Do you have $80k to invest and want to get the most from your money?

You can't just hop on the hottest stock and investing trends and expect to do well. You need to follow proven and tested investing strategies so you can grow your money and avoid heavy losses.

Here are the best ways to invest $80k to build wealth and grow your money.

Best Ways to Invest $80k

1. Crowdfunded Real Estate

Crowdfunded real estate through platforms like Arrived is a great way to get started in real estate with as little as $100.

This platform works by pooling money from different investors to finance income generating rental properties. As an investor, you'll earn a share of the profits from these projects which can amount to a decent return on your money.

By using Arrived, you can spread your $80k investment across several different properties and diversify your portfolio with ease.

Arrived is an attractive investment option for a few reasons.

First, you get complete control of which investments you make. Whereas many crowdfunding platforms will roll up several projects, Arrived allows you to invest in each rental property of your choosing.

Second, it's super simple to use, has minimal fees, and you'll get paid quarterly based on the returns of your property.

Finally, anyone can get started as long as you have $100 to invest. This means you don't need to be an accredited investors to get started.

Your returns will vary depending on the properties you invest in, but it's not uncommon to see returns greater than 8% to 10% annually on average.

Create your account below to get started!

2. Invest in the Stock Market

The stock market is another fabulous way to build long term wealth with your $80,000.

And the best part is that you can get started with as little as $5 through an investing app like Acorns or M1 Finance.

Just like with real estate, there are multiple methods to invest in the stock market depending on your goals and circumstances.

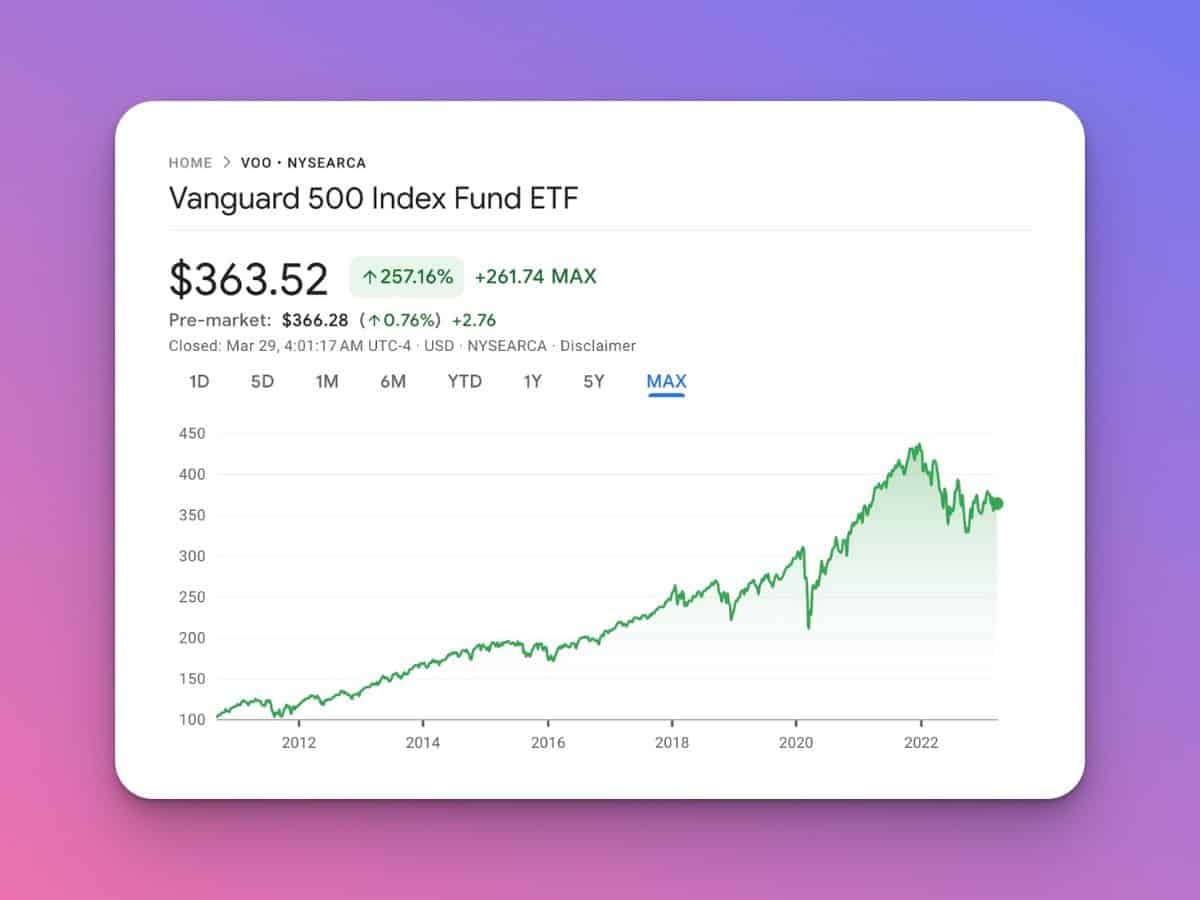

For example, index funds are a great option to construct a well-diversified portfolio without much effort.

