Do you have $100k to invest and want to turn it into $1 million?

While it might sound challenging, turning your money into a million dollars might be easier than you think.

That said, you need to be careful and invest wisely so you don’t lose money quickly.

Reaching the 7-figure mark is a great achievement and it's certainly possible when investing $100k.

Imagine what you could do with a million dollars. Maybe you could retire early, purchase a new home, or just stash some money in the bank for later.

In this post, I'll explore the best ways to invest 100k to make $1 million, how long it can take to reach millionaire status, the best investing platforms and much more. Let's get started!

How to Invest $100k to Make $1 Million

Investing $100,000 can be a scary concept. Losing access to your hard-earned cash in exchange for future income can certainly be nauseating. But considering 90% of investments grow over time, it's a tad less difficult to stomach.

Below are some of the best ways to invest $100k to make $1 million.

1. Invest in Crowdfunded Real Estate to Grow Your Money

One of my favorite ways to invest is in real estate for several reasons.

First, it's a tangible investment – meaning that you can touch and see it. This can bring peace of mind knowing that there is an actual structure backing your money.

Secondly, real estate is a great appreciating asset that typically grows over time.

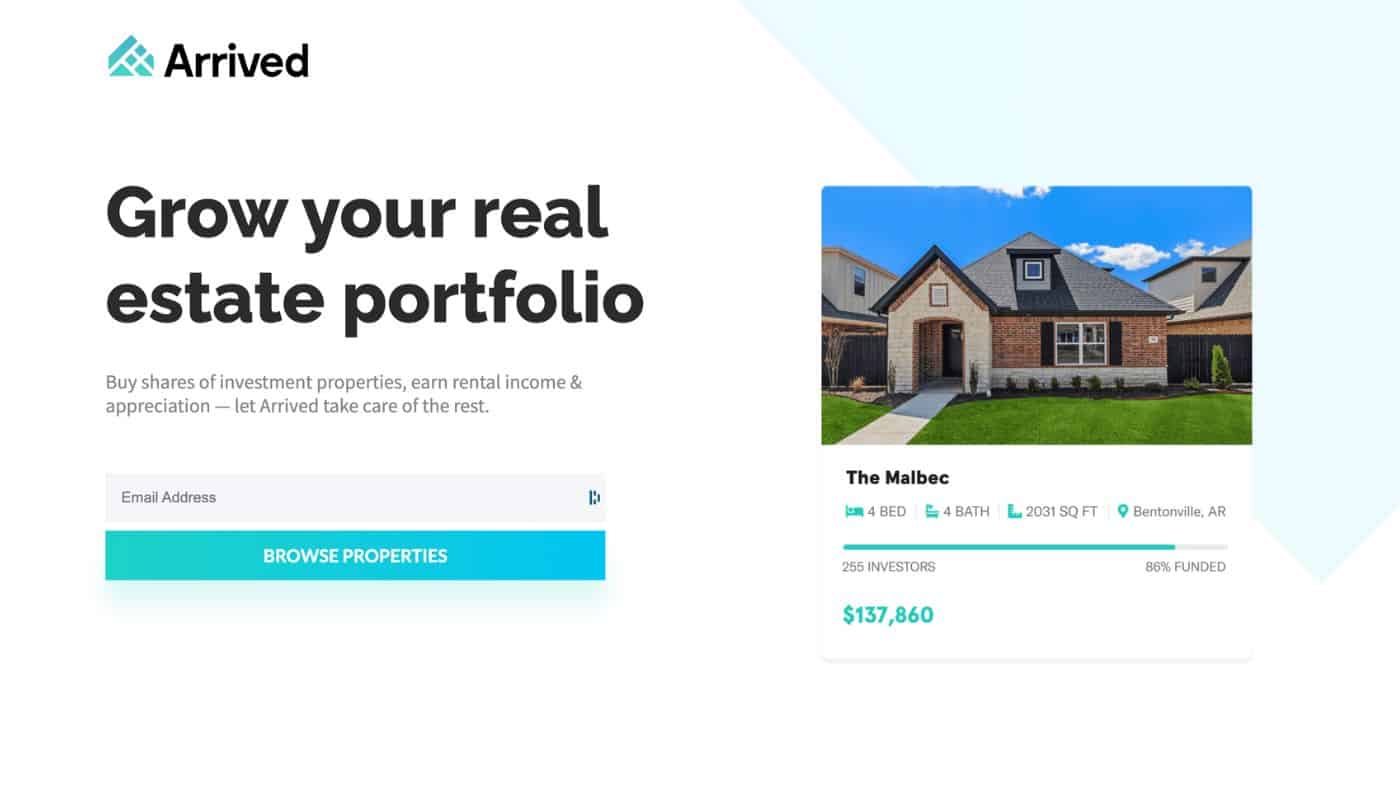

There are many forms of real estate investing but one of my favorites is crowdfunded real estate investments like Arrived.

With this platform, you can invest in a variety of real estate assets that you wouldn't otherwise have access to without a significant lump sum of cash. You can avoid having to make a large down payment and instead invest only what you feel comfortable with.

Crowdfunded real estate works by pooling money from multiple investors and using that money to purchase larger, expensive properties that you can buy “portions” of.

They make money in the same ways other real estate assets derive their income: rental income, rising property values, and equity built.

The returns with Arrived and other crowdfunded real estate investments tend to be slightly larger than that of the stock market.

You can expect to earn anywhere from 10% to over 20% annually on your investment with this investment.

Arrived is my favorite platform because they have a low initial investment and have some of the industry's lowest fees.

-

$100 minimum investment so anyone can get started

- Access to individual properties so you can pick and choose which properties to fund

- Quarterly payouts depending on your properties performance

