If you have $1,000 – you might be wondering what to do with it.

Should you invest in in stocks? What about real estate?

There are many things to do with $1,000, but you'll want to invest your money wisely so you can turn your money into more money.

In this post, I'll explore how to turn $1000 into $10000, some tips and strategies to help you reach your goal. Let's get started!

Best Ways to Turn $1,000 into $10,000

Invest in Real Estate with Arrived

Using a real estate investing app like Arrived is an excellent option to turn $1,000 into $10,000 over time.

With this platform, you can easily invest in individual rental properties that are vetted for income potential across the country. Then, as the renal generates income, you'll get paid out monthly on the returns.

This method will allow you to grow your money without having to put any work in, and you can start with as little as $100.

The average returns will vary depending on current economic conditions and the portfolio you're invested in, but it's not uncommon to see returns greater than 9% annually.

I love Arrived for several reasons. First, it has a super low barrier to entry – so anyone can get started. Second, I really like the ability to pick and choose exactly what properties you invest in. With many other platforms, your money is hidden in a collection of assets that you have no control over, this gives you more control and the ability to earn more over the long run.

-

$100 minimum investment so anyone can get started

- Access to individual properties so you can pick and choose which properties to fund

- Quarterly payouts depending on your properties performance

- Open to both accredited and non accredited investors

- Minimal 1% management fee

- Some offerings are funded quickly

Investing in the Stock Market

The stock market is a tremendous way to make compound interest – no matter how much money you have.

There are many different options when it comes to investing in the stock market include:

