Here's the deal, you might've heard of this new “high-yield account” called Tellus Boost, but you're wondering if it's legit and a way to actually turn your money into more money.

It sounds crazy. They offer 3.8%+ interest, paid daily, while other savings accounts offer a measly .05% that's paid monthly. It sounds like a no-brainer, right?

Well, there's more under the hood, as they say.

No matter what your financial goals are, there are tons of different tools and platforms you can use to reach them.

In this Tellus app review, I'm going to help you decide whether or not Tellus is right for you.

I'll explore what the app is, how they got started, if it's a safe place to store your money, and much more. Let's dig in!

What is Tellus?

Tellus is a financial technology company that was founded in 2016. While it originally began as a property management platform, it has since changed into a savings account and more.

Based out of Cupertino, California, this American company has worked to change the way people save money.

They offer a variety of services to help you manage your money including a high yield savings account that pays interest rates well above the industry standard.

Backed by a16z, Tellus is a unique way to grow your money outside of the stock market, cryptocurrency, and other volatile assets.

How Does Tellus Work?

Tellus Boost Account

The main offering from Tellus that's gotten the app publicity is their Tellus Boost account.

While Tellus is not a bank account, they offer lucrative interest rates on your money that is paid daily through the Boost account.

It is totally free to get started, and they offer interest rates that are more than 60 times that of traditional savings accounts. Current interest rates have an annual percentage yield of anywhere from 3.85% to over 5.12% with the potential for even more when using boosts.

Because it's not an actual bank account, it is not FDIC insured – something to keep in mind. However, all accounts, including Tellus Boost are backed by real estate assets.

You can withdraw your money at any time once it has processed and cleared your account, and it takes just a few days to get the money back to your checking account. Compared to other types of accounts like a money market or CD – this is a huge benefit because your money isn't locked up for extended periods.

The sign up process was extremely simple and took just a couple of minutes from start to finish. You'll need to be at least 18 years of age to create an account.

The minimum deposit is $125, which is slightly more than I'd prefer because most online banks only require $50 or $100.

Thanks to their Plaid connection, connecting my checking account was a breeze and took less than a minute to complete.

I was able to quickly deposit money and the entire process took less than 5 minutes.