- Open to both accredited and non accredited investors

- Minimal 1% management fee

- Some offerings are funded quickly

2. Invest in Index Funds to Make $1 Million

Index funds are a great, low-risk way to invest your money in the stock market and build your income.

With index funds, you can easily invest $100,000 into the stock market without taking a massive amount of risk. You can think of an index fund as a large group of individual stocks that can be purchased together.

This means your portfolio will be well-diversified without having to think twice about your holdings.

The stock market traditionally grows at around 7% to 10% annually. But it's not always linear.

Check out the annual returns of a popular index fund, VOO.

You can see that it has major ups and downs, which should be expected when investing.

This means it could take around 35 years to reach your $1 million goal.

If you want to expedite your journey, consider making additional contributions to your investment portfolio.

Want to invest in index funds but aren’t sure where to start? Try Acorns! You can invest in all of the top index funds, mutual funds, ETFs, and more with just $5.

As a bonus, you’ll get $20 completely free to invest using the link below!

3. Invest in Dividend Stocks

If you want to become a millionaire in 10 years, investing in dividend stocks can be a simple path to reach millionaire status.

While investing in individual stocks can be riskier compared to other forms of investing, you can find many different stocks to diversify your investment portfolio and optimize returns.

Some investors make a living off of the dividends they receive – making it a tremendous option to turn $100k into $1 million.

Dividend stocks can be purchased through robo advisors like Acorns. Register below to claim your free $10 to get started!

4. Invest in Growth Stocks

Growth stocks are the opposite of dividend stocks.

Whenever a company makes a profit, it can either return that money to investors in the form of a dividend payment or reinvest the profits back into the company to grow further. With growth stocks, the majority of profits are reinvested back into the company.

Growth stocks tend to be newer companies and in industries poised for growth whereas dividend stocks tend to be more mature and at their later stages.

For example, companies like Coca Cola is a more mature stock that pays dividends. Lululemon, on the other hand, is a growth stock that has set record revenues for the past few years.

Growth stocks can be purchased through any brokerage or investing app like Acorns or M1 Finance.

Now, investing in individual stocks can be risky. That's why I leave it up to the experts at the Motley Fool.

