Are you looking to grow your wealth while helping your local community?

Platforms like Mainvest are a new way to invest in small businesses across the country with as little as $100.

When you think about investing, you probably think about the usual culprits – the stock market, real estate, and maybe even cryptocurrency. Until now, investing in a small business has never been accessible to the average person.

If you're looking for a tangible investment that helps your local economy – Mainvest can be a great opportunity.

In this Mainvest review I'll explore the pros and cons of this investment opportunity, how you can get started, and much more. Let's get started!

What is Mainvest?

Mainvest is a platform for those who want to invest in individual businesses but don't want to spend the time or money to start their own.

It's a crowdfunding platform that provides a way to invest in local brick-and-mortar businesses easily with just the click of a button.

On Mainvest, you have variety of options that you can add to your investment portfolio. Restaurants, breweries, farms, and cannabis facilities are just a few places you can invest your money in.

When you work with small businesses on Mainvest, you're helping each other. The investment benefits the small business, and you get to take a portion of their success if all goes well.

Mainvest takes an interest in small business investments, which sets it apart from other companies. It works to guarantee the success of little businesses that are just starting.

Local businesses can be extremely profitable, but until now, it would cost a fortune to get started.

With Mainvest, you can earn passive income and support local small businesses at the same time.

Is Mainvest Secure?

When investing money, one of the most critical things is to know if your investment will be secure.

In this Mainvest review, we'll dive into that answer. Is your money protected? What kind of precautions does Mainvest take to ensure the money transfers between small businesses and investors?

The privacy policy in place on Mainvest ensures that the company won't sell or share your private information with anyone, which is already a win for users concerned with their personal information going out into the world.

Mainvest provides defense for investors in the form of a Secure Sockets Layer or an SSL. This item makes an encrypted link between your browser and the servers that allow Mainvest to operate. It's a tool that meets the industry standards and keeps everything as secure as possible while money transfers from small businesses to the one giving the funds and vice versa.

Mainvest also has an A+ rating with the Better Business Bureau. They have proven their capability in solving problems, resolving customer complaints without much issue.

It's critical to note that the security of Mainvest has nothing to do with the risk that comes with an investment. Investing money in a business, no matter the potential, is still a risky investment. Consider this factor as you get started with the features Mainvest offers to users.

Diversifying your portfolio is a proven way to reduce the risk of your investments and optimize your returns.

Don't worry – we hate spam too. Unsubscribe at any time.

How Long Has Mainvest Been Around?

Although most crowdfunding platforms have been around for a long time, Mainvest is relatively new compared to the competition.

Founded in 2018, it began in a small building in Salem, Massachusetts. Nick Mathews is the CEO and co-founder of the company, building an industry from a seed start of $3 million. It's made a strong impact in its short time on the market.

One of the differentiating factors with Mainvest compared to other investment opportunities is that both accredited and non-accredited investor individuals can invest money.

It has fewer restrictions, which frees up options for investors and makes it possible for small businesses to get off the ground.

How Mainvest Works

Curious how Mainvest helps fund small businesses and allows everyday investors to grow their money?

Here's how Mainvest works for everyone involved:

- Small businesses apply to be on the website based on what they need

- Mainvest vets and lists the passed companies right on their website for investors to view

- Mainvest lists details about the company, such as what they currently make and what they need

- Investors select the companies they want to invest in

- Businesses agree to pay a percentage and pay the money back once their company makes more money

The minimum investment needed to make in Mainvest is $100, which is a low minimum investment compared to some other investment opportunities.

You can choose to work with debt investments or equity investments which you will need to work through with the companies mentioned.

