If you have $150k to invest, you have a number of different options available to you. You could invest in stocks, bonds, real estate, or even start your own business.

It can be easy to get overwhelmed when trying to figure out where to invest your money. However, by breaking things down into smaller steps, you can make the process much less stressful and profitable.

Here are the best ways to invest $150k!

Best Ways to Invest $150,000

1. Invest in Index Funds

Index funds are a great choice to achieve a diversified portfolio with ease.

In my opinion, this is the hands down best way to invest $150k.

With index funds, you're investing in a basket of securities that track a particular market index. This means that you're not picking and choosing individual stocks, but rather investing in a broad market.

There are many different index funds to choose from, so it's important to do your research and find one that aligns with your investment goals. For example, if you're looking for a long-term investment, you might want to invest in a fund that tracks the S&P 500.

S&P 500 index funds have averaged returns of around 10% over the long term making it a solid investment option to generate passive income. You can even find some 12% compound interest investments!

So, how do you get started investing in an index fund?

I recommend an investing app like Acorns. Acorns allows you to invest with as little as $5. You can invest in a variety of stock market investments like index funds, ETFs, individual stocks, and more.

As a bonus, you'll get $20 completely free when you create an account with the link below. That's right, free stock!

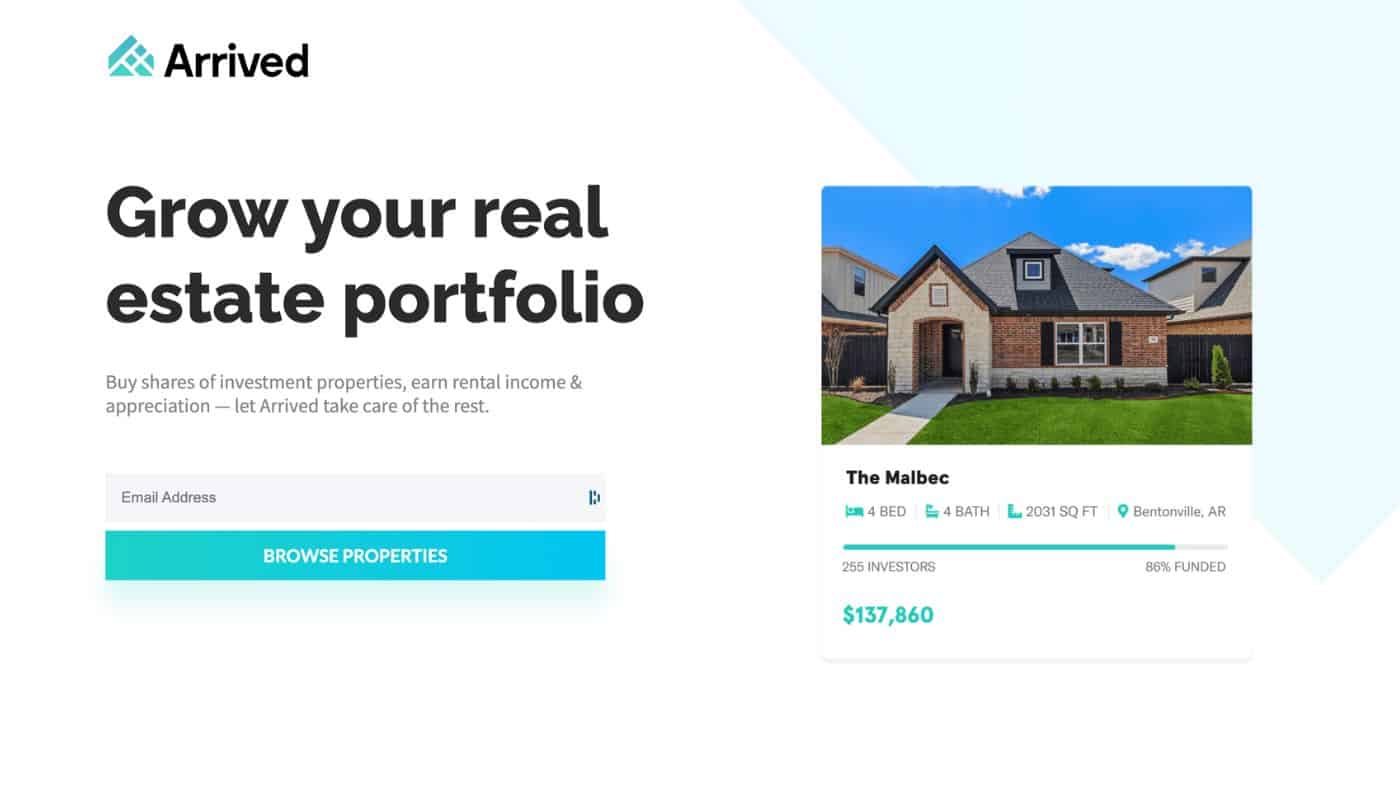

2. Invest in Rental Properties with Arrived

Crowdfunded real estate can be an excellent way to invest $150,000 and keep your investment portfolio diversified.

As any experienced investor knows, you want to have your money spread out over many different asset classes. For example, investing some of your money in the stock market, some in real estate, and perhaps some in other investments like bonds or precious metals.

By using platforms like Arrived, you can invest in real estate to make compound interest without the stress and headache of managing a property yourself.

It works by pooling money together from many different investors allowing you to invest in rental properties without having to purchase the entire property outright.

I love the ability to pick and choose which properties you invest in, which gives you more control over your money than other platforms. They also have a minimal fee of just 1%, which is less than other crowdfunding sites.

The returns will vary from property to property, but it's common to see results greater than 8% annually.

Overall, if you want to invest in real estate, Arrived is a tremendous option I highly recommend.