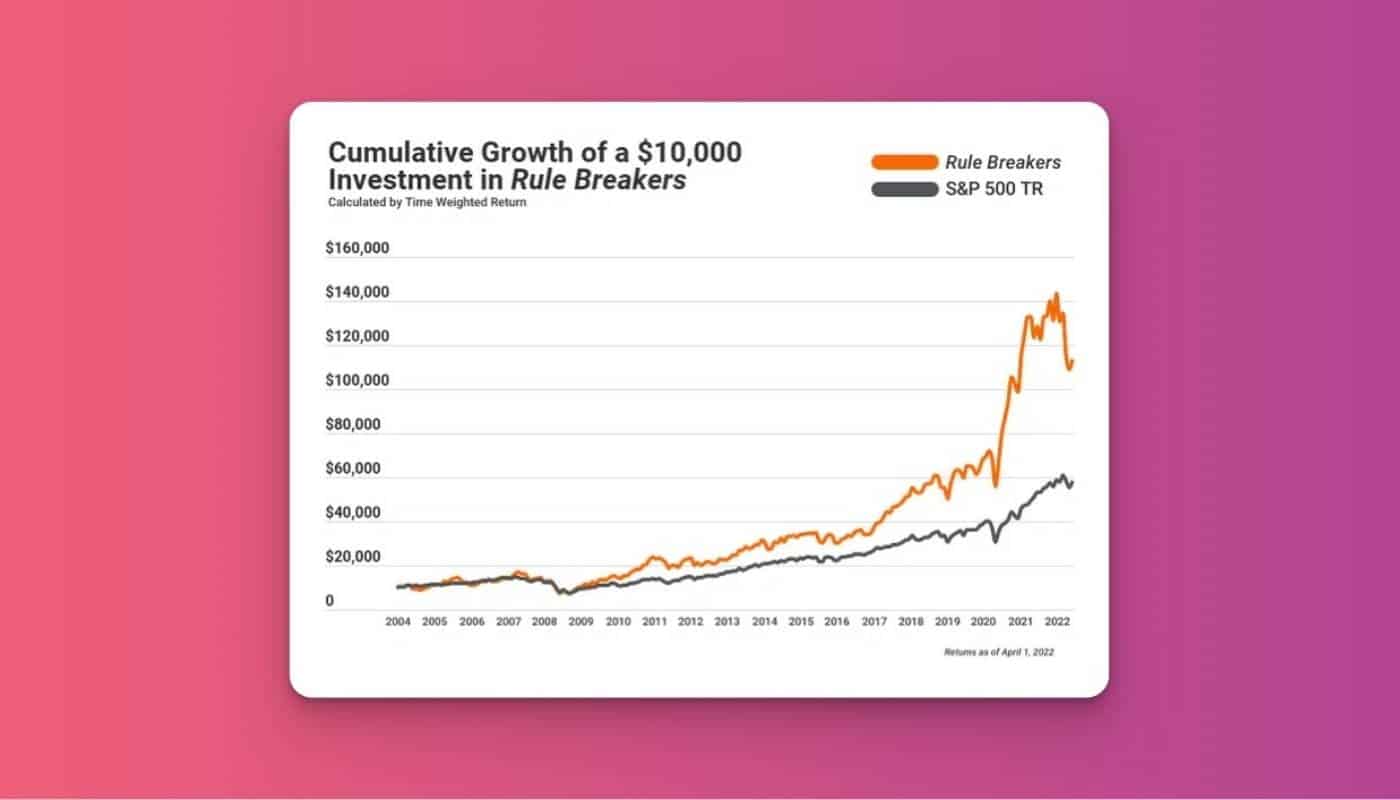

With over 17 years of experience, The Motley Fool Rule Breakers service is one of the best ways you can find professional stock picks that are prime for growth.

And the results are hard to argue against, with gains outpacing the S&P 500.

If you want professional recommendations and stock picks delivered straight to your inbox, sign up for the Motley Fool Rule Breakers below!

5. Invest in Commercial Real Estate

Commercial real estate is another option to grow your $100,000 into $1 million.

This investment focuses on real estate assets like office buildings, warehouses, strip malls, and other properties.

Commercial real estate is a great investment because it can provide a steadier income than other investments, like stocks or bonds.

Because commercial properties often obtain lease agreements for years as long as 10 years, they can provide stability to your portfolio that other investments lack.

You can use a platform like Streitwise or EquityMultiple to get started.

The returns are lucrative and can be a great way to diversify your portfolio. With EquityMultiple, it's possible to see returns greater than 15% some years.

You'll need $5,000 and be an accredited investor to get started with Equity Multiple, but once you're invested, you can use the cash flow to reinvest and grow your portfolio even faster.

If you aren't an accredited investor, my favorite commercial real estate platform is Streitwise.

With this platform, you can invest with as little as $5,000 and earn lucrative returns on your money. Create your free account below to get started!

