company Microsoft in 1975, which you likely use on a daily basis.

Warren Buffett

Warren Buffett is a self-made billionaire who started investing at the age of 11. He started a newspaper business at 13 and slowly built his wealth to now over $70 billion.

Jeff Bezos

Jeff Bezos started Amazon with the mission of selling textbooks online at a fair price. The company has since shifted to delivering everyday items through a robust operation offering superior shipping options and great prices.

Mark Zuckerberg

Mark Zuckerberg founded the term social media with the creation of Facebook. Before Facebook, social media websites were few and far between. The company has advanced and has over 1 billion members.

Actionable Tips to Help You Get Rich from Nothing

Below are some tips to help you get rich from nothing. Try using several of these methods to help you build wealth, save money, and better your finances.

Track Your Spending to Reduce Unnecessary Expenses

Whether you’re trying to start a business or make your way up the corporate ladder, maintaining your personal finances is necessary to get rich from nothing.

After all, if you’re consistently spending money on the newest designer clothing or luxury cars, it’ll be difficult to get rich.

Take a look at and aim to cut your monthly expenses on a regular basis to find patterns where you might be overspending without realizing it. For many people, it might be eating out too much or overspending at the grocery store.

If you do need to spend money, try to track down any savings possible. This means couponing, deal hunting, and using a credit card with rewards to help you save money.

Track Your Income

Your income is equally important as your expenses when aiming to get rich.

You’ll want to routinely track your income to find out how much money you’re bringing in each month. This will help you to understand areas where you could make more money.

Ask for a Raise or Change Jobs

One of the most overlooked ways to increase your income and get rich is by asking your company for a raise. While it might seem intimidating, you’d be surprised how effective it is in landing a larger paycheck. Many companies will not actively seek to pay you more money but if you ask, they may give your pay a bump.

To better your chances of landing a salary increase, try to put numbers behind your work. This will give the company a reason to increase your pay. For example, if a marketing strategy you implemented increased sales by 14%, be sure to point that out when asking.

If your company refuses to pay you more or you would rather leave the company, changing jobs can be an easy way to boost your pay to build wealth.

You could even work the same position at a different company for a 10% to 20% pay increase. While it’s not recommended switching jobs every year, stay on the lookout for new positions.

Start a Side Hustle to Get Rich from Nothing

If you’re looking to get rich, the best place to start is by increasing your income.

For most people, starting a side hustle is a great option to make more money. Many of these side hustles can also be turned into a full-time business perfect for those who hate their job.

There are thousands of potential side hustles. Some of my favorites include:

- Driving for a ride-hailing service

- Working as a food delivery driver

- Flipping money

- Flipping furniture

- Working as a freelancer

- Starting a blog

- Download passive income apps

But you have to use your additional income from your side hustles the right way if you want to get rich from nothing. This means you’ll need to invest your additional income so that it grows exponentially. Eventually, the returns on your investments might exceed the amount of money you make with your side hustle. At this point, you could consider quitting your side hustle or keep going to further your income.

You can also check out these remote side hustles to make more money.

Eliminate High-Interest Debt

Debt can crush you on your journey to get rich from nothing and cost you thousands of dollars each year.

To eliminate this debt, here are a few things you can start doing:

- Create a plan to pay back your debt

- Elite debt with the highest interest rate first

- Try to increase your income to tackle debt fast

High-interest debt is most commonly found on credit cards, student loans, and personal loans. Any debt with an interest rate larger than 6% or 7% could be considered high-interest debt.

If you cannot reduce these debts, another option is refinancing them to get a lower interest rate – potentially saving you hundreds of dollars each month.

Grow Your Knowledge

Your knowledge is one of the most powerful assets that you have. By growing your knowledge you will be open to making more money and growing your income.

Growing your knowledge can include a few things. Perhaps is furthering your education through college or reading blogs. By applying your knowledge, you can increase your income.

Lower Your Living Expenses

If you’re looking to get rich, lowering your expenses is essential. Because your housing costs are likely one of your highest monthly bills, lowering these costs can be a great way to save money and invest more.

If you’re looking to save money on housing costs, check out these ways to live cheaply. Some of these might be slightly extreme, but they can help you get rich if you are disciplined with your investing habits.

Automate Investing and Saving

One of the easiest ways to make managing your money a breeze is by using automation. This means having money automatically transferred into saving and investing accounts so you don't have to think twice about it.

For example, I use Acorns to invest automatically. This allows me to invest my money without even thinking.

Celebrate Wins Along the Way

As you advance through your financial journey, celebrate any wins you might have. This will help to keep you motivated and your mental health in check.

You don’t have to go overboard when celebrating. It might be something as small as a dinner at your favorite restaurant or getting takeout from a local restaurant.

Don’t Follow the Crowd

As you start to build wealth, the tempting thing to do is purchase a new home, upgrade your car, or buy the latest electronics. This will make figuring out how to get rich from nothing more difficult.

While others might be making these purchases, avoid lifestyle creep as much as possible. It’s okay to splurge sometimes, but try to limit it.

At the end of the day, you want to buy assets, not liabilities.

Don’t Give Up

Growing your wealth and getting rich will take time. If you don't succeed instantly, don't get down. It's going to take some time to make money and get rich from nothing.

To stay motivated, track your progress and celebrate the small steps.

Utilize Free Money

There are many ways to get free money including using credit cards to get rewards or signing up for websites with a signup bonus and more. This money can be used to invest or start a business to get rich.

👉 Rakuten Insights - Cash out directly to PayPal!

👉 OpinionOutpost - Earn up to $25 per survey!

👉 Survey Junkie - Make $150 for select focus groups you complete!

👉 Swagbucks - Get a $5 bonus instantly!

👉 InboxDollars - Get a $5 bonus when you register today!

👉 Pinecone Research - Earn fast money taking surveys

👉 Survey Voices - Make money taking online surveys

Final Thoughts on How to Get Rich from Nothing

Getting rich from nothing will not be easy but it is possible. By creating a plan to grow your wealth and giving your money time to grow, you are capable of becoming rich from nothing.

The best way to get rich is by starting a business, investing, and growing your income.

Getting rich will not come instantly, but by giving your income time to grow, you too can become rich from nothing.

Don't worry – we hate spam too. Unsubscribe at any time.