This is because index funds track a specific index (like the S&P 500) and automatically invest your cash in the top 500 stocks that make up the index. For example, here are the returns for a popular S&P 500 Index Fund ETF, VOO.

Another option to invest in the market is through mutual funds.

Mutual funds are like index funds but they're actively managed by real human fund managers.

This means that they have the ability to outperform index funds but they also come with higher fees which can sometimes offset the increased performance.

Additionally, there are ETFs.

Ultimately, these are very similar to an index fund, except on a smaller level. The average ETF return is around 7%, making it an excellent option to compound your money over time.

Finally, you can pick and choose individual stocks. I wouldn't recommend this option to any investor because it's very risky and you need to have a lot of knowledge about the stock market to make money trading stocks.

The stock market is a great way to invest $80k and you can easily get started thanks to platforms like Acorns or M1 Finance. Don't forget to claim your free $10 below!

3. Commercial Real Estate

Commercial real estate is another tremendous option to invest $80k and make money.

By using a platform like EquityMultiple, you can invest in a variety of commercial real estate projects that have strong potential for returns.

The minimum investment is $5,000, so you can spread your money across several different properties.

One of the great things about commercial real estate is that it's often less volatile than the stock market and residential real estate, making it a more stable investment.

So how much money can you make with commercial real estate?

It will depend on the investment but in many cases, you can earn a return of 12% or more annually.

This makes commercial real estate one of the best ways to invest $80,000.

But there's one thing to keep in mind: you'll need to be an accredited investor to invest with EquityMultiple, so if you're not – I'd take a look at Realty Mogul. Register for EquityMultiple below to start building wealth!

4. Real Estate Debts

Have you heard of real estate debts? It's a lesser-known but highly effective (and profitable!) way to invest in real estate and earn strong returns.

Real estate debts are basically loans that are secured and backed by real estate. This means that if the borrower defaults on the loan (doesn't pay it back), the lender can seize the property so they don't have a total loss.

For example, if a home flipper needs money to finalize or complete a flip, they may utilize platforms like Groundfloor to find the money they need.

These are often short term loans with terms ranging from 6 to 24 months.

As an investor, you can choose which loans you want to invest in – which is a big advantage so you can do some analysis yourself.

The returns on these investments are typically over 10%, making them an amazing way to grow your money and keep your portfolio diversified.

You can get started with as little as $10 with platforms like Groundfloor.

5. REITs

REITs, or real estate investment trusts are a great way to invest in real estate without having to put down a large amount of money.

Additionally, these funds are comprised of many different real estate assets – so there's more diversification than say, a single rental property.

The returns for REITs will depend on several factors, but they're similar to other stock market investments like index funds or mutual funds. You'll typically get around 10% give or take a few points annually.

You can checkout these high yield REITs if you're not sure what to invest in.

You can use an investing app like Acorns to get started investing in REITs with as little as $5. As a bonus, they're giving new investors $10 completely free when you register with the link below!

6. Rental Properties

Rental properties are often the most profitable method to invest in real estate but they also require the most work and headache.

However, if you're willing to put in the time and effort, rental properties can be an excellent way to invest $80k.

Rental properties can make money through several avenues – which many people overlook.

Sure, you have the rental income. We all know about that. It's the money your tenants pay you each month to stay at the property.

Then you have equity that's built. If you have a mortgage on the rental property – after 30 years, the home would be yours outright.

Finally, you have home and rental appreciation. Because real estate tends to appreciate over time, this means you will be worth more and more as the property increases in value. At the same time, as it increases, you can charge higher rents and make even more money.

While appreciation is never guaranteed, it's a nice additional form of wealth that's built.

All in all, rental properties are a great way to invest $80k and make money if you're willing to put in the work.

7. Invest in Small Businesses

Did you know it's possible to invest in small businesses?

That's right! Thanks to platforms like Mainvest, you can start investing in small businesses around the country with just $100.

Mainvest is a solid platform that allows you to invest capital with small businesses in your community and help them grow.

In return for your investment, you'll earn a percentage of the profits generated by the business.

This is a great way to invest $80k because the returns can be extraordinary.

It's possible to make between 20% and even 30% in some cases. While this isn't the standard, it's possible to earn these types of returns more often than you might think.

8. Cryptocurrency

Are you looking to maximize your returns and don't mind to take a little risk?

