So you want to invest $500,000 but aren't sure where to start? Investing a half-million dollars can be very risky if you aren't sure what you're doing.

With that amount of money, it can be easy to get roped into the latest fad investment that's promised extreme returns – but that can be a recipe for disaster when it comes to your finances.

And with so many investing options and jargon, it's easy to get overwhelmed.

If you want to build long term wealth and grow your $500,000 into millions of dollars in the future, I've put together some of the best investment options to easily invest your money wisely.

In this post, I'll explore how to invest $500k, how much money you can make from your investments, and much more. Let's get started!

- Investing in real estate with Realty Mogul

- Investing in index funds or ETFs with Acorns

- Investing in small businesses with Mainvest

- Diversifying your portfolio with alternative investments

- A mix of bonds, peer to peer lending investments, and high yield savings accounts

24 Best Ways to Invest $500k for Income

Believe it or not, you don't always need a financial advisor to invest wisely (although it is recommended in many cases). Below are some of the best ways to invest $500k for income.

Invest in Real Estate to Make Passive Income

Real estate is another great way to invest $500,000 and diversify your investment portfolio.

There are many ways you can invest in real estate assets to grow your income. Some of my favorites include crowdfunded real estate, rental properties, and REITs.

Invest in Crowdfunded Real Estate

Crowdfunded real estate is my favorite way to build wealth and make passive income without the hassle of managing properties, collecting rent payments, and dealing with tenants.

If you're looking for investments that generate income monthly – some crowdfunded real estate assets can be the perfect fit.

My favorite platform for investors is Realty Mogul. You can get started with $5,000 and they have meager fees so you can keep more of your money. With Realty Mogul, you can invest in a variety of real estate investments to make passive income. So if you're looking for the best way to invest $500k –Realty Mogul should undoubtedly be considered.

If you want to focus more on commercial real estate, I recommend using a platform like EquityMultiple. Their historical rate of return is 17.4% – which is much higher than other investment options.

This is another crowdfunded real estate investing platform that focuses more on commercial offerings to help you grow your money.

It's worth noting that EquityMultiple is only accepting accredited investors at this time, so it you aren't an accredited investor, I recommend using Streitwise.

Their team has over $75 billion worth of real estate transaction experience making them a trusted by to invest your money. Create your account below to get started!

Invest in Commercial Real Estate

There's more to real estate than just single family and multi-family homes. Commercial real estate can open up an entire new avenue for your portfolio to help you diversify and maximize your returns.

By using a platform like Streitwise you can invest in commercial real estate without needing millions of dollars. With over 100,000 users and billions of dollars in assets, this is a trusted platform to grow your money.

Create your account below to get started and check out my Streitwise vs Fundrise comparison for more info.

Consider a Real Estate Investment Trust

A real estate investment trust is similar to crowdfunded real estate except for the fact that it is publicly traded on the stock market.

REITs own a variety of real estate assets so you can keep your portfolio diversified.

The returns for many REITs tend to be more similar to those of index funds and the stock market as a whole – however, it allows you to diversify away from other assets.

Just like other forms of real estate investing, REITs make money by purchasing real estate and collecting rent payments and capital appreciation. You can invest in a REIT with an investing app like Acorns. Be sure to claim your free $10 below!

Invest in Rental Properties

Rental properties will require the most work, but will also generate the most significant return.

Owning a rental property is a great way to invest $500,000 because your returns can exceed 15% annually in some cases depending on market conditions.

Owning a rental property is an incredible income producing asset because they make money through a variety of methods.

The most apparent income you'll see is through rent payments. Each month your tenant will write you a check for their rent that you can use to make your mortgage payments (if applicable) or pay yourself.

Next, you'll see your net worth swell through appreciation. In most cases, single family homes and other pieces of real estate will appreciate in value over time. While the amount of appreciation is hard to predict, historically it has been around 1% to 3% annually. While this might not seem like a significant amount of money – it can add up over time.