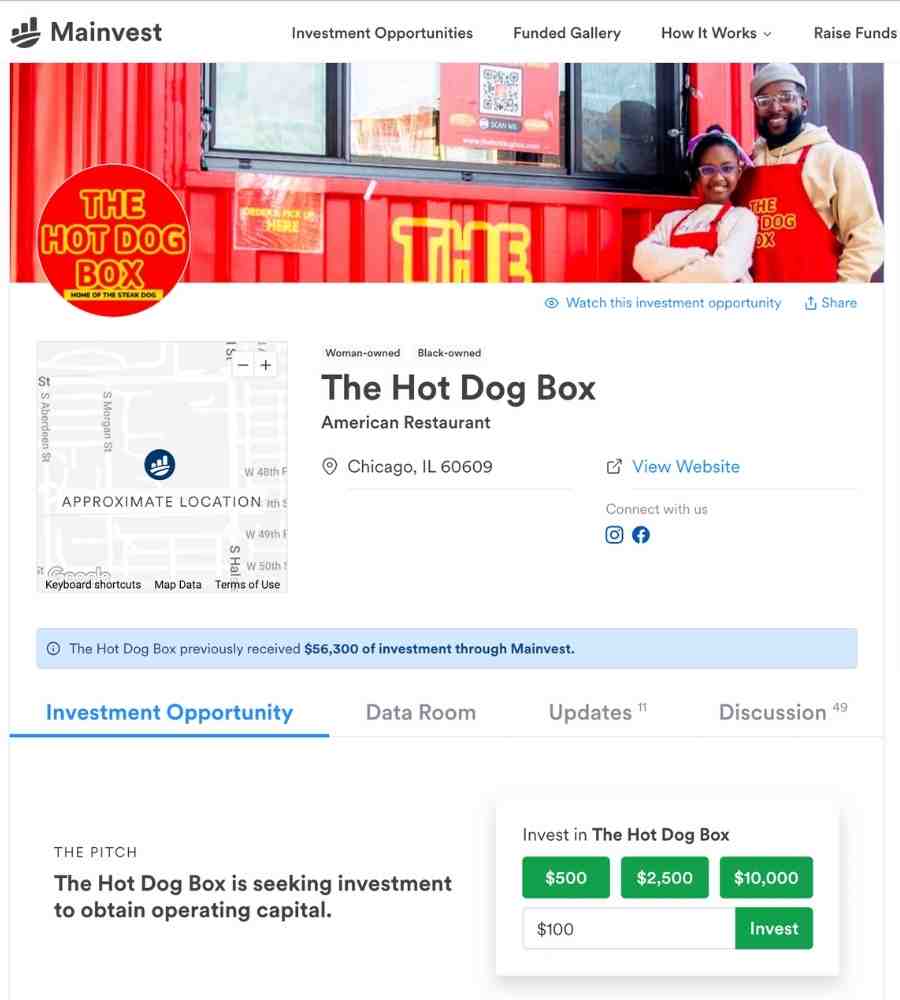

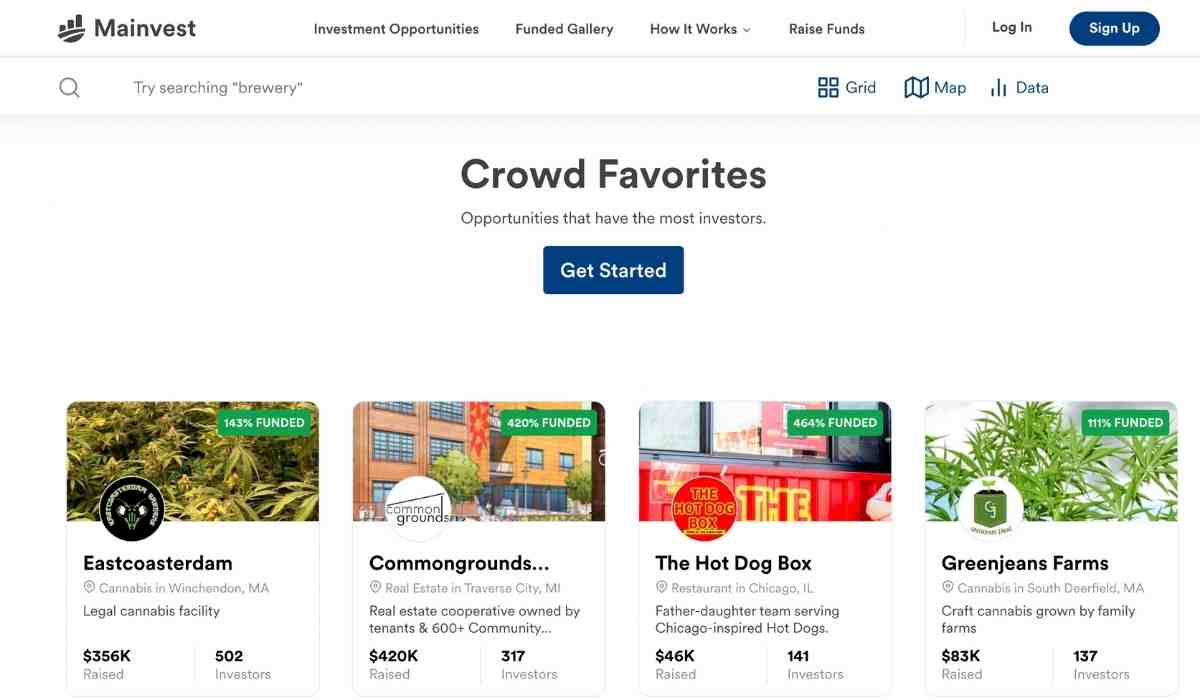

Here's an example of an investment that's on Mainvest. The Hot Dog Box is a restaurant located in Chicago.

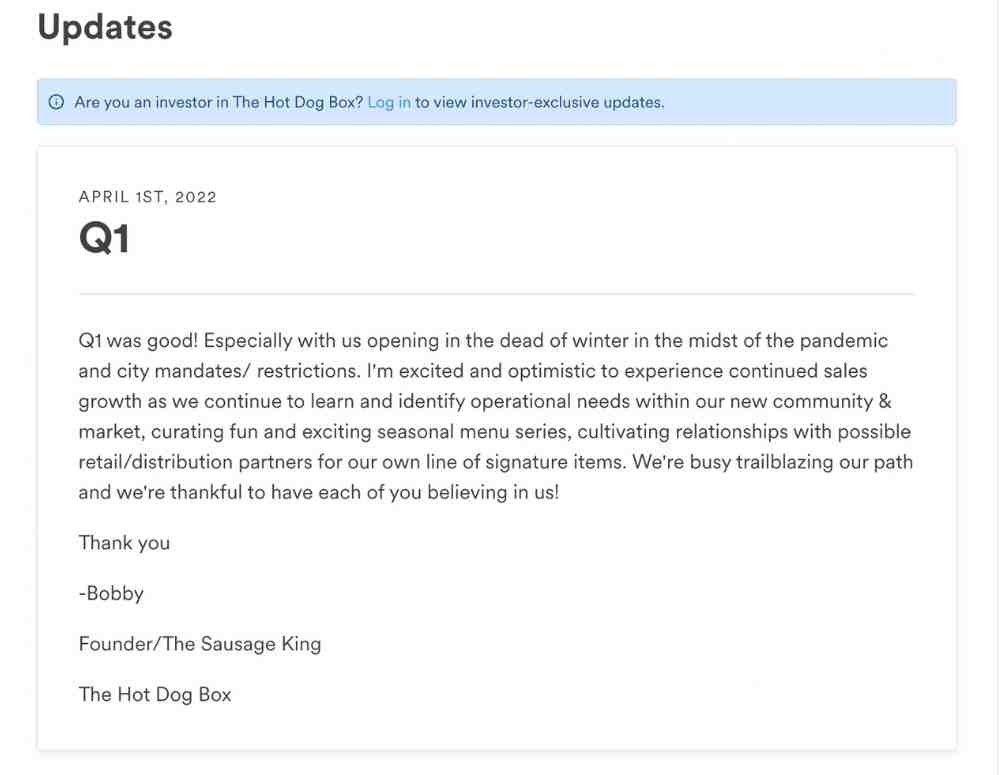

You can look at the data provided by the business as well as updates they've given. Here is an example of one of the updates they've provided. If you choose to invest in the business, you'll gain access to exclusive updates that aren't shown publicly.