5. Invest in Retirement Accounts

Investing through retirement accounts can be an excellent way to generate $1 million from your $100k investment.

When you invest $100,000 via a retirement account like a 401k or Roth IRA, you'll get many tax benefits that don't come with a traditional brokerage account.

Within your retirement accounts, you can invest in exchange traded funds, mutual funds, and other stock market investments to build wealth.

Because of the tax advantages these accounts provide, the IRS has set limits to how much money you can contribute.

In 2022, the contribution limit for 401ks is $20,500 and the contribution limit for Roth IRAs is $6,000 for those under 50.

This means you'll need to spread your investments out over a few years if you want to invest all of your money in these accounts.

6. Invest in Mutual Funds

Mutual funds can be an excellent way to invest your money and become a millionaire while minimizing risk.

Similar to investing in an index fund, investing in mutual funds gives you the advantage of a well-diversified portfolio without having to do much work.

There is one disadvantage to this kind of investment, however. Because many mutual funds are actively managed (meaning investment advisors will restructure the fund based on their investment outlook), they tend to have higher fees than an index fund or ETF.

Investing in a mutual fund is a simple way to diversify your portfolio and grow your net worth over time.

7. Invest in ETFs

Exchange traded funds are recommended by many financial advisors because they are a low-cost way to balance your portfolio and experience tremendous investment growth.

ETFs can be purchased on the stock market through a retirement account, a traditional brokerage account, or robo advisors making them extremely accessible for any investor.

Just like with mutual funds or other stock market investments, your rate of return tends to be around 7% to 10% annually.

8. Invest in Small Businesses with Mainvest

If you want to turn $100k into $1 million quicker than traditional methods, you're going to have to take a look at some alternative investments.

One excellent investment that many investors don't know about is small business investing through a platform like Mainvest.

With Mainvest you can invest as little as $100 in small businesses across the country ranging from breweries to restaurants, and more.

They have target returns from 10% to 25% making it an attractive investment option if you want to make $100k a month or more.

Create your free account below to get started!

9. Invest in Cryptocurrency

While cryptocurrency can be an extremely volatile investment, there's no debating that some individuals have made a fortune from it. If you want to turn your $100k into $1 million, consider investing in cryptocurrencies.

With this method, you'll need to have a high risk tolerance for your portfolio because many types of cryptocurrencies can experience swings of greater than 10% throughout the day.

Not sure what crypto to invest in? Check out this guide to investing in crypto for help.

To get started, you'll want to open a crypt wallet through an exchange like Binance. Then you can buy and sell various cryptocurrencies to make money. Best of all, you can get started with as little as $10. Create your free account below to get started!

10. Consider Art Investing

Art investing is a newer alternative investment that can be an excellent way to grow your wealth and reach your $1 million goal.

The investment returns on artwork can be more lucrative than you might think.

By using a platform like Masterworks or YieldStreet, you can generate as much as 15% annually from your initial investment – which is much larger than other forms of investing.