For example, if your home has a current value of $200,000 and it appreciates 2% – this would amount to $4,000 in just one year. That's an additional $333.33 per month in income!

If you do have a mortgage on the property, as you collect your rent each month, the equity in your property will increase. You can think of your tenants as paying your mortgage for you. Who wouldn't want that!?

Finally, rental appreciation can be another way to make additional income from your property.

As home values rise, so will your rental income. While some landlords will choose to keep rents the same if they have great tenants – in many cases, it's normal to increase rent over time. Even if it's just $10 per month – that will amount to $120 per year in additional income. Keep in mind that if you have a fixed-rate mortgage, your mortgage payment will remain the same – making this income pure profit.

There are several different types of rental properties including vacation rentals, duplexes, and other multifamily properties. Each has their own benefits and drawbacks so it's important to do your research before investing.

You can also read my full Fundrise vs rental property comparison here!

Invest in Index Funds to Maximize Returns

Index funds are the best way to invest $500k because they offer you a decent amount of diversification.

You can think of index funds as a sort of mutual fund or ETF because they invest in a variety of companies to give you a wide range of returns.

Investing in an index fund is one of the most reliable ways to make $50,000 in extra income per year with your $500k as the best index funds will return around %10 annually.

Why Invest in Index Funds?

Index funds are great for making $50,000 with your $500k because they give you excellent returns. The average return for many index funds are around 8% to 10% annually.

How do you invest in index funds?

My favorite way to start investing in an index fund is through a robo advisor like Acorns. With Acorns you can invest in all of your favorite stocks and index funds with as little as $5. As a bonus, you'll get $10 completely free when you use the link below.

Don't forget to track your wealth by using a free platform like Personal Capital. This completely free platform can track all of your investments making it easy to see your net worth in real time. You can also uncover hidden fees and get access to an investment advisor free of charge. There's no risk, so create your account to get started!

- Best Ways to Make Money While You Sleep

- Best Appreciating Assets

- How to Start Apartment Investing

- Investments That Pay You Every Month

- How to Invest $200k

Invest in Real Estate Syndication

With real estate syndication, you can invest in real estate through a pool of other investors to get better rates on loans and make more money.

It is similar to crowdfunded real estate except more private. You will have to find syndications to invest in as they are often not promoted to the public.

Many syndicated real estate companies will require that you are an accredited investor to join the . There are different qualifications for becoming an accredited investor but some of them include:

- Having an income greater than $200,000 annually ($300,000 for joint)

- Having a net worth over $1,000,000

- If you are a general partner, executive officer, or director for the company issuing the securities

Invest in Small Businesses

Starting and growing a small business can take a significant amount of work and money to become profitable. And while this is completely acceptable for some investors – others are likely looking for a way to make passive income so they can achieve financial freedom.

This is where a platform like Mainvest can be very beneficial. Mainvest allows you to invest in small businesses around the country so you can grow your money without needing to do the work.

For example, it's possible to invest in restaurants, breweries, and other small operations that can be very profitable. The platform has no fees and has target returns anywhere from 10% to 25%. You can get started with as little as $100 making it an attractive investment option for both new and experienced investors.

If you're looking for a simple way to invest your money in small businesses, open your free Mainvest account below!

Invest in Dividend Stocks

Dividend stocks are a superb way to make a consistent income from your investments through the stock market.

Whenever a company makes a profit, they have the option of keeping the profit to continue to grow the company or they can disperse the profit to investors in the form of dividend payments.

Many times, dividend paying stocks tend to be more mature and at lower growth stages. For example, Coca Cola is an excellent example of a dividend stock with years of positive returns.

Owning dividend paying stocks is a great way to keep a diversified portfolio and invest $500k.

To purchase these investments, I recommend a robo advisor like Acorns.

Acorns automatically rounds up your purchases and invests your spare change. This means your money will grow automatically without having to do anything. Don't forget to claim your free $10 with the link below!