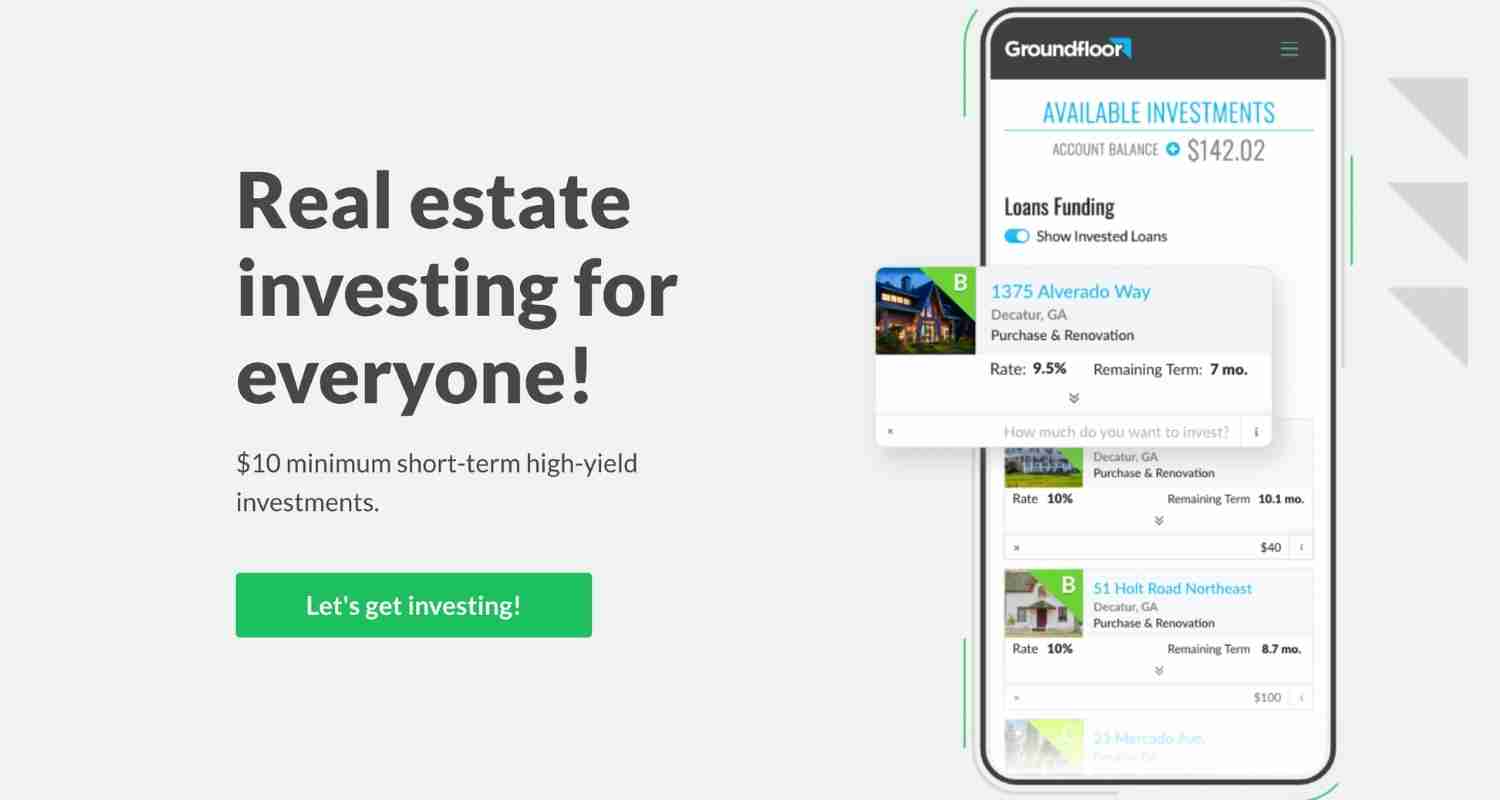

3. Invest in Real Estate Debt

Another way to invest in real estate is through short term debts with a platform like Groundfloor. This type of investment is slightly higher risk, but can offer a higher return.

With this method of investing, you'll essentially be loaning money to real estate developers who are then responsible for repaying the loan plus interest.

For example, if they need money to complete a house flip, they might look for investors who can help them complete the project.

The big advantage of this method is that it's a relatively short-term investment, with many loans lasting for less than a year.

Plus, the developers are typically responsible for finding the properties, so you don't have to do any of the legwork.