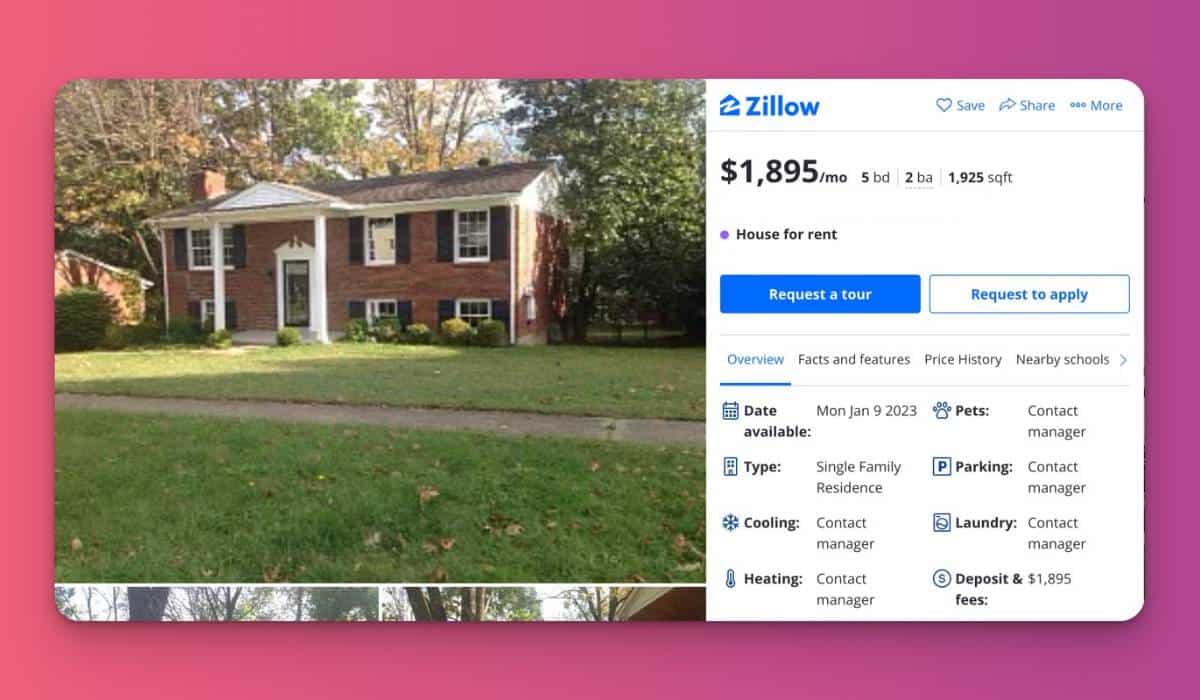

11. Buy Rental Properties

Rental properties are another great way to generate passive income and make money on autopilot. I've owned a rental property for over a year now, and it's been a pretty strong investment thus far.

Rental Property Investing

With this form of real estate investing, you’ll need to do more work compared to other methods, but it also comes with larger returns.

By purchasing an investment property you can generate income through multiple methods.

While your rental income is most likely your largest source of income, there is also equity that is built if you have a mortgage on the property.

But that’s not it!

For many properties, you’ll also build wealth through the appreciation in your property.

It’s common to see around a 2% annual increase in your property's home value. This could amount to a few thousand dollars each year of additional income.

Finally, rent prices don’t stay the same over time even if your mortgage does.

For example, if your mortgage is currently $1,000 a month, unless you have an adjustable-rate mortgage (which is less common), your mortgage will remain relatively stable over the next 30 years (taxes and insurance may increase slightly). However, rent prices will likely increase. If you’re currently renting your property for $1,500 a month, it could rise to $1,600 in the next few years.

Owning residential real estate also comes with tax benefits that some other investment strategies don't provide.

If you have a mortgage on a piece of traditional real estate all of your mortgage interest and taxes can be deducted from your income come tax season.

Now that we've covered all of the positives of investing in an investment property, it's not always as easy as it seems.

Just as owning a traditional real estate asset like your home, there are many expenses and tasks that come with owning a property.

Between home repairs and maintenance, tenants not paying rent, or vacancy costs, you'll want to try to account for these expenses when determining whether or not to invest in real estate through a rental property.

The amount of money you can make from real estate can be quite lucrative making it one of the best ways to turn $100k into $1 million.

12. Invest in Short Term Rental Properties

Long term rental properties are certainly a superb way to build real wealth with $100,000.

But that's not the only option when it comes to real estate investing with investment properties.

Another way to make money is through short term rentals like vacation rentals. Many investors claim you can make more money with these investments if you're willing to do some extra work.

Short term rental sites like Airbnb or VRBO have become mainstream in allowing you to list your property for rent for as few as just one night.

While getting a property rented for just one night might not seem like a great venture, your nightly rates can be lucrative.

At $500 per night, your property could bring in more than $10,000 per month in rental income.

However, there is much more work with this type of real estate investing. You'll need to be sure the home is cleaned after each guest, the beds are made, and everything is in place before the next guest arrives.

13. Invest in Real Estate Investment Trusts

Real estate investment trusts can be another simple way to invest in real estate without much effort.

Also known as a REIT, these investments can be purchased through the stock market like other assets.

REITs are great for any DIY investor because they can be easily purchased and sold with a traditional brokerage account.

The returns for real estate investment trusts tend to be in line with other stock market assets. You can expect a return of around 7% to 10% annually.

To invest in REITs, you can use an investing app like Acorns or M1 Finance to get started.