While I certainly wouldn't invest all $80,000 into cryptocurrency – it can be a great way to invest a smaller portion of your money.

If you're capable of picking the right coin, you could make fortunes.

For example, some popular cryptocurrencies like Bitcoin have generated returns of over 400% in a single year before.

But with reward comes greater risk.

Cryptocurrency is a very volatile asset class and prices can swing up or down by double digit percentages on any given day.

This means that you could lose a significant portion of your investment if you're not careful.

To get started investing in cryptocurrency you can use a platform like Binance to start buying and selling all of the most popular coins.

9. Bonds

If you have a low risk tolerance, bonds can be a great investment that you might want to consider.

You can think of bonds like a loan of sorts.

You give a company (or the government) money, and they'll give you an interest payment in return.

There are several types of bonds that you might want to take a look at.

For example, government or treasury bonds tend to be the safest investments, but they also provide the lowest return.

Corporate bonds, on the other hand, offer much greater returns, but have more risk associated with them.

It's all about how much risk you're willing to take.

Some bonds can yield greater than 7+ while others might yield less than 3%.

Ultimately, I recommend allocating a small portion of your portfolio to some safer bonds, like treasury bonds – so you can generate some return on your money without taking on massive risk.

10. Alternative Investments

There are many alternative investments that can be a great addition to your portfolio if you're looking to invest $80,000.

For example, investing in artwork or fine wine are two lucrative alternative investments that can yield string returns.

Art can be a great investment because it's a physical asset that you can enjoy while it appreciates in value. You can use a platform like YieldStreet to get started without needing a fortune.

Fine wine is another great option because it's a luxury item that tends to go up in value as the years go by. You can use a platform like Vint to invest in wine with as little as $100. Check out the returns on Wine vs the S&P 500 below!

Sign up with Vint below to get started!

Alternative investments make great additions to any investment portfolio. They offer a simple way to diversify and can provide you with the potential to earn high returns.

11. Peer-to-Peer Lending

Peer to peer lending is another investment option that can provide you with decent returns on your money.

You can think of peer to peer lending as being similar to bonds expect instead of loaning money to an institution, you'll lend it to another person.

With peer to peer lending, you'll be able to choose who you want to lend your money to and for how long.

There are many platforms you can use to start investing in peer to peer lending such as Lending Club and Prosper.

12.High Yield Savings Accounts

If you're looking for the safest way to invest $80k, high yield savings accounts can be your best friend.

While you won't make a fortune, that's not the goal with a savings account.

Instead, you're looking for a small return but a safe place to store your cash at the same time.

My favorite account is through CIT Bank, which pays around 7 times the national average in interest and you only need $100 to open your account.

In addition, there are no fees and you can withdraw your money at any time without having to pay any penalties.

13. Retirement Accounts

If you have $80k to invest, there's a good chance you know about retirement accounts by now.

But if not, you should!

Retirement accounts like a 401k or IRA allow you to invest in a variety of assets like the stock market while paying less in taxes.

That said, there are some restrictions on retirement accounts and you might face penalties if you withdraw money early, but if you're looking for a place to store your nest egg – retirement accounts are the way to go.

How Much Interest Will I Earn on $80,000?

If you have $80,000 to invest, you'll be able to earn a decent amount of interest depending on how you choose to invest it.

For example, if you choose to invest your money in the stock market, you could get an average return of around 7% to 10%.

Or if you take on more risk and invest in small businesses with Mainvest, you could easily see returns greater than 10%.

It's all about how you invest your money.

Here is a breakdown of your potential annual earnings when you invest $80k based on an average return amount:

- 1% – $800

- 2% – $1,600

- 3% – $2,400

- 4% – $3,200

- 5% – $4,000

- 6% – $4,800

- 7% – $5,600

- 8% – $6,400

- 9% – $7,200

- 10% – $8,000

Don't worry – we hate spam too. Unsubscribe at any time.

How to Invest $80k in Real Estate

The best way to invest $80,000 in real estate is through a combination of crowdfunding platforms like Arrived and REITs with Acorns.

This will give you a diverse portfolio of properties and help you maximize your return.

Final Thoughts

There are many different ways you can invest $80k depending on your goals and the amount of risk you're willing to take.

If you're looking for safety, you may want to consider investing in bonds or a high yield savings account with CIT Bank.

But if you're willing to take on more risk for the potential of higher returns, you may want to consider investing in real estate with LEX Markets or the stock market with Acorns.

No matter what you decide, make sure you do your research and always remember to diversify your portfolio and speak with a financial advisor before investing.

Looking for more awesome investing ideas? Check out these posts!

- How to Invest and Make Money Daily

- 24 Best Investments That Pay Monthly

- Are Vacation Rentals a Good Investment?

Don't worry – we hate spam too. Unsubscribe at any time.