Want to invest $20? You might not think this is enough to invest, but it actually is!

There are many methods you might consider to grow your money, but which is right for you?

In this post, I'll explore some of the best ways to invest $20, how to invest $20, and how much money you could make from your $20 investment. Let's get started!

Best Ways to Invest $20

1. Invest in the Stock Market with Acorns

One of the easiest ways to invest your $20 is by investing in stocks.

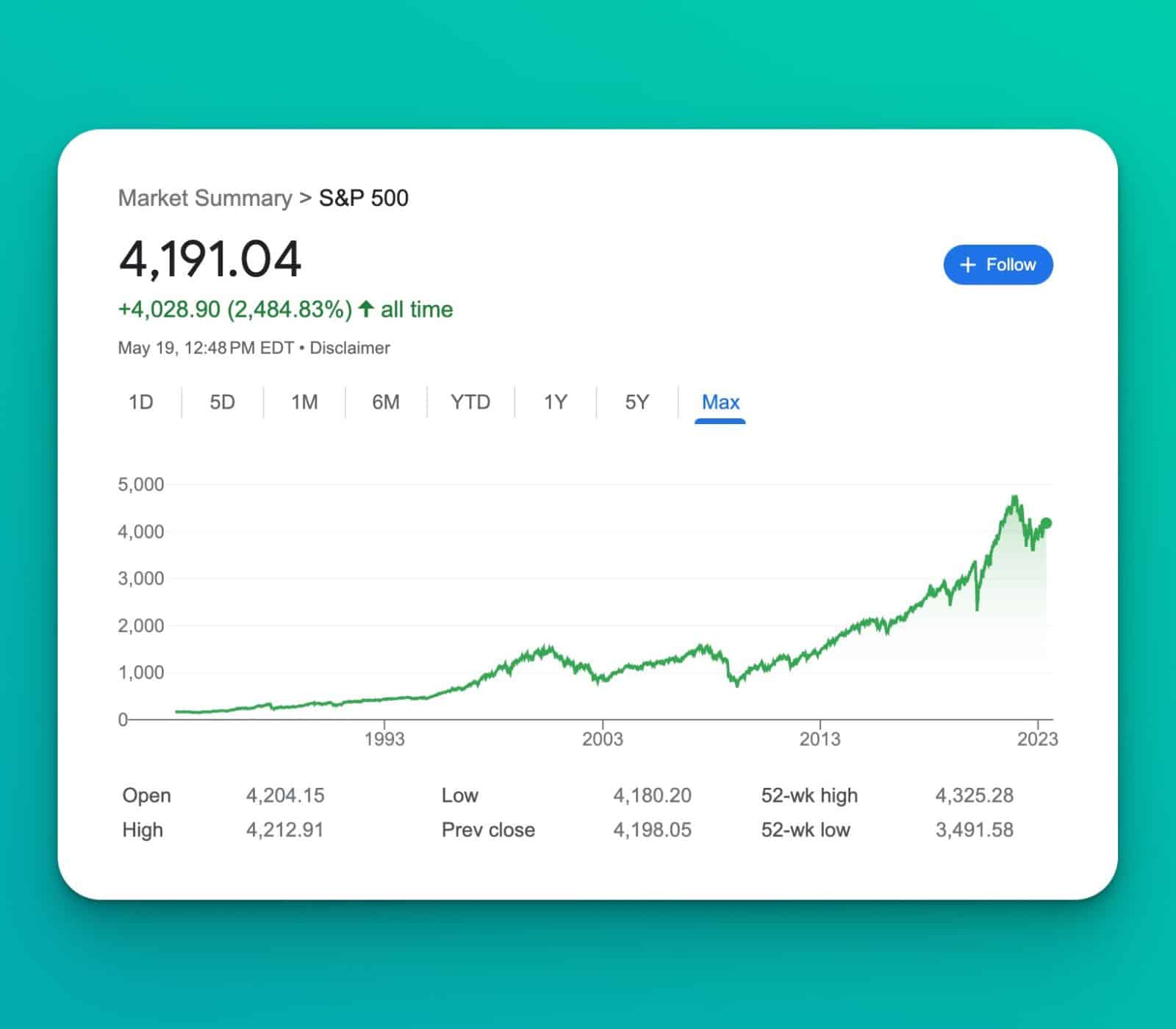

By investing in the stock market you can grow your money with an average return of around 7% to 8% annually. While this might not sound like much, your money will compound over time to increase exponentially.

The stock market offers a variety of options you can choose to invest money. Some of the most common are index funds, ETFs, mutual funds, or individual stocks.

I always recommend investing in index funds and ETFs over individual stocks because they are much less risky and provide great returns.