14. Start a Business with $100,000

Starting your own business is one of the fastest ways to turn $100,000 into $1 million if you have the work ethic to succeed.

There are many types of businesses you can start to make money by I prefer those that are less risky and have a proven business model.

While there’s nothing wrong with starting a business that has never been attempted before, these tend to be much more risky.

When starting a new business venture, you need to have a plan so you can reach your financial goals.

If you have business partners, you’ll want to be sure you know who is responsible for what parts of the business.

Depending on how much risk you’re willing to take on, starting a business can be one of the fastest methods to reach the million dollar mark from your investment.

15. Try Passive Investing with Peer to Peer Lending

Peer to peer lending is a great way to build your passive income streams and make money without working for it.

Peer to peer lending is quite easy to understand. You can lend money to peers in exchange for regular cash payments until the balance is paid back in full. You will also earn interest for your risk that is determined by the borrowers credit score.

It’s possible to earn up to 10% annually for some peer to peer lending lending deals, but these high yield offers tend to rely on borrowers with a lackluster credit score.

A lower risk borrower might yield 4% to 5% annually.

16. Invest in Bonds to Boost Your Monthly Income

Investing in bonds is a relatively safe way to grow your money and reach financial success.

There are several types of bonds you can consider depending on your risk tolerance.

For example, government bonds (or treasury bonds)tend to be the most safe, but offer lower returns. Corporate bonds offer much higher yields but come with more risk.

When it comes to bonds, you’ll need to hold your investments longer than other options

17. Invest in Precious Metals

Precious metals like gold, silver, and others can be a safe way to invest $100,000 to make a million dollars, although it might take longer than other methods.

While precious metals tend to returns less than other investments like stocks or bonds, they can be seen as a great tangible investment to keep your portfolio balanced.

18. Invest in Digital Real Estate

While many investors might not know exactly what digital real estate is, it can be a profound way to build wealth and invest $100k to make $1 million.

Digital real estate can be a variety of digital assets like a website or NFT.

My favorite pieces of digital real estate are websites that make money through content (also known as blogs).

While these might traditionally be thought of as a cute, personal project can actually make over 6-figures annually for many website owners.

Blogs make money through several methods. Between display advertising, affiliate marketing, and sponsored content, owning a website can be very profitable.

Although it won’t come overnight.

Growing a website or blog can take some time. Many blogs won’t make a penny in less than 6 months. It isn’t until after the first year that many websites a earn a significant income.

The best part of this investment is that is can become passive income if you rely on certain channels for your traffic. For example, building a website based on search engine optimization – your traffic will slowly compound so you can make more money each month.

Not sure how to start a blog? Check out my ultimate guide here!

19. Invest in a High Yield Savings Account

Opening a high yield savings account is one of the safest places to store your money while earning a little money while you're at it.

While this isn't the fastest way to turn $100k into $1 million, it is the safest.

The amount you can earn in interest will depend on the current interest rates set by the Federal Reserve and the bank you choose.

One of my favorite accounts is through CIT Bank. You can earn more than 7 times the national average in interest and you can open your account with just $100!

Where to Invest $100k in 2023

You might be wondering where to invest $100k in 2022. And with so many challenging economic conditions, it can be difficult to know the right answer.

Ultimately, traditional investments like the stock market, real estate, and even investing in digital real estate are some of the best places to invest $100k in 2022.

Don't worry – we hate spam too. Unsubscribe at any time.

What to Do Before You Invest $100,000

Before you go investing all of your money, there are a few things you should do first.

Pay Off High-Interest Debts

High-interest debts can be very expensive for your budget. Debts like credit card debt, student loans, or personal loans can cost you tens of thousands of dollars in interest alone.

Before investing your money, it's wise to pay down your debts with a higher interest rate than your potential investment returns.

For example, if you have debts (like personal loans or student loans) with interest rates larger than 7% annually, it makes sense to pay these off before investing because your potential returns would be similar.

However, if you have a low-interest debt (like a mortgage), with rates lower than 4%, it might be smarter to invest your money because your returns would be larger than the interest rate of your loan.

Deciding between paying off debt or investing is highly debated in the personal finance community. There isn't one right or wrong answer 100% of the time. For many people, it is a personal decision that they make.

Build an Emergency Fund

Having an emergency fund that is established is essential if you want to reach financial success.