I love the ability to easily see updates and discuss with others the investment. Here's a comment about the company posted in the discussion section.

User-Friendliness Review

Mainvest is one of the most user-friendly investment services you will find in today's market.

You can easily navigate investment opportunities and find the ones that are right for you. There are three main ways you can sort and filter investment opportunities.

The first is the grid view show below. You can see popular investments or choose by industry.

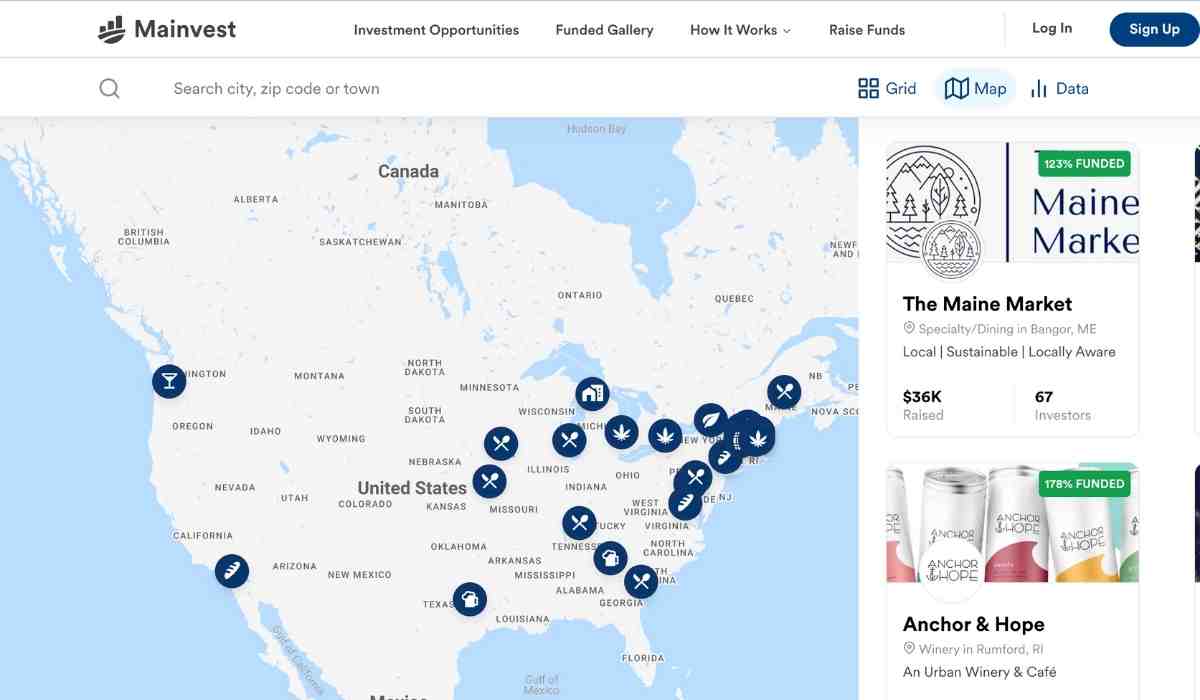

Next, you can browse by the map view. This can be helpful to find businesses that are close to you.

