When it comes to investing in real estate, there are a few main platforms that are often debated.

Two of those, Sreitwise and Fundrise both offer great investment options to build wealth through real estate.

So which is better?

In this post, I'll compare Streitwise vs Fundrise in terms of performance, ease of investing, and several other factors you might want to consider before investing. Let's get started!

What is Fundrise?

Fundrise is a top-rated real estate investing platform that is trusted by over 300,000 investors.

It was founded in 2010 and has since then helped people invest in real estate without the hassle of traditional methods.

Fundrise is a private real estate investment trust, meaning it cannot be traded on the stock market.

As opposed to traditional real estate investing methods where you might have to purchase an entire rental property to reach your investment goals, Fundrise allows you to purchase “shares” of their funds that contain many different underlying assets.

The company takes a long-term approach to investing meaning you should only invest if you plan on leaving your money in the fund for 5 years or longer.

The platform offers a unique approach to real estate investing that allows you to passively invest in high-quality properties across the United States ranging from apartment buildings, to commercial properties, and more.

Anyone can get started with Fundrise whether you're an accredited investor or non-accredited with just $10 – making it an one of the most accessible real estate investing platforms on the market.

If you're looking to generate compound interest, Fundrise is an excellent platform every investor should consider.

Currently Fundrise is giving new investors $10 completely free when you register with the link below!

How Fundrise Works

Fundrise is simple to sign up and start investing in real estate assets.

You'll need to enter your personal information, link your bank account, and make an initial deposit of just $10.

It has multiple different investment options to invest in private real estate offerings.

There are 5 different account levels: Starter, Basic, Core, Advanced, and Premium depending on your minimum investment amount.

Every account level offers auto-investing which can make it easy to have your dividends automatically reinvested for you.

You can then earn money through quarterly distributions and long term capital appreciation from the underlying assets.

The platform makes money through management fees that are automatically deducted from your account.

What is Streitwise?