Invest in Individual Stocks

Investing in individual stocks can be much more risky than other options like a mutual fund, index fund, or government bonds – however you can also make tremendous money if you can pick the right stocks.

If you do choose to invest in individual stocks, be sure to conduct research and review the financial details of the company before making a large investment.

Making a living trading stocks can be difficult, but it is possible in some cases.

Invest in Mutual Funds to Earn Money

Mutual funds are very similar to index funds or ETFs except that they are managed by a group of investors instead of computers. You can invest in mutual funds to make $50,000 with your $500k.

I have noticed that the best mutual funds for your $500k are those investing in blue-chip companies with a long history of profit growth.

For example, the DWS Blue Chip Growth Fund invests in some of the best companies in America that have a history of making money. These companies include companies like Disney, Apple, 3M, Google, and more.

You can invest in mutual funds with Acorns. Don't forget to claim your free $10 below!

Try ETFs to Build Wealth

Exchange-traded funds (ETFs), like mutual funds, are baskets of stocks that track the performance of an index or sector.

The great thing about ETFs is that they are very low cost investments that charge just a fraction of what mutual funds do.

ETFs are great because they have the same features as mutual funds but cost much less.

If you are looking for more diversification with your $500,000 then exchange-traded funds are for you.

Store Money in a High Yield Savings Account

High yield savings accounts are a simple way to keep your money safe while receiving monthly income from your investment.

While you won't see as strong of returns as other investments like the stock market or a mutual fund, you'll receive much more than a traditional savings account.

The amount of interest you make will be determined by market conditions. As interest rates rise, the amount of money you'll get paid will also increase. However, if interest rates decline, so will your earnings.

My favorite high yield savings account is through CIT Bank. There are zero fees and you can earn around 10 times the national average in interest. Register below to open your free account now!

Grow Your Money with Peer to Peer Lending

Peer to peer lending is relatively new in the investment community. With peer to peer lending, you can lend money to individuals for mortgage or loan payments.

In some cases, this can be more risky than other investments, but the returns can also be more significant. Your return will be based on the borrower's credit score, income, and other factors.

Depending on your risk tolerance, peer to peer lending can be a good way to make a fixed income from your money.

There are plenty of peer to peer lending options you can consider. Some of the top rated platforms include:

- Peerform

- Upstart

- Prosper

Invest in Art for Diversification

Art investing is one of the newer investment options you can use to build wealth.

While you might be wondering how to get started, it's easier than you think. By using a platform like Masterworks or Yieldstreet, you can invest in art without the trouble of securing pieces, keeping them safe, and storing them.

Famous pieces of art can cost millions of dollars – but these platforms allowsyou to purchase smaller shares of the entire piece so you don't have to be a millionaire to get started.

Since it's inception, Yieldstreet has proven strong returns averaging 15% annually – which is much higher than the stock market of some other investments.

Using art is a great way to keep your portfolio diversified and invest $500,000.

Open a Money Market Account

Money market accounts are similar to traditional savings accounts except that they tend to pay slightly higher interest payments.

This is an extremely safe investment as almost every money market account is backed and insured by the federal reserve.

While I wouldn't invest all $500k into a money market account, it's a good idea to store some essential savings in this account.

Maximize Returns with Cryptocurrency

Depending on your risk tolerance, cryptocurrency can be a very profitable investment if done right.

There are now thousands of possible cryptocurrencies to invest in which can make it challenging to find the right coin for you. Most investment advice recommends the more common coins like Bitcoin or Ethereum but sometimes you can fund other options that are poised for growth.

My favorite way to invest in cryptocurrency is through Binanace. You'll have access to all of the most popular coins and the platform is simple to use. Register for Binanace with the link below!

Not sure how to get started? Check out this video on how to trade cryptocurrency below!

Consider Bonds to Invest $500,000

If you're looking for a different asset class to boost your income, some bonds can be a good option.

These investments don't always have the strongest returns, but many of them are considered “safer” investments.