The downside is that it's a slightly higher-risk investment than something like a REIT, but it can be a great option to help keep your investment portfolio diversified.

If you're ready to get started, I recommend using a platform like Groundfloor. You can get started with as little as $10! Sign up below to create your free account!

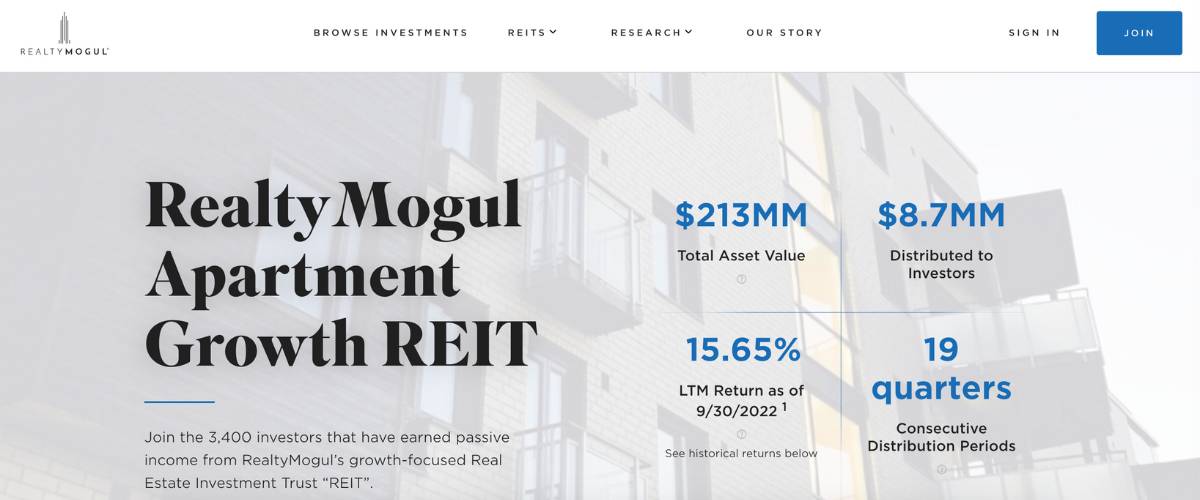

4. Invest in Commercial Real Estate

Another real estate investing option is commercial real estate like office buildings, strip malls, and other large real estate assets.

The best method to get started investing in commercial real estate is Realty Mogul.

There are many different benefits of commercial real estate as opposed to residential offerings. Some of the benefits include:

- Commercial real estate is usually leased out to creditworthy tenants with long-term leases, which results in a more stable investment.