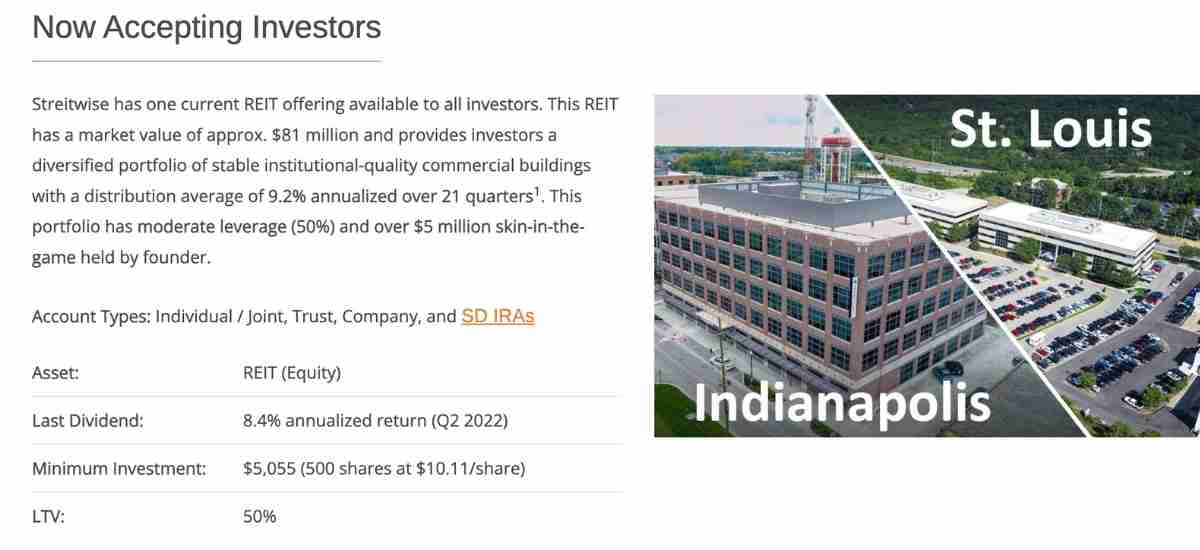

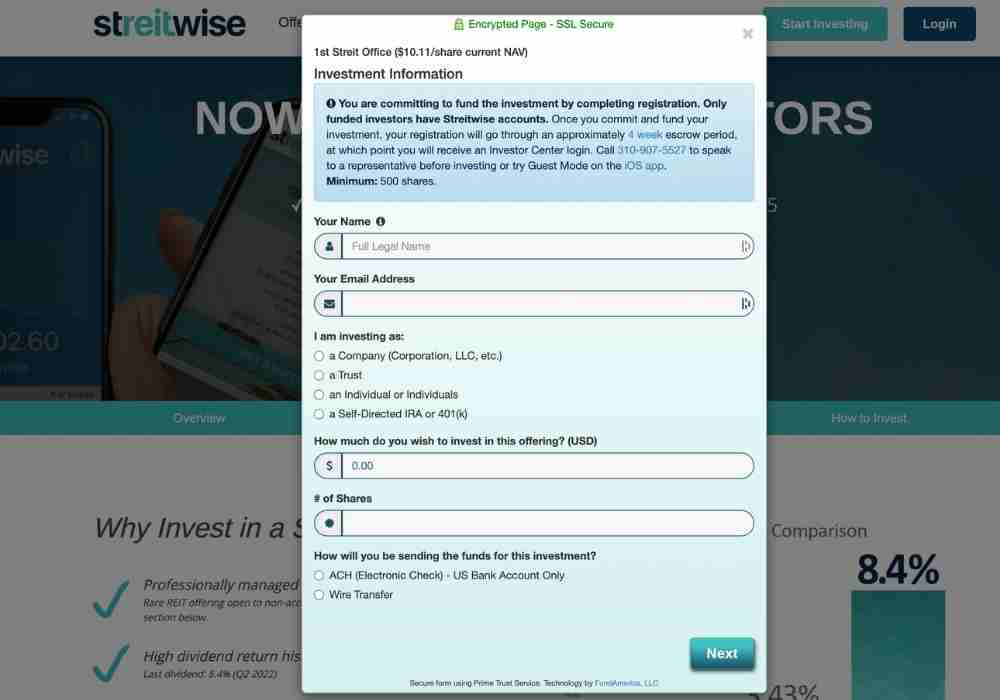

Streitwise is a commercial real estate investing platform that allows both accredited and non-accredited investors to start investing in commercial real estate with as little as $5,000.

Streitwise was founded in 2017 and is based out of Los Angeles, CA.

Similar to Fundrise, it works as a real estate crowdfunding platform – meaning that multiple investors pool their money together to buy shares of investments.

You'll need to keep your money invested to maximize your gains as there is a 1-year lockout period where you cannot withdraw your money.

Streitwise focuses on investments in office buildings, warehouses, and other commercial real estate properties.

There are several advantages of commercial real estate investing including:

- Stability – commercial properties tend to be more stable thanks to longer term lease agreements

- Reliability – commercial properties tend to avoid hazardous tenants because the tenants have a vested interest in keeping the property maintained to attract customers

- Diversification – commercial real estate allows you to diversify your portfolio to keep your returns well-balanced

How Streitwise Works

Streitwise is pretty straightforward – you simply sign up for an account, enter your personal info, link your bank account to make an initial deposit, and then choose the property or properties you want to invest in.

If you wish to invest in larger projects that require you to be an accredited investor, you'll need to confirm your income or net worth.