For example, check out the returns of the S&P 500 below since its inception.

S&P 500 Returns

To start investing in the stock market, I recommend using Acorns. With this app you can easily purchase your favorite stocks, index funds, or a plethora of ETFs to start your investment portfolio.

Need another reason to begin investing with Acorns? You'll get a FREE $10 when you register with the link below! Who doesn't love free money?

Below are a few of the most common ways to invest in the stock market and the pros and cons of each!

Fractional Shares

When investing 20 dollars, you'll need to be capable of purchasing smaller chunks of investments – and that's exactly what fractional shares do.

Also called stock slices, fractional shares allow you to purchase a portion of a single stock. For example, if the price of 1 share of Amazon stock is currently $3,327. That's a lot of money!

With fractional shares, you can purchase as little as $5 worth of Amazon, stock giving you access to many different investing options. You can also purchase fractional shares of ETFs and index funds as well, which will help you stay diversified.

Basically, you get a fraction of a share of a stock, which makes it more accessible to anyone whether you have $20 to invest or $60,000.

Individual Stocks

If you feel passionately about a company, you might be tempted to invest in a single stock. While I rarely would recommend doing this, it can certainly pay off if you pick the right stock to invest in.

For example, if you believe in a company like Lululemon or Coca Cola, by investing in their individual stocks if they company performs better than expected you can earn a fortune.

There are two main types of stocks – growth stocks and dividend stocks.

Growth stocks are usually younger companies that are in their high growth phases. These stocks will pay very little in dividends but their stock price should rise dramatically as the company expands.

Dividend stocks are the opposite. These tend to be more mature companies who are in slower growth phases. Whenever these companies make money, instead of reinvesting the profits back into the company, they pay them directly to shareholders in the form of a cash dividend.

Both growth and dividend stocks can be great, quality companies that can earn great returns on your money, so I wouldn't recommend one over the other – it's just wise to know the difference.

Index Funds

Index funds are a popular group of stocks that are very similar to an ETF. The main difference is that ETFs can be traded throughout the day while index funds will only be traded at the end of the trading day. Other than that, these are very similar investments.

Index funds contain many different stocks that can help balance your portfolio. This means that instead of investing in one single company, you'll be investing in hundreds with just one investment.

Index funds are a tremendous way to build long term wealth and invest $20. They are safe, reliable, and easy to invest in which is why I recommend them so much.

ETFs

Just like an index fund, an ETF can be thought of as a group of stocks and investments grouped together into one investment. This investment is not actively managed like mutual funds, meaning they have minimal fees. This means you'll get to keep more of your profits – which I'm all for.

There are many different types of ETFs you can invest in. For example, some might focus on more conservative investments while others may be focused on more growth potential. This can be nice because you can limit risk, while also investing in higher returning assets.

You can also invest in sector based ETFs. For example, this could be technology based, healthcare, energy, or many other individual sectors.

Mutual Funds

Mutual funds are slightly different than ETFs and index funds. Whereas index funds and ETFs are more stable and have extremely low fees, mutual funds typically come with larger fees (but not always!).

Mutual funds are often more actively managed than the others, meaning that an investment professional will determine when to buy and sell different companies on your behalf.

The advantages of this are that the returns can sometimes be more than an ETF or index fund.

The downside is that the fees will eat into your profits. In many cases, the increase in returns is offset by the additional fees, but not always.

In general, I recommend going with an ETF or index fund over a mutual fund, but mutual funds are a smarter investment than picking and choosing individual stocks.

2. Grow Your Money with a High Yield Savings Account

Don't want to worry about losing your money in the stock market or other assets?

A high yield savings account is one of the least risky ways to invest $20 – perfect for those with a low risk tolerance.

This type of savings account acts just like a traditional savings account or bank account with the main difference being the much larger interest rate.

Some high interest savings accounts can offer over 10 times the amount of interest as a traditional savings account.

If you don't have a high yield savings account yet, what are you waiting for!? I highly highly recommend these accounts because there's no risk and you can earn decent interest on your money.

My favorite account is the CIT Bank savings account. It's completely free to open and has no fees associated with it. Register below to open your account and starting growing your money!

3. Invest in Real Estate

While many real estate assets will require higher initial investments than $20, it's a great strategy to keep in mind as your money grows.

Between appreciation, rental income, and equity built – real estate investing can be a very lucrative investment that can pay you monthly.

It's possible to see returns greater than 15% annually for some investments, so it's definitely worth considering.

My favorite way to get started is by using a platform like Arrived. Arrived allows you to invest in individual rental properties with as little as $100.

While you'll need a little more than $20 to get started with this method, if you can manage it – this is a great investment that I would recommend. You can create your free account below to get started.