- Commercial real estate properties often appreciate at a higher value than residential properties.

- You can add value to a commercial property by making improvements, which can lead to higher rents and increased occupancy rates.

With returns averaging over 10% – this is a great investment for anyone. Create your account below to get started!

5. Invest in ETFs

Exchange-traded funds (also known as ETFs) are a type of stock market investment that is similar to index funds or mutual funds.

ETFs have very low fees, which makes them a good investment option if you're looking to optimize your returns.

Another benefit of ETFs is that they are very liquid, meaning you can sell them quickly and easily, just like a regular stock.

The amount of money you can make from this investment will vary depending on the ETF you choose but it's common to see returns ranging from 7% to 12% annually.

Take a look at the average returns of a popular ETF, VOO over the past 10 years.

Overall, ETFs are very similar to index funds in that they are well-diversified, low-cost investments that can give you exposure to a wide range of assets.

You can invest in ETFs with an investing platform like Acorns or M1 Finance to get started!

6. Invest in Small Businesses

Small businesses can be extremely profitable, but not everyone has the time to start a business.

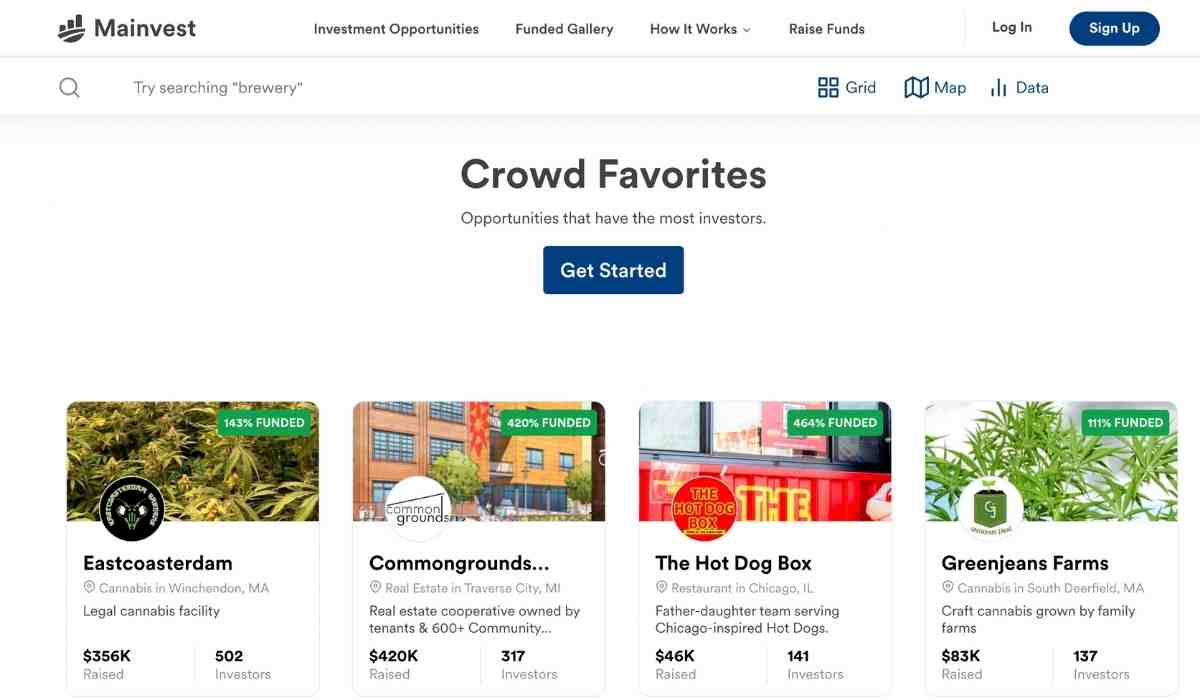

Thanks to platforms like Mainvest, you don't have to. With Mainvest you can invest in small businesses across the country with as little as $100.

For example, there are plenty of restaurants, real estate offerings, and brewing companies you can invest in to make money.

They target 10% to 25% annual returns making it one of the more lucrative methods to make money.

This is an excellent way to diversify your portfolio to avoid having all of your eggs in one basket.