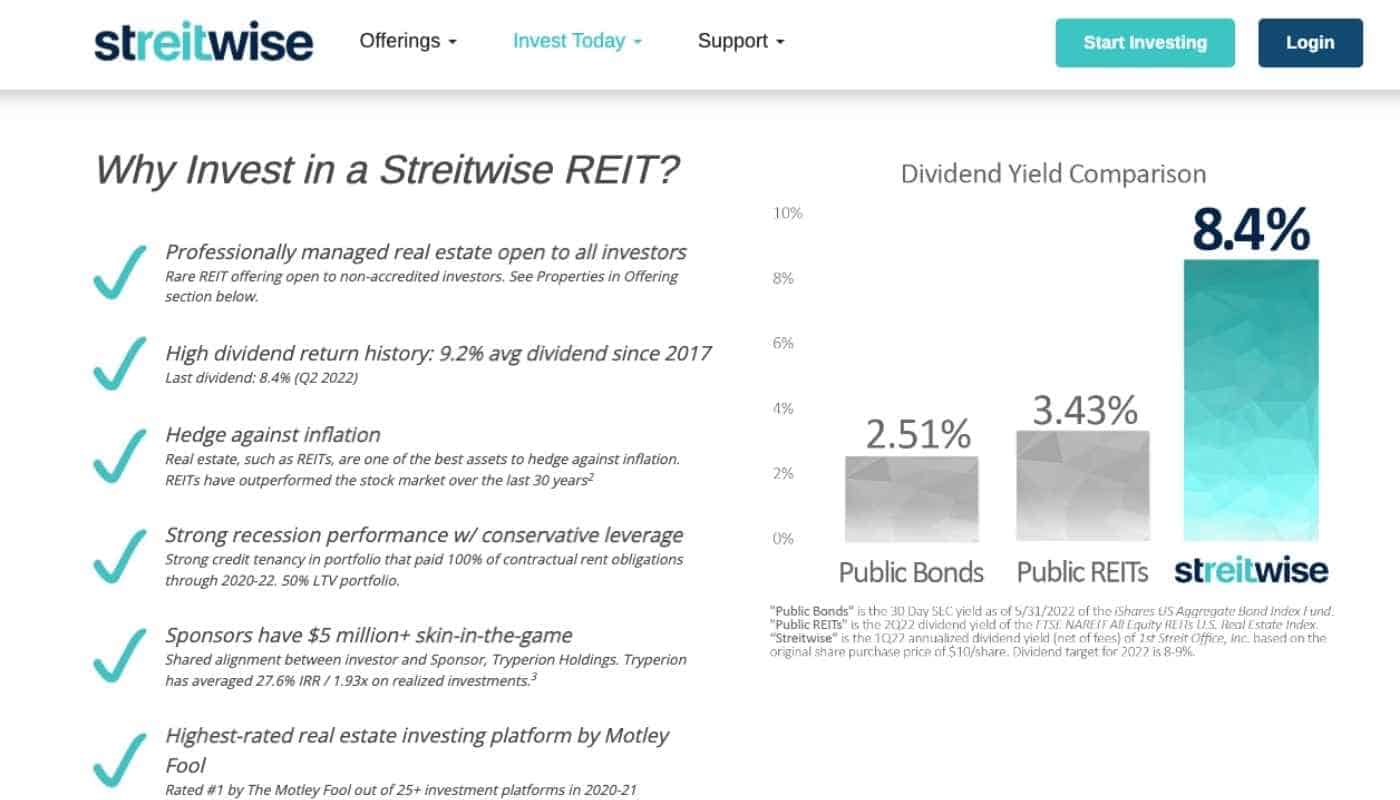

Streitwise is one of the most popular private real estate investment trusts and is a great way to passively invest in commercial real estate.

The founders have invested $5 million into their funds, so they have skin in the game when it comes to performance.

Don't worry – we hate spam too. Unsubscribe at any time.

Streitwise vs Fundrise: Returns

When you invest in real estate, one of the most important factors in your investing decision is the potential returns.

After all, that's why you're investing your money in the first place, right?

When analyzing returns, it can be difficult to compare these two platforms because of the diverse offerings.