An emergency fund is money that is typically stored in a savings account or bank account that can be used in case of a serious emergency like an unexpected medical bill or sudden job loss.

How much money is enough money for your savings?

Experts debate, but it's wise to have a minimum of at least 6 months of your normal living expenses. If you have a lower risk tolerance, you can save an additional 3-6 months to pad your savings.

Have a Plan for Your Finances (And Keep Track)

Having a plan for your money is critical if you want to grow your own portfolio and reach your million dollar goal.

What will you do once you reach the $500k mark?

Keeping track of your progress is a great way top stay motivated to reach your goal. Try to setup recurring check-ins with your finances so you can keep tabs of your current progress and how close you are to reaching your goal.

Consider a Financial Advisor

When you have a significant amount of money to invest, it’s always wise to consult a financial advisor to help guide your investing strategy.

Financial advisors can help you make better decisions with your investing and pose questions you might not have thought about.

How to Turn $100k into $1 Million

If you want to turn $100k into $1 million, there's no shortage of investments to consider. Here are some steps to help you turn your savings into a 7-figure portfolio.

Create a Plan

It's important to have an investing plan to reach your goal. This plan should include your investment goals, risk tolerance, and timeline. Consider what you want to achieve and how soon you need the money.

Are you saving for retirement? Or is this money just for fun?

This can make a large difference in how you invest. If saving for retirement, for example, you'll probably want to utilize tax-advantaged accounts like a 401(k) or IRA.

While you won't be able to achieve your goal overnight, you can reach it within 10 years if you invest regularly and earn a healthy return.

Determine Risk

Whenever you invest, there's a certain amount of risk that you're willing to take. Understanding your own risk tolerance is crucial to finding investments that fit your needs.

Some people are more comfortable with lower-risk investments, like bonds, which tend to provide steadier returns over time. Others are willing to take on slightly more risk for the potential of higher returns, like equities and real estate.

Risk and reward are directly correlated, so the more risk you're willing to take, the higher your potential return.

Keep Fees Low

To turn $100k into $1 million, minimizing your fees is essential. Fees can eat into your profits and lessen the affects of compounding returns.

Fees can be hidden in more places than you think.

For example, many people don't realize that most mutual funds have an annual expense ratio of 1-2%. This means that for every $100 you have invested, you're paying $1-$2 in fees.

On a $100,000 investment, that's $1,000 to $2,000 a year!

Instead, look for low-cost index funds or ETFs. These funds tend to have lower expense ratios, often 0.1% or less. For a $100,000 investment, that's just $100 a year in fees!

How Long will It Take to Make $1 Million?

You’re probably wondering how long it will take your money to swell into the million-dollar club.

And while it’s hard to say exactly, there are a few ways to calculate this.

Ultimately, the length it will take will depend on the exact amount of money you invest and your rate of return.

For example, an investment that generates returns of 15% will take much less time than an investment that grows at a rate of 6%.

Best Investing Platforms to Build Wealth

Below are some of my favorite platforms to invest and grow your money.

- Acorns – robo advisor to invest in the stock market

- Realty Mogul – low cost crowdfunded real estate platform

- Masterworks – invest in art

- Binance – invest in cryptocurrencies

- Personal Capital – tool to keep track of your investments and watch your wealth grow

Final Thoughts on Investing $100,000 to Make $1 Million

There are plenty of ways to invest $100k to make $1 million.

Between real estate, stocks, and exchange traded funds, there are options for investors of any kind.

To minimize risk to optimize your returns, it's wise to diversify your portfolio as much as possible. By investing in different asset classes and investment options you can reach your financial goals without worry.

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

How to Invest 500k: 24 Safe Methods (2024 Guide)

Want to learn how to invest $500k? Explore these 24 best ways to invest $500,000 to build wealth and make money!

How to Become Wealthy in 5 Years (Proven Methods in 2024)

Want to become wealthy in 5 years? Check out these actionable ways to make more money and become wealth in 5 years or less!

Are Investing Apps Worth It (2024 Guide)

Looking to start investing but aren't sure if it's worth it? Read to learn if investing apps are worth it or not!

15+ Best Real Estate Investing Apps (Ultimate 2024 List)

Check out these real estate investing apps to start growing your money and managing your properties with ease!