If you don't want to invest more than $20, your next option is to invest in a REIT in the stock market.

A REIT is basically a public company that mainly invests in real estate that you can trade through the stock market just like you would with other assets.

REITs are great if you don't have $100 to invest, but if you have $100 – I'd go with Arrived.

4. Invest in Bonds

If you're searching for a low risk method to invest your $20, you might consider investing in bonds. While there are several types of bonds, government bonds (or treasury bonds) tend to be the safest option.

While the minimum is $25 – I'm sure you can scrape together an extra $5. If not, check out these apps that give you free cash.

You can purchase government bonds from TreasuryDirect which is super easy to use.

When compared to the stock market, your returns on bonds will often be lower, but your risk will also be less – which is something to consider.

5. Start a Small Business

While there aren't many businesses you can start for $20, you might be surprised there are a few.

Many service based businesses can cost less than $20 to get started. For example, starting a cleaning business might not cost you anything if you already have the supplies.

Another great business to start would be an online business like a blog or website of your own. While an online business might not make a ton of money right off the bat, over time they can make massive profits and be a tremendous investment.

I'm a huge fan of starting a business if you want to reach financial freedom because you'll have total control of your income and work schedule. It's a great way to escape the rat race and invest $20 for the future.

6. Invest in Yourself

Investing in yourself can be a great way to invest $20. In fact, this is recommended by one of the richest men in the world, Warren Buffett.

There are tons of different ways you can invest in yourself ranging from furthering your education to learning news skills online.

For example, one great option is to purchase Skillshare to learn new skills. When you use the link below, you'll get 14 days of free learning. You can take online classes in photography, coding, and just about anything else you can imagine.

Here are some great tips to invest in yourself!

7. Cryptocurrency

This is the most speculative investment on the list but I think it's worth mentioning as an option. If you have a high risk tolerance and you're seeking larger returns, cryptocurrency can be a good option.

The main downside of this alternative investment is that is can be extremely volatile. Some days your investment could grow by 10% or 20% while other days it could fall by more than 30%.

While some personal finance experts wouldn't consider cryptocurrency as an investment, I believe that some can be. The key is to keep your portfolio diversified. I wouldn't allocate more than 5% or 10% of your total portfolio to an alternative investment like cryptocurrency.

To get started purchasing cryptocurrency, I recommend using Binance. The free app allows you to buy and sell many different cryptocurrencies with as little as $5!

Investing Tips to Maximize Returns

Diversify Your Investments

You don't want all your eggs in one basket. When it comes to investing, this means spreading your money across multiple assets to limit risk.

If you are currently invested heavily in the stock market or real estate, consider another investment like bonds or a small business.

Stay in it for the Long Run

You won't become rich overnight when investing $20. You'll invest your money for more than a decade to maximize your returns and build wealth. While you might only start with a little money, this money will compound and grow over time.

Utilize Retirement Accounts

Retirement accounts like a 401(k) or Roth IRA offer many tax benefits over a traditional brokerage account.

These investments are just like others, they're just held in a different account that gives you tax breaks that can save you money.

Don't worry – we hate spam too. Unsubscribe at any time.

What to do Before Investing

Establish an Emergency Fund

You'll likely experience an emergency expense sometime over the course of the next year. Will you be ready for it? If not, establishing a proper emergency fund should be a priority. Even if it's just $20 or $50 to start, the goal is to get started.

With investing, there is a chance that you could start losing money – even if it's just a small amount. Because past performance is not indicative of future results, having an emergency fund is a good idea.

Become Debt Free

High interest debts can cripple your financial goals. Credit card debt, student loans, personal loans, and other high interest debts can make managing your money a challenge. Aim to pay down as many debts as possible before you start investing.

Final Thoughts

While you're not going to become a millionaire overnight by investing $20, you can grow your money over a few years and start to see your earnings stack.

If you want to reach financial freedom, starting with a $20 investment is a no brainer. The best ways to invest $20 including investing in the stock market, investing in real estate, investing in yourself, and investing in other assets like bonds or cryptocurrency.

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

How to Invest $25k: 19 Safe Methods (2024 Guide)

Want to learn how to invest $25k? Check out these best investments to make money and build wealth easily!

24+ Best Investments That Pay Monthly (Ultimate 2024 Guide)

Looking for investments that pay you every month? Check out this complete list of investing options to consider.

How to Invest 10k in Real Estate – Simple & Easy Methods (2024)

Looking to invest $10k in real estate? Check out these simple real estate investments to grow your wealth and make money!

How to Turn $10K into $100K – 20+ PROVEN Methods (2024 Guide)

Learn how to turn 10k into 100k quickly and effectively with this guide to investing your money. Read now!