There are many kinds of bonds for almost any investor. For example, corporate bonds are issued by large companies looking to raise capital. Treasury bills are issued by the treasury to pay debts owed by the country. Usually investments like treasury bonds (or t bills) pay much less because the risk is minimal.

Investing some of your $500,000 in alternative asset classes like bonds is a good way to keep your money diversified.

If you want to invest in bonds, I recommend a mix of treasury bonds, corporate bonds, and municipal bonds.

Browse Annuities

Fixed annuities are another way to invest a lump sum of cash. These are typically offered by an insurance company.

Annuities are a great investment for those nearing or in retirement because you'll receive a fixed payment for your investment rather than “hoping” your investments don't decrease in value.

Annuities are one of the best low risk investments to grow your money, although it's worth considering how your returns compare to inflation. As inflation rises, your purchasing power will decrease and your annuity may not be able to keep up.

Related: How to Invest $25,000 for Income

Use Retirement Accounts to Invest $500k

While retirement accounts are not technically an investment, they are a great way to grow your retirement savings and strengthen your financial position.

When compared to a traditional brokerage account – retirement accounts like a 401k or IRA offer many tax advantages to keep more money in your wallet and away from Uncle Sam.

Capital gains taxes are not paid on retirement investment earnings through these accounts which means you can keep more of your money.

The reasons to use a retirement account extend beyond the tax benefits, however. As social security benefits continue to be underfunded, there is no guarantee of this income later in life, meaning it is essential to fund your retirement on your own.

Invest by Starting a Business

Not everyone would consider starting a business as an investment, but it certainly can be. With this “investment” you'll need to put in more work than with other investments, but the returns can be extraordinary.

Many small businesses can be very affordable to start and can produce a 6 figure income for yourself.

If you have $500k to invest, your options are limitless when it comes to starting a business.

I recommend starting smaller with more profitable small businesses like a pressure washing business, rental company, or storage unit rental business.

With these types of businesses you can grow rapidly and turn your investment into a 7 figure empire in less than 10 years.

Consider Investing in Yourself

While investing $500,000 in yourself would be considerably difficult, using some of your funds to improve your education or lifestyle can be a good investment.

That doesn't mean you should purchase a million dollar home, but dropping a few thousand dollars on your education or developing your skills can go a long way in growing your income.

For example, if you take a course to learn how to code, you could then make money building websites for small businesses to boost your income. This would be a good investment because your future income would rise, allowing you to invest in other assets in the future.

Check out the video below for more info on investing in yourself!

Pay Off Debt

If you have any high interest debts, you should almost always consider paying these off before investing your money.

High interest debts can have interest rates greater than 7% annually. Usually these debts include:

- Credit card debt

- Some personal loans

- Student loans

Donate Money for Tax Savings

While I wouldn't consider donating money as an investment – it can help you save some money on your tax bill. By donating money you can deduct your donations up to 100% of your adjusted gross income.

This is an easy way to lower your taxes for some people.

Invest $500,000 in a Private Company

Just because a company isn't publicly traded doesn't mean there aren't other methods to invest in it.

Believe it or not, there are ways you can invest in private companies to make money, but it's not quite as simple.

By investing in companies in the earlier stages of growth you can have enormous returns, but they also have much more risk involved.

Becoming an angel investor or investing in a venture capital firm are the most common ways to invest in private companies.

Save for a Home

If you're wondering what to do with $500k, saving up for a downpayment on a home is another great option if you don't already have a home.

While some people may not see a home as an investment, there are plenty of people who do. Because of appreciation, over time your home will be worth more and more.

While this might not be the highest returning investment, it's a great way to improve your overall life and finances.

How Much Money Can You Make with $500,000?

The amount of money you can make from your $500,000 investment will vary depending on many factors.