- Index funds

- Mutual funds

- ETFs

- REITs

- Dividend stocks

- Growth stocks

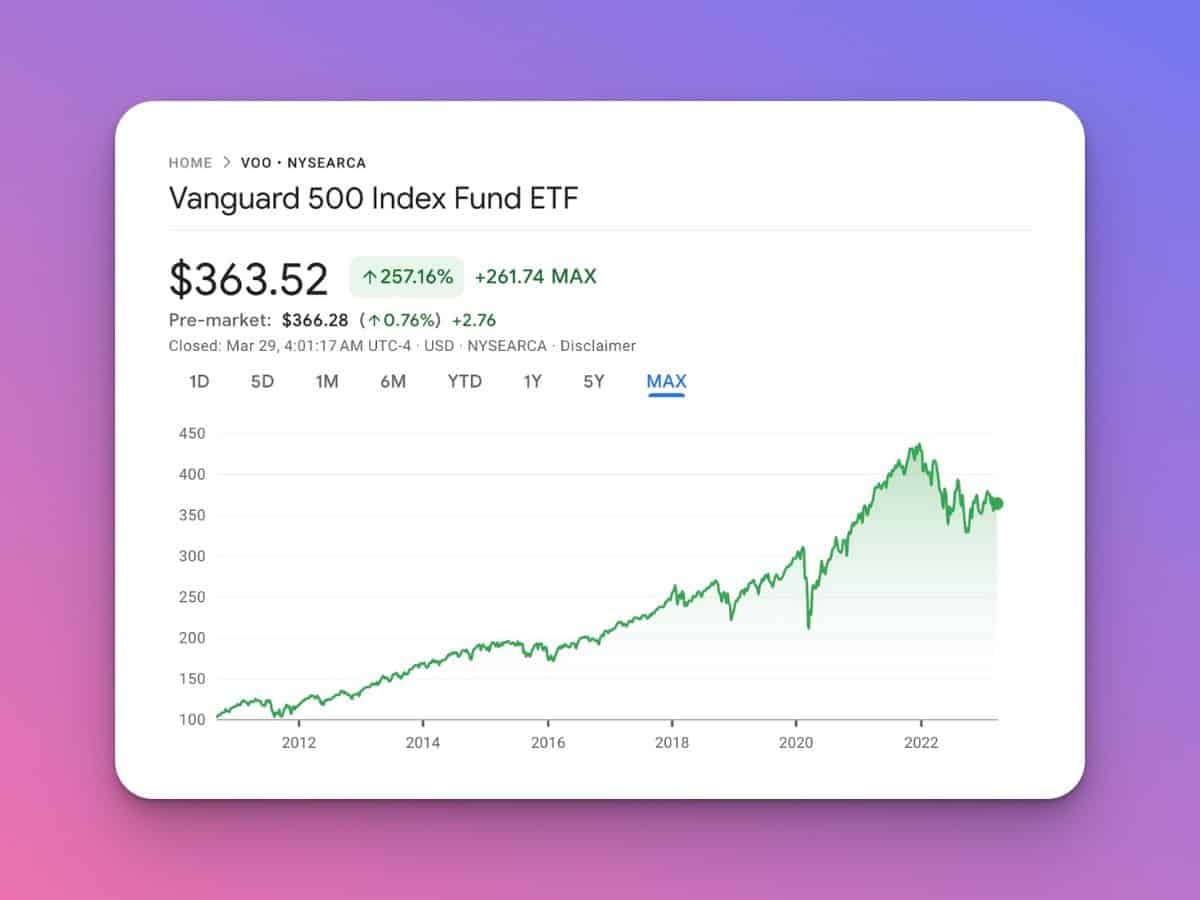

My favorite option is index funds because they give you a diversified portfolio with very little risk.

With index funds, your returns will mirror the stock market as a whole which has averaged around 10% per year over the last century.

For example, below is the chart for a popular (and my favorite) index fund, VOO.

You can see how fast your money can grow through the stock market and over time – it's one of the most reliable investments you can make.

This means you don't need to pick one winning stock to double your money.

For example, if you have $1,000 and can average a 10% return, in 10 years you will have turned your $1,000 into $2,593.74.

To get started investing in the stock market, you can use an investing platform like Acorns or M1 Finance.

With Acorns, you can get $10 completely free when you open a new account with the link below!

Invest in Small Businesses with Mainvest

If you want to turn $1000 into $10000 in less than a year, you're going to need to be creative with your investing strategy.

One way is to invest in small businesses with a platform like Mainvest.

You can start investing with just $100 and choose from a variety of businesses in different industries.

Just like with Arrived, you can pick and choose exactly which businesses you invest in, and you'll have more control of your investments that you would with other platforms.

The average return on investment for Mainvest ranges from 10% to over 25%, so if you're able to find a few businesses that you're confident in, you can reach your goal of turning $1,000 into $10,000 very quickly.

Invest in Real Estate Debts

Another method to invest in real estate is through real estate debts.

In short, this means you're lending money to a real estate investor who will use the funds to buy and or rehab a property.

The benefit of this method is that it's a relatively low-risk investment since the property is used as collateral for the loan.

The returns will vary depending on the deal, but you can expect to earn 8% – 12% per year on your investment.

To get started, you can sign up with a platform like Groundfloor.

The minimum investment is just $10 – making it a viable option for anyone looking to invest whether you have $10 or a thousand bucks.

Start Flipping

Flipping your money is a great way to turn your initial investment of $1,000 into $10,000 in a few months or less.

If you have a little extra cash, flipping can be a great side hustle to grow your earnings.

Flipping is the process of buying an item for a low price and selling it for a higher price. Now, it's not always as easy as it sounds, and you'll need to do some research so you can identify which items are worth more than others.

The most common items that are flipped are:

- Furniture

- Clothing

- Electronics

- Books

- Collectables and antiques

There are a number of ways to source your items, but some of the most popular include:

- Facebook Marketplace

- eBay

- Garage sales

- Flea markets

There are many other options available as well, but these are a great place to start.

Once you have your items, the next step is to list them for sale.