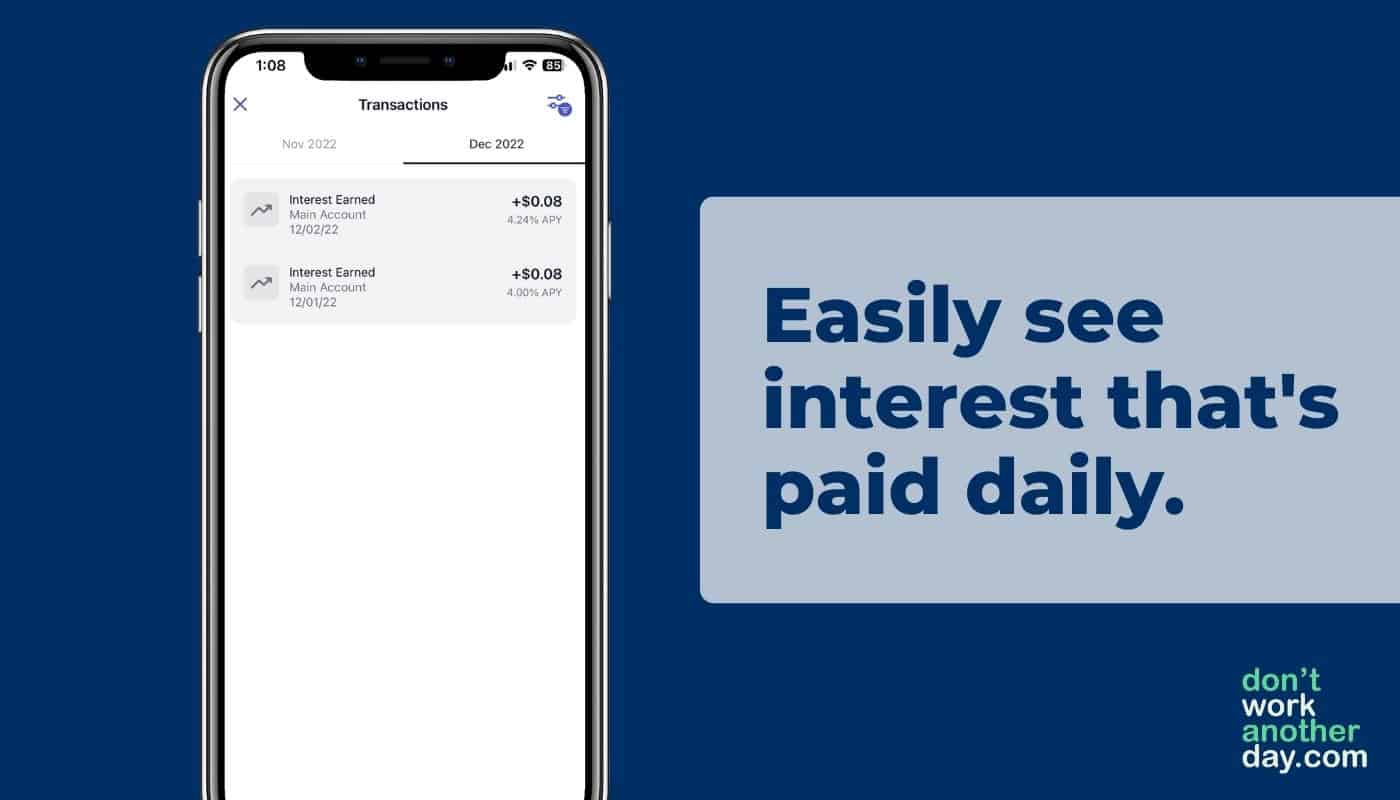

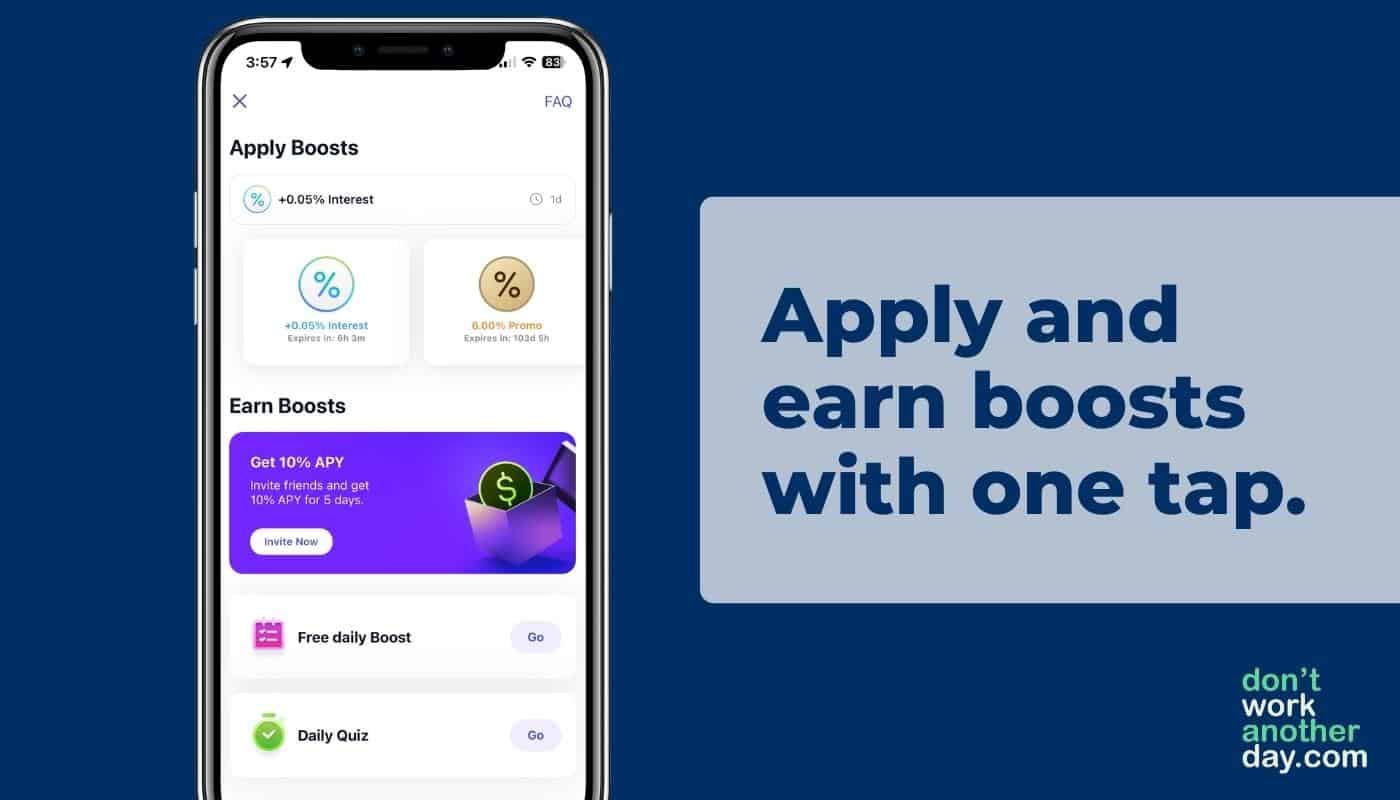

As soon as you initiate your deposit, your balance will start earning interest in your account daily (paid at 12PST). If you want a higher interest rate, you can check out the free daily boosts to receive a temporary boost in your interest rate.