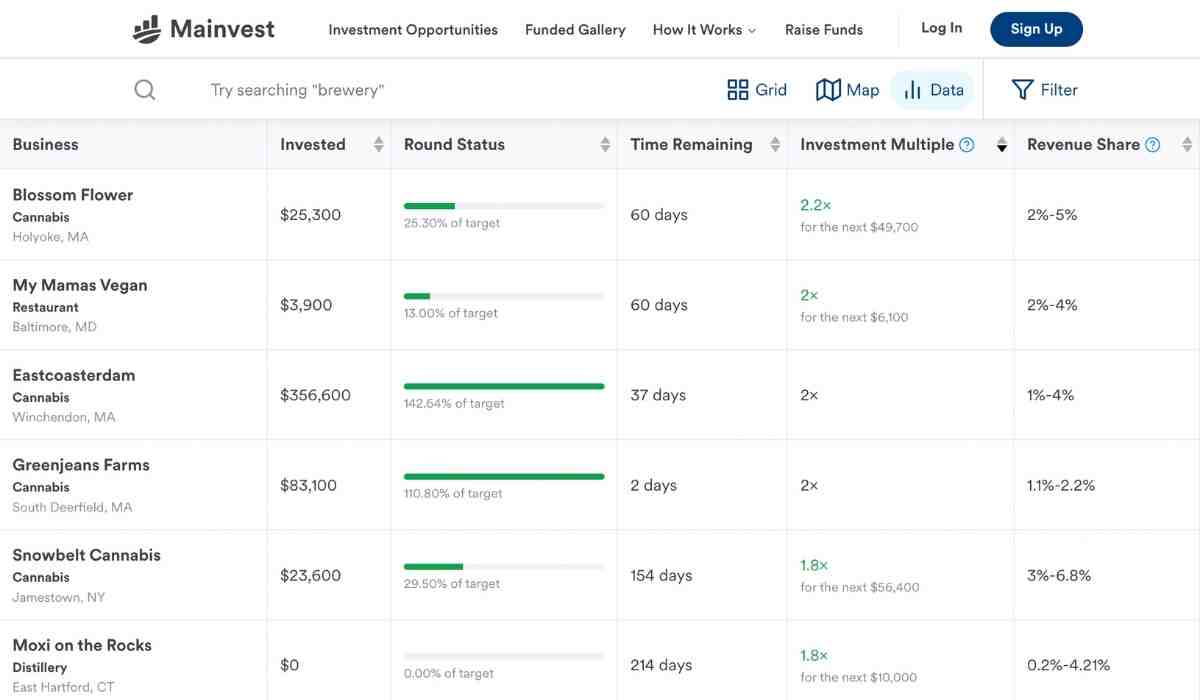

Finally, there is the data view. This allows you to sort and filter by business metrics – which some investors might prefer.

The application process is also simple and can be done all online without any paperwork.

Mainvest is one of the top-rated crowdfunding platforms, and it's easy to see why.

Who Can Register with Mainvest?

Mainvest allows both accredited and non-accredited investors who are at least 18 years of age and located in the United States to begin investing in small local businesses through the platform.

How Do You Open an Account on Mainvest?

To open an account on Mainvest, you will need to do the following:

- Head to the Mainvest website here

- Click the sign-up button

- Create a new account with your email

- Fill in contact and bank account information

For a limited time, Mainvest is offering readers a free $10 when they open a new account. Claim your free investment below!

Is Mainvest Risky?

While Mainvest businesses must go through an extensive vetting process, sometimes things don't work out.

When you start investing in local small businesses with Mainvest, you'll want to be sure you can afford to lose the money you invest, as with any investment.

Because small businesses are inherently risky, you may not get your initial investment back.

Ultimately, Mainvest is more risky than other types of investing like real estate or the stock market – but your returns will also be larger with Mainvest.

Debt Investment Vs. Equity Investment

There are two main investment types on Mainvest – a debt investment and an equity investment.

Before you put down any money, you might wonder – what is a debt investment? What's equity investment? Which one will benefit you and the business owner?

Here is the difference between each investment type:

- Debt investment: This loan is expected to be paid back with interest at the end of a period.

- Equity investment: This loan involves owning part of a company and having other items attached to that ownership, such as debts and liabilities.

There are a few pros and cons that come with each type of investment, but you can choose the type you're more interested in.

A debt investment can take a long time to mature, and an equity investment means taking partial responsibility for the small business you are now involved with.