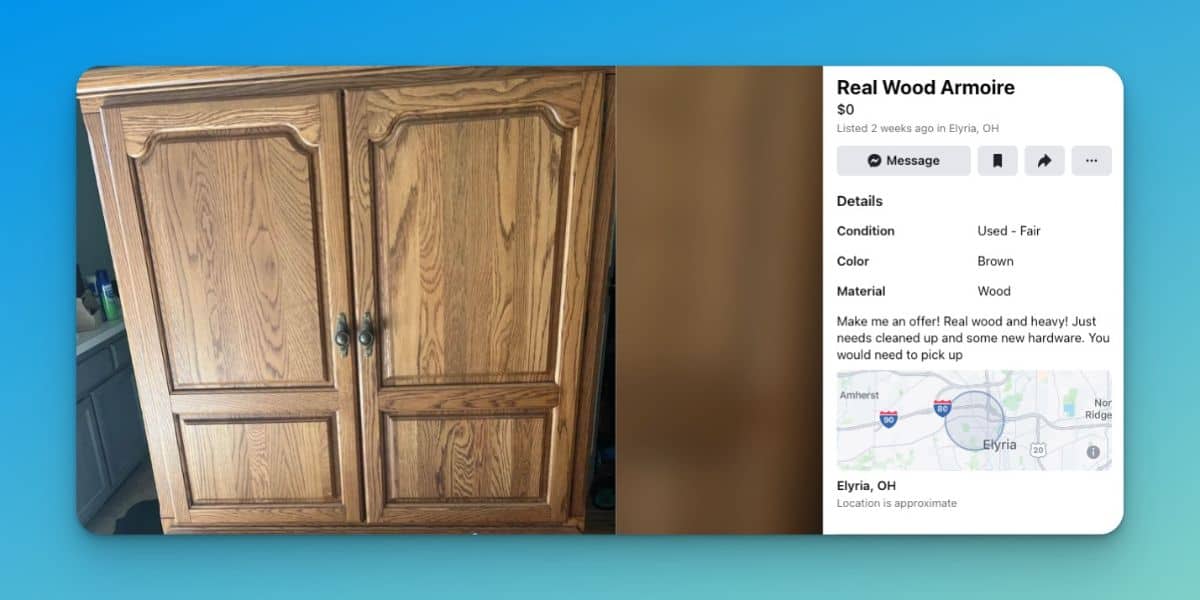

Let's take a look at a real example.

I found this piece of furniture listed completely free on Facebook Marketplace. You should be able to see it for at least $100 after a little TLC.

Depending on the item, you can expect to make anywhere from 50% to 500% on your investment.

This means that if you're able to flip just a few items per month, you can easily reach your goal of turning $1,000 into $10,000 in a year or less.

Start Your Own Business

If you're searching for one of the most effective ways to turn $1000 into $10,000 – starting your own business should be at the top of your list.

While there's no guarantee that your business will be successful, if it is, the sky's the limit on how much money you can make.

The key to starting a successful business is to find a niche that you're passionate about and then offering a unique product or service that solves a problem for your target audience.

If you can do this, you'll be well on your way to turning $1,000 into $10,000 or more.

Most people make the mistake of thinking running a business is simple – but it's not.

It takes a lot of hard work, dedication, and hustle to make a business successful.

But, if you're up for the challenge, it can be an incredibly rewarding experience both financially and personally.

There are many different businesses you can start with little money to reach your long term goals.

Check out these tips to starting a profitable business below!

Use High Yield Savings Accounts

Looking for a safe way to turn one thousand dollars into ten thousand dollars?

Using a high yield savings account is an easy way to build wealth over time without taking on any risk.

The average savings account interest rate is around 1% right now – which means your money will grow slowly.

However, there are a few online banks that offer interest rates around 4% – which can help your money grow a bit faster.

For example, if you have $1,000 in a high yield savings account that earns 4% interest, in 10 years you will have $1,267.

While this may not seem like a lot, it's important to remember that your money is completely safe in a savings account.

My favorite account is through CIT Bank. You can open an account with just $100 and they offer the highest interest rates on the market.

Create your free account below to get started!

Invest in Cryptocurrency

If you have a high risk tolerance, crypto can be a great option to turn $1,000 into $10,000.

The returns on crypto have been very volatile, but if you're able to time the market correctly, you can make a lot of money in a short period of time.