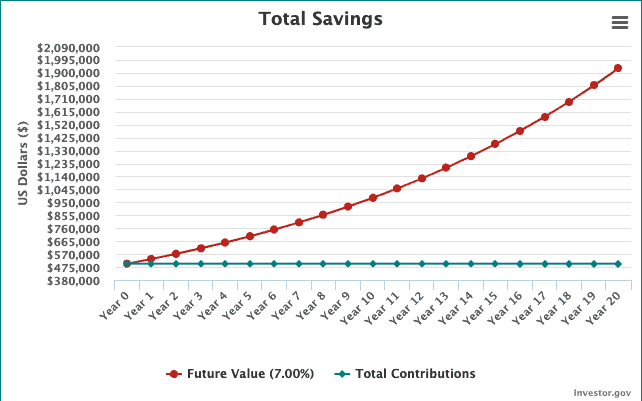

Depending on the investments you choose, it's safe to assume around a 7% return on investment with a well diversified portfolio.

With a $500,000 portfolio, this would amount to an annual return of $35,000 for your first year of investing. But that's only your first year.

In the following year, your portfolio would grow even more because of the compound interest generated from your investments.

In the second year, you would generate $37,450. You can think of the additional $2,450 as interest on your interest.

Below is a chart to help you visualize the impacts of compound interest on your net worth.

After 15 years of investing your 500k, assuming a 7% interest rate, your portfolio would amount to $1.934 million!

It's important to understand that when it comes to investing – time is your best asset. You won't get rich overnight unless you invest in something risky where luck is involved.

Don't worry – we hate spam too. Unsubscribe at any time.

Considerations Before Investing $500,000

Before you invest $500,000, you'll want to consider your financial situation. It's wise to consult a financial advisor or financial professional before investing all of your money because every individual is in a unique circumstance.

Do You Have an Emergency Fund?

Having an emergency fund is essential when investing $500k. If you invest all of your money into illiquid assets and an emergency happens, will you have the cash to pay for it?

An emergency fund is a great way to cover any expenses that may arise from an unexpected life event like a major hospital bill, job loss, or another situation.

How is Your Retirement Savings?

Saving for retirement is a critical part of your wealth management strategy. Many financial advisors recommend saving at least 15% of your income for retirement.

I wouldn't go invest all of your cash into a brokerage account if you are nearing retirement and don't have a significant nest egg.

How to Turn $500,000 into $1 Million

If you want to turn $500,000 into $1 million, you're going to need to decide on which methods are best suited to double your money.

One of the easiest ways to do this is through stock investments. With an average return of anywhere from 7% to 10%, you should be capable of doubling your money in about 7 years to reach your $1 million goal.

By spreading your investments over several asset classes, you can reduce your overall risk and maximize your returns.

You can also check out my post on how to turn 100k into $1 million for more info!

Investing $500k for Income

Some of the best ways to invest $500k for income include:

- Investing in real estate with Realy Mogul or an investment property

- Fixed income investments like bonds and annuities

- Opening a money market account with CIT Bank

Whether you're looking to invest $150k, or investing $300k – investing for income can be a wise approach.

Final Thoughts on How to Invest $500,000

Figuring out an investment strategy for your money can be extremely challenging, especially when you're looking to invest $500,000.

Between the stock market, real estate, and alternative investments – it's always wise to consult your financial adviser when investing a half-million dollars.

Investing always comes with some level of risk, so you'll want to create a strategy that reduces risk and optimizes your returns so you can be well suited on your financial journey.

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

How to Invest $150k – 17+ Safe Methods (2024)

Looking to invest $150,000? Check out these best investments to grow your money safely and earn passive income!

24 Best Compound Interest Investments (For Beginners & Pros in 2024)

If you're looking for the best compound interest investments, give these a try to start growing your money and building wealth!

15+ Best Real Estate Investing Apps (Ultimate 2024 List)

Check out these real estate investing apps to start growing your money and managing your properties with ease!

How to Make $500 a Month in Dividends (2024 Guide)

Want to make $500 a month in dividends? Check out this guide to determine how to get started making money with dividend stocks!