7. Purchase a Rental Property

Purchasing a rental property can be a lucrative way to invest $150k if you're willing to put in some work.

Rental properties can be a great investment because they can make money in several fashions. For example, you can make money from the monthly rent payments, the appreciation in the value of the property, and by cashing out any equity you've built up through mortgage payments.

Another source of income is rent appreciation. Assuming you have a fixed-rate mortgage, your mortgage payments will remain steady throughout the life of the loan. However, as your property increases in value, so can the amount you charge for rent.

For example, if your home is currently being rented for $1,200 per month, it's possible to raise the rent to $1,300 a month in a few years while your mortgage payment remains the same.

With this real estate investment, you'll need some money to get started but $150,000 is plenty. There are many rental properties you can purchase with that amount of money when getting started. You'll need at least 20% for a down payment to qualify for a mortgage.

If you want to purchase a rental property but don't feel like dealing with tenants, collecting payments, or doing other tasks, you can consider hiring a property manager to do this for you.

Hiring a property management company will typically cost around 10% of your property's monthly rent but it can be a good idea for many new real estate investors.

Here is a great video that highlights the process of investing in rental properties!

8. Invest in a High Yield Savings Account

If you're looking for a safe investment to grow your money, using a high yield savings account can be an easy way to make monthly income with low risk.

While your returns might be lackluster, this is one of the safest investments you can make with your money. These accounts are very similar to a money market account except you can withdraw your money whenever.

The amount you can make will depend on current market conditions and the bank you choose.

My favorite high yield savings account is through CIT Bank. You can start with just $100 and it's completely free to open.

Currently, you can earn up to 10 times the national average in interest – which can add up. Open your free CIT Bank account with the link below!

9. Invest in Mutual Funds

Mutual funds can be another stock market investment option to invest $150k.

Mutual funds are a collection of stocks, bonds, and other securities that are managed by a professional fund manager. This means that you don't have to do any research or analysis to invest in a mutual fund – the manager will take care of that for you.

The downside to some mutual funds is that they typically have higher fees than other stock market investments because they are actively managed.

After fees, many mutual funds can make anywhere from 7% to over 15% depending on the fund and the year.

You can use a robo advisor like Acorns or M1 Finance to get started!

10. Invest in Dividend Stocks

While investing in individual stocks is riskier than other forms of investing, if done correctly it can be a great cash-flowing asset to make money.

Dividend stocks are stocks that pay out a portion of their profits to shareholders in the form of a dividend. For example, Coca Cola is a large, well-known dividend stock.

While there is always the risk that the company could go bankrupt, in many cases these companies have been around for decades and are very stable.

The key to investing in dividend stocks is to find companies that have a long history of paying out dividends and that are growing at a healthy rate.

You can invest in dividend stocks with Acorns. Don't forget to claim your free $10 here!

Check out these ways to make $500 a month in dividends!11. Invest in REITs

A REIT (or real estate investment trust) is another stock market investment if you want to invest money in real estate.

Real estate investment trusts are similar to ETFs and mutual funds in that they are very diverse assets.

REITs can contain many different real estate properties so that all of your money isn't invested in a single property.

You can invest in REITs through a traditional brokerage account like Acorns or M1 Finance.

12. Invest in Bonds

There are many different types of bonds you can invest in to make passive income.

Bonds are debt investments where you loan money to a company or government in return for interest payments.

The amount of money you can make from bonds will depend on the interest rate and the length of the loan.

One thing I like about bonds is that you can choose your risk level meaning if you have a low-risk tolerance you can choose lower-risk options. If you want to make more money or have a higher risk tolerance you can invest in riskier options.

13. Invest in Cryptocurrency

Not everyone believes that cryptocurrency is an investment, but it's difficult to argue with some people making fortunes from these digital currencies.

If you do choose to invest in crypto, remember to only invest what you can afford to lose. Because many of these currencies can fluctuate massively throughout the day, it's possible to lose money quickly if you're not careful.

My favorite platform to buy and sell crypto is Binance. With millions of users, they are a trusted exchange to invest in crypto offering all of the most popular coins. Open your free account below to get started with as little as $10!

14. Consider Art Investing

Investing in art can be a great way to make money, but it hasn't always been available to the public retail investor.