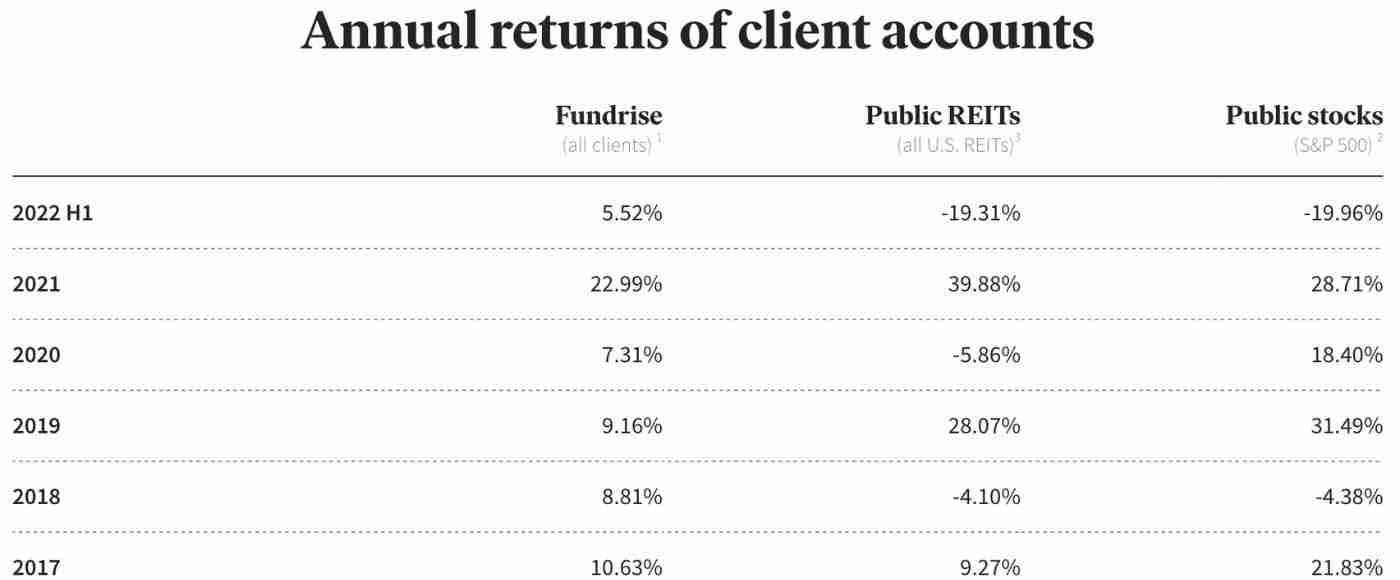

For example, Fundrise's Starter Portfolio – Flagship Real Estate Fund, had a 29.3% net return in 2021 and has netted a 6.1% return so far in 2022.

Across all accounts, Fundrise had an average return of 22.99% in 2021.

It's important to note that because you can choose to invest in individual properties and investments, this number can vary.

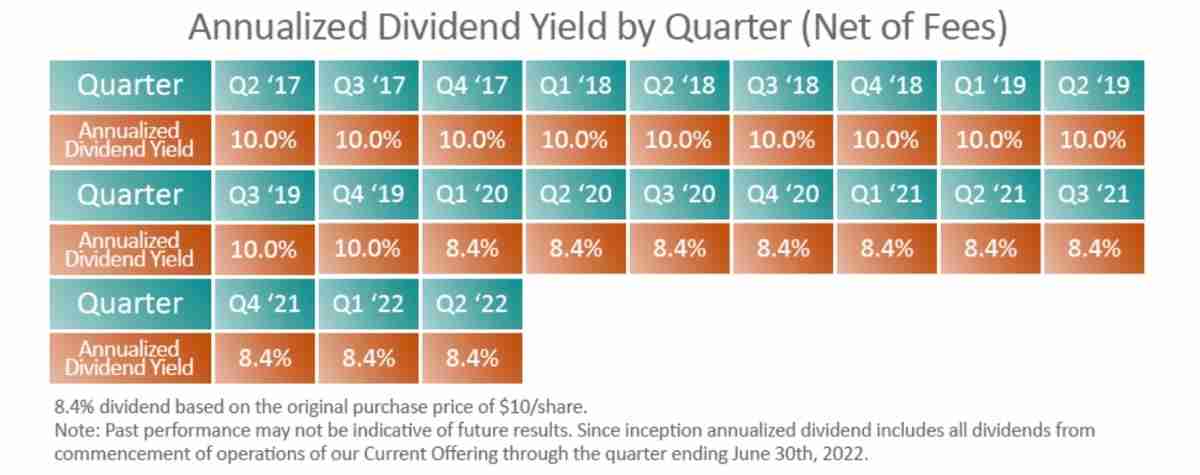

For Sreitwise, the average return is 9.2% since 2017.

With these numbers, it's safe to say that Fundrise typically offers stronger returns on your money.

Streitwise vs Fundrise: Features

Types of Investments

One of the key differences between Streitwise and Fundrise is the types of properties they invest in.

Streitwise ONLY invests in commercial real estate investments like office buildings and warehouses.

Fundrise, on the other hand, offers a much wider variety of investment opportunities including residential properties like apartment buildings, commercial properties, and more.

Both real estate investment options allow you to invest in retirement accounts which can be beneficial for tax purposes.

Currently, Streitwise only has 1 REIT offering available – the 1st Streit Office.

Fundrise has many different available investments that take a balanced investing approach to limit risk and maximize returns.

Depending on your minimum investment you can gain access to directly allocate your funds in projects you're most interested in.

Minimum Investment

Another big difference between these two real estate crowdfunding platforms is the minimum investment.

Fundrise only requires a $10 minimum investment while Streitwise requires a minimum of $5,000.

Additionally, additional deposits on Streitwise must be a minimum of $500 while Fundrise only requires an additional $10.

So if you're looking to start investing with a smaller amount of money, Fundrise is the better option.

Security Features

Fundrise and Streitwise both have strong security functions in place to keep your money protected and safe.

Fundrise's parent company is regulated by the SEC – meaning they're held to a higher standard when it comes to safeguarding your money.

Streitwise is also a SEC-registered platform but is not a member of FINRA.

Both platforms offer two-factor authentication and use 256-bit SSL encryption to keep your account safe.

When it comes to security, both platforms are equally safe and reliable.

Liquidity Features

Whenever you invest in real estate, you might wonder how liquid your money really is.