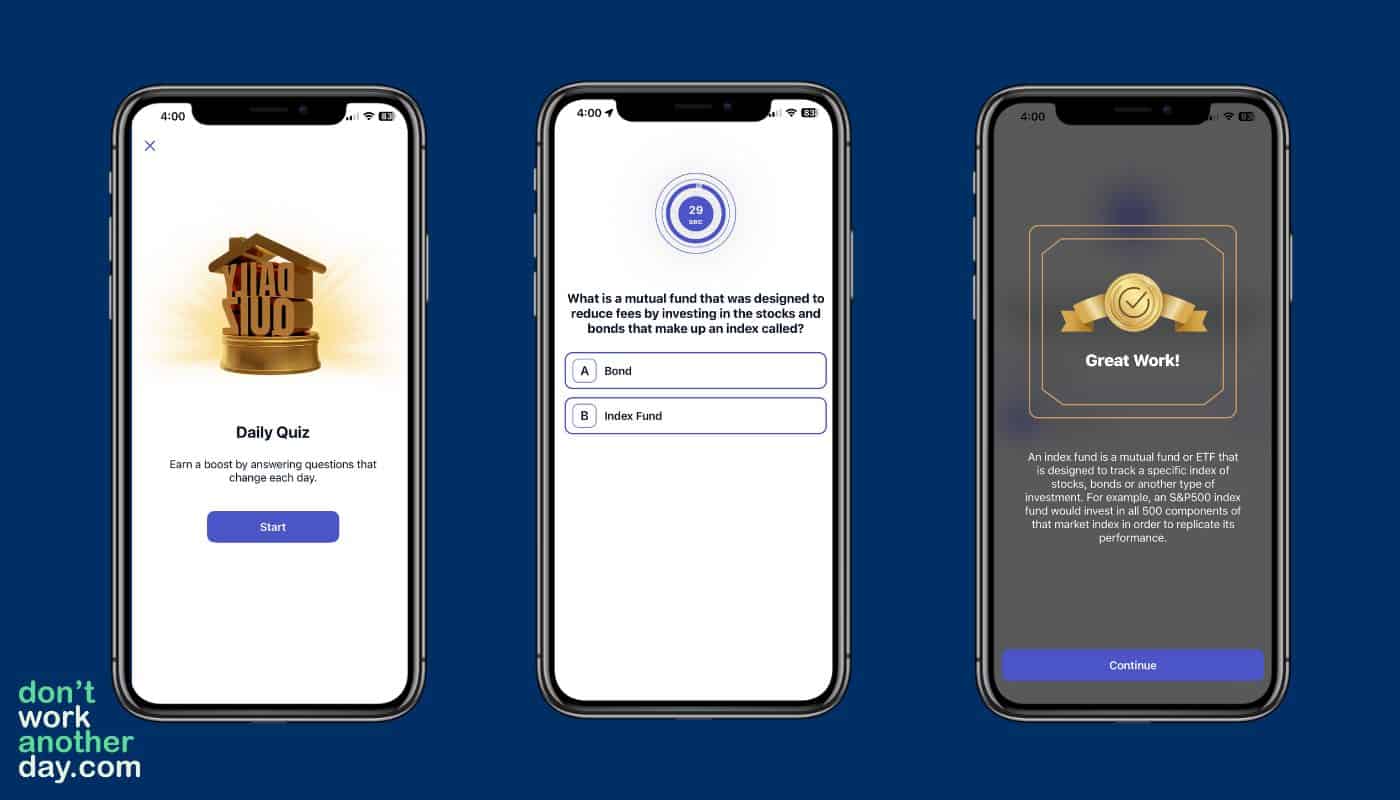

There are several ways to receives boosts, but the most common are the “Free Daily Boost” and “Daily Quiz”. The Free Daily Boost randomly offers you an interest rate hike ranging in value and duration. The Daily Quiz offers the opportunity for an increase interest rate if you answer the personal finance related question correctly. They also offer other opportunities to receive boosts like referring friends to the platform and more. Boosts do expire. This means if you don't apply your boost before the expiration, you will lose it.

You can easily setup recurring deposits to have money automatically transferred to your Tellus account for you.

If you're a visual learner, Tellus offers a product called “Stacks” within their accounts to help you set savings goals. Tellus Stacks are essentially sub-accounts under your main account that can be used to set goals. For example, if you're saving for a down payment on a home, you can create a Stack labeled “Down Payment Savings” and store a portion of your money in that Stack. I think this is a really cool feature that's great if you need some visual aid when it comes to managing your money and savings.

What I Liked:

- Extremely easy to use and sign up

- Lucrative interest rates

- One of a few accounts that pays interest daily

- Ability to earn daily boosts

- Ability to see interest earned daily

- Withdraw and transfer money at any time

- Bank-grade encryption

- Stacks make it easy to set savings goals

What I Don't Like:

- Not FDIC insured

- App can be confusing with so many options

- Must login daily to receive boosts

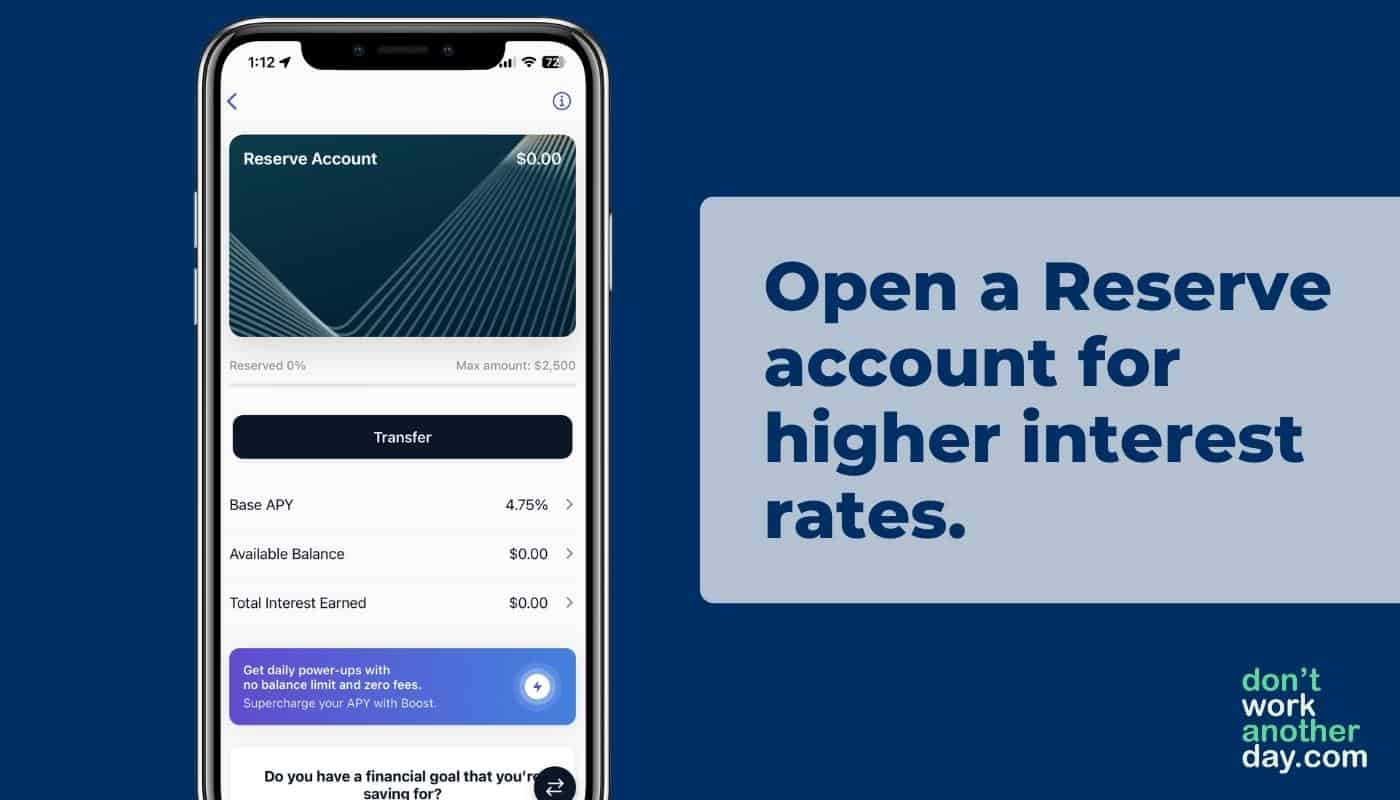

Tellus Reserve Account

Recently Tellus launched a new kind of account known as a Reserve Account.

This account offers a higher flat rate APY than the Boost account but you cannot earn or apply boosts to the rate.

Additionally, this account is capped at $2,500 currently because of the higher annual percentage yield.

As of the date of publishing, the current annual percentage yield for Reserve accounts is 5.5%.

This account was created for a more hands-off approach to managing your money so you don't have to worry about getting and applying boosts.

This account contains many of the same features as the Boost account such as:

- Withdraw money anytime

- No fees

- Interest paid daily

Ready to open your Tellus account? Sign up below!