It's critical to understand what sets these two investment types apart before selecting an option.

Accredited vs Non-Accredited Investors

Here's how Mainvest works with both accredited and non-accredited investors as well as the difference between them.

Accredited Investor

According to the SEC, an accredited investor fits one of these items:

- Have an individual net worth of at least $1 million

- Have an individual income of more than $200,000 for at least two years and plan on getting the same this year

- Invest on behalf of a business worth more than $5 million in assets

Why does this matter?

The SEC made rules around investing with the goal of protecting smaller investors from more speculative investments.

Non-Accredited Investor

As we mentioned, Mainvest is unique in that it permits non-accredited investors to invest money right along with their accredited counterparts.

Even if you don't meet one of the above criteria, you can still start investing in local businesses.

A non-accredited investor is a person who doesn't meet the criteria above – they don't make enough, don't have a high net worth, and don't represent a company with at least $5 million in assets.

How Does Mainvest Choose Its Businesses?

There's an intricate process that helps Mainvest select the best small companies for potential investors to grow their money.

Here's how Mainvest selects businesses for its site:

- They select small companies that don't have much attention thus far and need assistance growing towards success

- They perform an anti-frauding check to ensure the business owner is capable of handling the funds given and that they won't spend them on unrelated items

- They do a responsibility check to see the responsiveness of the business owner to ensure they are reliable

- They do a bad actor check to see what the background of a business owner looks like

- They do a continuous review to monitor information continuously, even after the company goes live for potential investors to see

Mainvest only lists about 5% of the businesses that apply, so you can assume they are pretty stringent when it comes to their selections.

It's critical to be picky when choosing companies for investors to see. The more responsible a potential company is, the better the chance at a good return for investors.

Mainvest does an excellent job working through various applicants and determining which fits their criteria.

How Does the Investment Process Work?

Now that you understand how Mainvest vets the businesses you can invest in, are you ready to get started?

Here's how the investment process works:

- Choose a way to look at potential businesses in the grid, map, and data form

- Examine all the possible businesses in your area

- Find the ideal investment opportunity near you

- Offer money for an investment in one of two forms

Before you invest any money, be sure to think about what you are about to invest in and do your own due diligence.

There is a high rate of failure with new companies – about 20% of new businesses fail within the first two years of opening, making it a risky proposition for any investor.

Remember, you should never invest more than you can afford to lose.

Are There Any Fees?

Another quality thing about Mainvest is that there are no fees with the company.

However, it's critical to note that Mainvest does take a portion of the businesses funding from the platform, which not everyone will enjoy – but it's essential to keep their operations afloat.

Still, the lack of fees sets it apart from the competition in a big way.

Many investment opportunities will have fees over 1% or 2%. While this might not seem like a lot, it can add up with compounding returns.

For example, let's assume that you invest $25,000 for 15 years and receive a 10% average return. After 10 years, your entire investment would be worth $104,431.

If you reduce your average return to just 9% (subtracting the 1% fee), your investment portfolio would be worth $91,062. That's a difference of $12,369 all because of fees!

The Mainvest platform has somewhat higher risk, but without fees – it can help to maximize your returns.

What About Returns?

One thing Mainvest excels at is its return potential.

As an investor, you can expect somewhere from 10% to 25% in returns, even if you only hand over $100 in investment. Some even bring back 30% annually in returns!

Of course, there's no guarantee of these returns.

However, Mainvest does an excellent job at ensuring investors get some return if the company is in business.

Small businesses make a promise to give you back a portion of the income made every year. You might not make much, but you will make something on Mainvest if you make an intelligent choice.

Pros of Mainvest

Many incredible features come with Mainvest and help it stand out from other crowdfunding platforms in the industry.

Low Minimum Investment

You only need $100 to invest in Mainvest – which is very affordable for many investors.

Other crowdfunding platforms can require a financial commitment greater than $5,000 or $10,000 to begin investing.

Non-Accredited Availability

Even if you're non-accredited, you can still invest in small businesses on the Mainvest platform.