If you need your money for something else, can you get it?

With Fundrise, liquidation requests are analyzed on a quarterly basis. This means it might take 3 months to get your money and it is not guaranteed.

It's also worth noting that their could be fees when withdrawing early from certain offerings if you do not hold them for 5 years, up to 3%.

With Streitwise, you cannot withdraw your money for at minimum 1 year. After 1 year, you can withdraw your money, but there are substantial fees that come with it.

If you withdraw your money between 1-2 years after investing – you will be charged a hefty 10% fee. The fee phases out the longer you hold it until you reach the 5 year mark.

After you've help your investments for 5 years, there are no fees to withdraw.

All in all, Fundrise gets the nod for liquidity and withdraws as there is no mandatory 1 year lockout or 10% fees.

Design and Functionality

When it comes to the design and ease of use of both platforms, Fundrise is the hands down favorite.

When registering for Fundrise, it took me a total of about 3 minutes to complete the sign up process, link my bank account, and deposit my initial investment. It was a smooth process that wasn't overly cumbersome.

The Streitwise registration process was a bit out of date and didn't seem quite as professional despite requiring a larger minimum investment.

If design and functionality are important to you, go with Fundrise.

Fundrise vs Streitwise: Fees

When it comes to fees, both investment options have relatively low fees.

Fundrise charges a .15% annual advisory fee in addition to a .85% fund fee to manage the funds that make up your portfolio. This nets a total of 1% on assets under management.

There are no transaction fees or fees for reinvesting your dividends which is a bonus.

Streitwise does not charge an advisory fee, but instead a flat rate 2% fee on assets under management.

There are also fees that come with withdrawing your money early.

This means Fundrise is the clear favorite with half as many fees.

Fundrise vs Streitwise: Ease of Investing

Because both platforms are open to both accredited and non-accredited investors – investing in real estate with either platform is quite easy.

While there are some limits in place for Strewise as a non-accredited investor, for example – you can only contribute up to 10% of your annual income or 10% of your net worth, both platforms make it easy to invest in real estate.

Both platforms offer a mobile app that makes it easy to keep track of your investments on the go.

If you're looking for a hands-off investing experience, both platforms offer an auto-investing feature that will automatically reinvest your dividends and interest payments into new investments.

Fundrise Pros and Cons

Fundrise has many benefits including:

- Low $10 minimum investment

- Low fees of just 1%

- Variety of investments including both commercial and residential real estate offerings

- Variety of account levels with a various features

- Strong historical performance of delivering quarterly dividends

Some of the disadvantages of Fundrise include:

- No guaranteed liquidity

- Possible early redemption fees for some investments

Streitwise Pros and Cons

The pros of Streitwise include:

- Open to all types of investors

- Very strict vetting process for new projects to optimize investment returns

- Straightforward fee structure of a flat 2% fee

- Easy to invest in commercial real estate projects

The cons of Streitwise include:

- Substantial early redemption fees

- Higher management fees of 2%

- Higher minimum investment of $5,000

- Founded in 2017 with limited historical records

Tips for Investing in Crowdfunded Real Estate

Whenever it comes to investing your money in real estate, there are a few tips that can help you maximize your returns.

- Invest for the long term – investing for the short term can sometimes be considered gambling. You'll want to hold your investments for longer than, at minimum, 2 years. Ideally, a 5+ year outlook can help you to make more money from your investments.

- Only invest what you can afford to lose – results are never guaranteed, even with Fundrise or Streitwise. If your investments plummet in value, be sure you can keep your bills paid.

- Diversify your investments – having a diverse investment portfolio is essential to making the most money. By owning a combination of stocks, real estate, and other asset classes you can increase your returns and limit losses by not putting all your eggs in one basket. You can use Acorns to invest in the stock market or Mainvest to invest in small businesses.

Final Thoughts on Fundrise vs Streitwise

When it comes to choosing between Fundrise and Streitwise – it's hard to go wrong with either real estate investment company.

Both platforms offer many different investment properties you can invest in to make passive income and pay quarterly dividends to investors.

Both platforms are open to both accredited and non-accredited investors making it easy for anyone to invest in real estate deals.

If you have less than $5,000 to invest – Fundrise is the obvious choice for you as Streitwise as a high minimum investment of $5,000.

If you have over $5,000 to invest – I would still recommend Fundrise as the better option due to the lower fees and diverse offerings, but Streitwise can help you to diversify your investment portfolio through commercial real estate.

Don't worry – we hate spam too. Unsubscribe at any time.