There are many different cryptocurrencies out there, but I recommend sticking to the most popular and well known coins like Bitcoin and Ethereum.

I personally invest in crypto with Binance, but there are many different exchanges that you can use.

Peer-to-Peer Lending

Another excellent way to turn $1,000 into $10,000 is by investing in peer-to-peer lending.

With this method, you'll be lending money to individuals or businesses and earning interest on the loan.

The amount of interest you earn will depend on the borrower's creditworthiness and the length of the loan.

For example, if you were to lend $1,000 to a borrower with a good credit score for 36 months, you could earn around 7% annually on the loan.

This method is a great way to earn passive income, and it's one of the best ways to turn $1,000 into $10,000.

There are tons of great platforms for peer to peer lending, so do your research to find which is best for you.

Start a Side Hustle

Starting a side hustle is any easy way to make more money and improve your financial life.

You can start making money with a side hustle as soon as the same day you start it – and, with a little hard work, you can make a lot of money.

There are many different side hustles you can start, but some of the most popular include:

- Starting a blog

- Freelance writing

- Delivery side hustles

- Start a YouTube channel

Some side hustles require no cash to get started, while others may require a small amount of money.

For example, if you want to start a blog, you'll need to pay for hosting and a domain name.

But, once you have those things set up, you can start making money with your blog almost immediately.

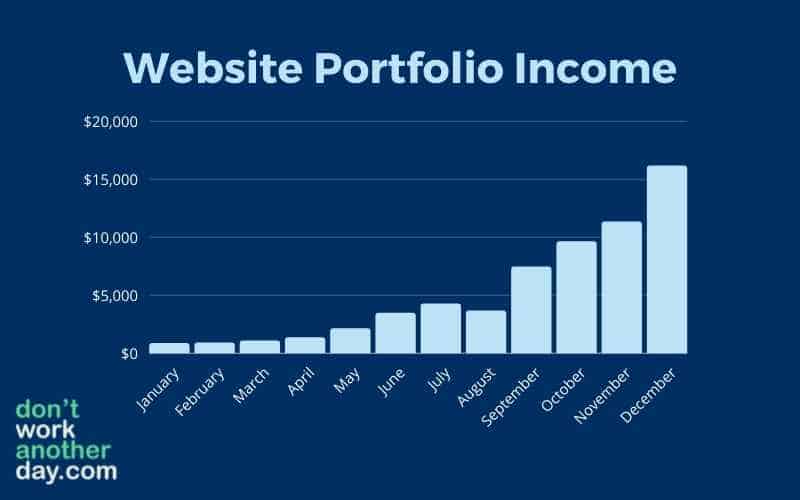

I have been blogging for a few years now and it has become my full time income!

With the additional money you make, you can invest it and grow it even further.

For example, if you make $500 per month from your blog, you can reinvest that money into strategies to grow your traffic and earnings further.

Over time, you can turn your side hustle into a full-time business – and you can use that business to reach your goal of turning $1,000 into $10,000.

Invest in Yourself

Investing in yourself is one of the best investments you can make with your money and time.

When you invest in yourself, you're essentially investing in your future.

There are many different ways you can invest in yourself but some of the best ways to invest in yourself include furthering your education, taking courses, reading books, and attending conferences.

Investing in yourself will help you develop the skills and knowledge you need to reach your long term goals.

While you might not see immediate benefits from investing in yourself, it's important to remember that you're investing in your future.

Final Thoughts on How to Turn $1000 into $10000

Learning how to turn $1000 into $10000 is easier than you might think.

There are many different investment options to consider, and it's important to find one that fits your risk tolerance and goals.

Ultimately, there are a few key investments that have a strong mix of stability and returns.

These include:

- Real estate investing with Arrived

- Index fund investing with Acorns

- Investing in small businesses with Mainvest

- Peer to peer lending

Remember to give your money time to grow. While you might want to reach your goal overnight, this will rarely happen and it can come with tremendous risk.

Don't worry – we hate spam too. Unsubscribe at any time.