This means you don't need an annual income greater than $200,000 or a net worth exceeding $1 million.

You can get started with as little as $100 to invest in a small business.

Passive Quarterly Income:

There's a potential to earn every four months without doing anything.

Because the crowdfunding platform uses revenue sharing notes, you can receive money based on the profitability of the company.

As long as the business is doing well and making a profit, you will get a return on your original investment.

High Returns

Mainvest offers up to a 30% return on many of their investments. While this is by no means guaranteed, it's realistic depending on the business's revenue.

No Fees

If you are an investor, you don't have to pay any fees to invest with Mainvest.

Some crowdfunding platforms will charge investors a small fee to manage their money – but not with Mainvest.

Quality History

In its short history, Mainvest has proven that they are capable of serving customers well and creating happy systems.

They've made over 50,000 repayments to date, speaking to the quality of the investment options that promote.

Cons of Mainvest

Here are a few of the cons that come from Mainvest.

Light Track Record

Although Mainvest has done well so far, they've only been around for four years and don't have much standing.

No Secondary Market

There are no secondary market options to sell shares on for additional income.

This means that you're stuck with your investment for the entire duration.

You can't cash out if you need money and you can't sell your shares for a profit – you're simply waiting until the maturity date.

Business Fee

If you are a business that wants to go on Mainvest, you will get hit with a 6% fee.

While this won't necessarily impact investors, it does take away from the business's total funds.

Low Investment Activity

Some businesses on the site just don't succeed, which is bad news for lesser-known local companies.

No Repayment Requirement:

If a company falls through, Mainvest doesn't have to pay you back for your loss.

Risky

With investments in small businesses comes high risk of losing money.

Customer Service Reviews

In terms of customer service, you can feel confident putting your trust in all that Mainvest offers.

You can contact Mainvest by phone, email, social media, and even website chat. They're in the eastern time zone, and they have a solid history of contacting customers whenever they're in need.

Mainvest has excellent reviews from customers on the Better Business Bureau and other common review platforms. They're received many 5-star reviews from multiple customers.

Is Mainvest Legit?

If you're interested in brick and mortar businesses – Mainvest is a great investment platform that has completely revolutionized the way you can invest in local businesses.

Mainvest investments go through a very strict vetting process which allows them to promote only the strongest businesses out there.

It's open to non accredited as well as accredited investors which means you don't need to be an expert investor to lend money to businesses on Mainvest.

The platform is very user-friendly and it's very easy to stay updated on your investment portfolio.

You can get started with just $100, which makes it a viable way to any investor to grow their net worth while helping a small business in their community.

By offering a revenue sharing note instead of a flat interest rate, you can earn a lot more money from your money compared to other investment platforms.

The fact that they don't charge any fees whatsoever is also a big plus.

Mainvest is a legit investment platform that has a lot to offer to both local businesses and investors looking to make money. I would highly consider it if you're looking for a simple way to diversify your portfolio.

I found this quick Mainvest review on Reddit that seems to suggest the same.

Is Mainvest Worth It?

Now that we've gone through the Mainvest review, one question remains – is Mainvest worth it?

Mainvest is worth it for your life if you:

- Don't have any debt on your hands, particularly high-interest debt

- Are interested in the potential of high returns, even with the risk

- Don't like the volatility that comes with the stock market

- Need defense against inflation that comes with other investments

If you have little experience in crowdfunding, don't like risky investments, and have debts of your own to handle, Mainvest might not be for you at the moment.

Summing Up this Mainvest Review

Mainvest is a great investment platform that can be used by both accredited investors and non-accredited investors looking to build wealth and grow their money through small businesses.

The Mainvest platform is extremely easy to navigate and browse potential investment opportunities and they have strict vetting process for businesses looking for funding.

Investing in small businesses can be a great way to diversify your portfolio and earn high returns, but it does come with some risk.

Don't worry – we hate spam too. Unsubscribe at any time.