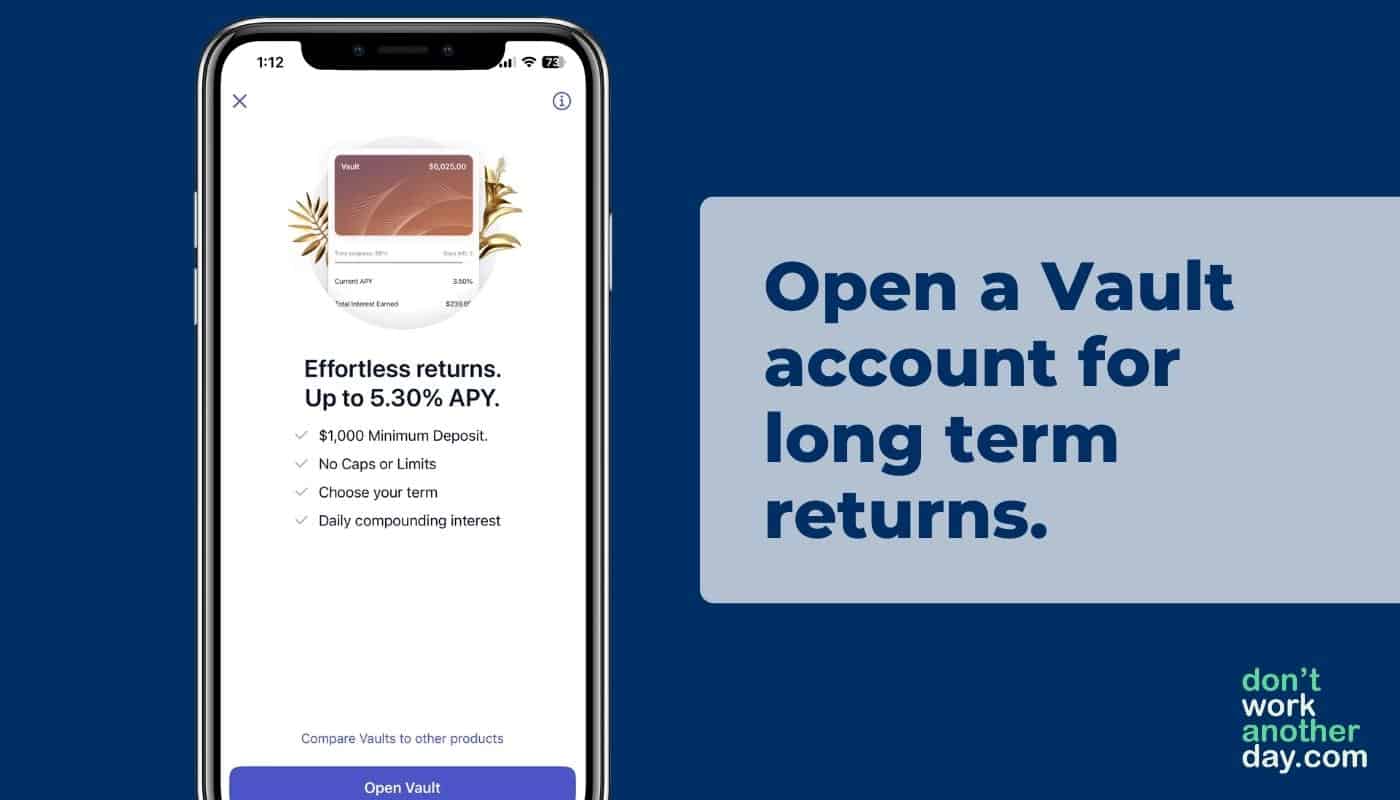

Tellus Vaults

Want to lock in an even higher interest rate?

Tellus Vaults allow you to earn even more, with a longer term commitment.

There's no maximum amount you can hold in a Vault account and just like other accounts, you'll always earn interest daily.

The minimum deposit for this account is $1,000 and you can select the terms of your Vault before starting.

There are currently 4 different Vault offerings – 3 months, 6 months, 12 months, and 24 months. Each has a different interest rate associated with the account, acting similar to money market accounts and CDs.

Once you make your initial deposit, you cannot make another deposit into the account.

Just like other Tellus accounts, your money is backed by residential real estate assets but is not FDIC insured.

Similar to the Reserve account, boosts cannot be applied to Vaults because of the elevated interest rate.

Tellus Property Management

Because the Tellus Boost account is backed by real estate, it makes sense that they would offer a property management service.

You can find tenants, screen them, collect rent, and even chat with tenants and your property managers within the platform.

They offer cloud document storage which can be helpful for things like lease agreements, walk through images, and other documents that come with managing rental properties.

Real estate investors can add additional users so everyone can have access to the same data, seamlessly.