With the introduction of platforms like YieldStreet you can invest in art with little money instead of needing hundreds of thousands of dollars to get started.

Art is unique in that it can't be reproduced which makes it a valuable commodity.

The returns on art vary, but you can expect to make returns of 8% to 12% on art investments.

If you're ready to get started, create your YieldStreet account below!

15. Try Website Investing

There are many digital real estate assets that can produce massive income for your portfolio.

By purchasing a website or online business, you can make passive income for years to come.

Websites and blogs can make money through a variety of methods. Some of the most common include display advertising and affiliate marketing.

You can browse for websites on brokerages like EmpireFlippers or Flippa to find an online business that suits your goals.

16. Take Advantage of Retirement Accounts

Using a retirement account like a 401k or IRA is a great way to invest money and get tax breaks in the process.

Using retirement accounts to invest your money offers the ability to grow your money tax-free or tax-deferred.

This can help to reduce your taxable income and future tax bill while saving money for your future.

You can open a retirement account through many traditional brokerages.

17. Invest in Fixed Income Annuities

Another option for invest $150k for income is to invest in fixed income annuities. These types of annuities provide a guaranteed stream of income for a set period of time, typically 10 to 20 years.

There are several benefits of investing in a fixed income annuity, including:

- Guaranteed income for life: A fixed income annuity provides a guaranteed stream of income for as long as you live. This can be especially beneficial in retirement, when you may no longer have a regular paycheck coming in.

- Protection from inflation: With a fixed income annuity, your payments are fixed, which means they won't be eroded by inflation. This can be a valuable way to maintain your purchasing power over the long term.

- Death benefit: If you die before the annuity's maturity date, your beneficiaries will receive a death benefit equal to the remaining value of the annuity. This can provide peace of mind knowing that your loved ones will be taken care of financially if something happens to you.

While the returns for annuities can oftentimes be lower than other investments, it's a great way to have an income secured for years.

Considerations Before Investing

If you have $150k to invest, you might be tempted to find the best investments to start making your money work for you.

But that's not always the best idea.

Before investing, you'll want to take a look at your debts, retirement savings, and if you have an emergency fund established.

If you have credit card debt or other high-interest debts like student loans, it's wise to pay these off before investing.

Similarly, if you have no money invested for your retirement, it's a good idea to build your savings for the future.

Finally, if you don't have an emergency fund, this should be a critical step before you invest your money to weather any problems that could arise.

Don't worry – we hate spam too. Unsubscribe at any time.

Monthly Return on $150,000 Investment

If you have $150k to invest, you might be wondering what kind of monthly returns you can make on your money.

Depending on the investments you choose, it's possible to safely earn anywhere from 7% to 12% on your money annually.

Monthly returns from your investment can amount to around 1% for strong investments or slightly less depending on your risk tolerance.

When you invest $150k, this would amount to $1,500 per month in returns and up to $15,000 annually.

What to do with $150k Cash

There are plenty of options to grow your money with $150k cash depending on your financial goals.

For example, if you want to make passive income from your money, investing in rental properties can be a smart investment.

I would recommend investing in the stock market with Acorns and investing in real estate with Realty Mogul with $150k cash. These methods have a strong risk-reward ratio offering robust returns without assuming a significant amount of risk.

Final Thoughts

There are plenty of strong investment options to reach your financial goals when investing $150k.

Between investing in the stock market, real estate, or bonds – growing your money is a matter of getting started.

I recommend opening a brokerage account with Acorns to start investing in the stock market and using Realty Mogul to grow your money in real estate. So, what are you waiting for? It's time to start making money while you sleep.

It's always wise to consult a financial advisor before making any investment.

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

How to Become Wealthy in 5 Years (Proven Methods in 2024)

Want to become wealthy in 5 years? Check out these actionable ways to make more money and become wealth in 5 years or less!

How to Invest 10k in Real Estate – Simple & Easy Methods (2024)

Looking to invest $10k in real estate? Check out these simple real estate investments to grow your wealth and make money!

How to Make $500 a Month in Dividends (2024 Guide)

Want to make $500 a month in dividends? Check out this guide to determine how to get started making money with dividend stocks!

15+ Best Real Estate Investing Apps (Ultimate 2024 List)

Check out these real estate investing apps to start growing your money and managing your properties with ease!