The app benefits everyone from landlords to property managers, to the renters themselves.

Renters can pay rent and submit maintenance requests within the app, property managers can communicate with renters, landlords, and contractors, and landlords can collect rent and more all within a single application.

Don't worry – we hate spam too. Unsubscribe at any time.

Is Tellus Safe?

So the one question you might be asking yourself is, “is Tellus safe?”

And the answer is, “it depends”.

In terms of security, the Tellus app is a safe application that's built on bank-grade encryption.

In terms of safety of your money, this is more up in the air.

Tellus claims that your money is “backed by real estate investments” and “providing single-family home loans to American borrowers.” meaning that there does seem to be some backing behind your money.

Unfortunately, because Tellus is not a publicly traded company, you won't have easy access to their financial reports and balance sheet.

Currently, Tellus boasts a 4.3/5 star TrustPililot rating speak to its reputation and trustworthiness.

Is Tellus Legit?

Tellus is a legitimate platform that allows it's users to deposit money and earn interest daily.

The interest rate will vary depending on many different factors like current market rates, any potential boosts you have available, and the type of account you open.

While Tellus is not like other savings accounts in that they are FDIC insured and have to meet certain regulations, it's still a legitimate account that's backed by real estate assets.

In order to earn interest, you'll need to maintain a minimum balance of $125, which is also the minimum deposit.

Tellus offers many unique features that make saving money simple and routine.

Tellus App Fees

One of the major advantages of Tellus verse other investing platforms is that there are no account fees.

Whereas other platforms may charge a 1% or 2% management fee, Tellus does not. This means you can keep more of the money you earn, instead of giving it away to meaningless fees.

Neither Tellus Boost or Reserve accounts have fees of any kind.

How Does Tellus Make Money?

Tellus makes money by offering mortgages on single-family homes. They can afford to offer high interest rates to customers because of the income generated from their loans.

All Tellus mortgages are over collateralized, meaning your money is backed by a physical residential home, rather than an intangible asset like digital real estate, crypto, or stocks.

Is Tellus FDIC Insured?

No! Tellus is not a bank or FDIC insured.

Because Tellus is not a bank account and it does not offer banking services, you do not have the same protections as a traditional high yield savings account.

Tellus is backed by real estate, so that may make you more comfortable, but there is no federal guarantee to your money.

Apps like Tellus and the Best Tellus Alternatives

Looking for a few Tellus alternatives?

To be honest, there aren't a ton out there, but there are a couple you might want to consider.

-

CIT Bank – a traditional high yield savings account

-

Acorns – app for investing in the stock market

-

LEX Markets- invest in real estate

While these accounts don't pay daily interest, they are great options to start investing money.

Tellus vs High Yield Savings Account

When compared to a traditional high yield savings account, like through CIT Bank, there are some key considerations you'll want to know of.

For example, if FDIC insurance is essential, you should go with a traditional savings account.

However, if you're looking for something with higher interest rates and don't mind the higher risk, Tellus is worth it.

Tellus Customer Support

Customer support is simple with Tellus. You'll have access to live chat once you download the app but you can also email customer support at support@tellusapp.com.

It's worth noting that I couldn't find a reputable phone number to contact Tellus and you must contact support to get a physical mailing address.

Final Thoughts on My Hands-On Tellus Review

Tellus is a unique online savings account offering that offers strong interest rates for you to grow your money.

But here's the catch, it's not a bank, so it is not FDIC insured. This means that you could lose money in the case of a bankruptcy filing, with no ways to get your money.

While the chances of this are slim, it's definitely worth noting.

I would not advise storing a large amount of money into a Tellus Boost account because of this. However, this is a great place to store a little amount of your savings to earn competitive interest rates on your money.

With no account fees and an easy to use platform, Tellus is a great way to earn a small chunk of passive income daily from your money.

Whether you're saving money for your next vacation, or you're trying to reach financial freedom – storing a little cash in Tellus can be a good choice.

Don't worry – we hate spam too. Unsubscribe at any time.