We all want to make more money every month, right??

By utilizing some of these investment options, you can grow your passive income each month and ultimately grow your wealth.

While investing can be risky in the short term, creating a plan for your money and having it work for you is an essential step in growing your income and reaching financial freedom.

If you're looking to build your monthly income without working, check out some of these investments that pay monthly, how to buy investments that pay monthly, and how much money you need to start investing. Let's get started!

Best Investments that Pay You Every Month

Whenever investing, you'll want to consider the risks and potential rewards involved. Below are some of my favorite investments that offer a monthly income.

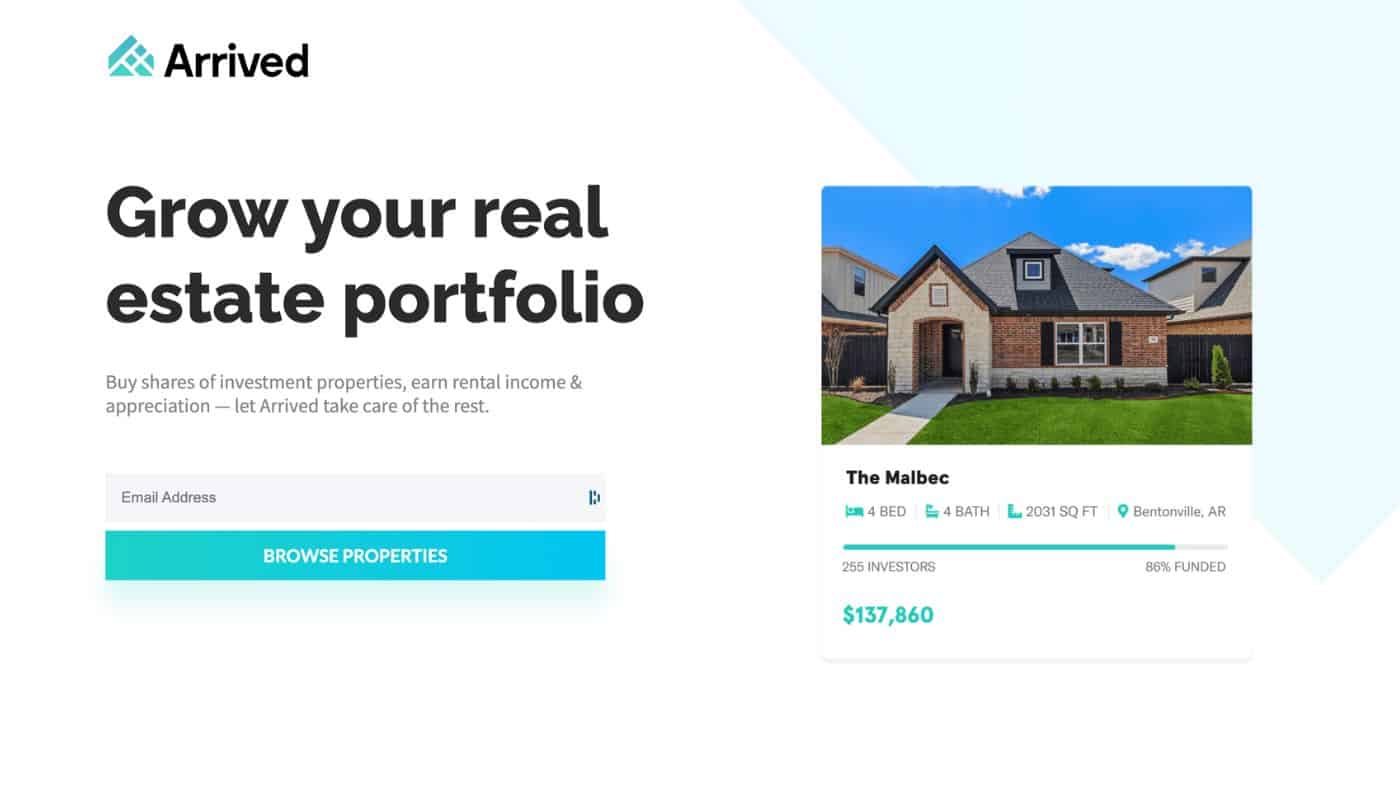

Invest in Rental Properties with Arrived

If you're looking for one of the easiest ways to start investing in real estate without needing a ton of cash to get started – I strongly recommend checking out Arrived Homes.

I've been using the platform for months and love how easy it is to invest in properties across the country. You can get started with just $100 – meaning just about anyone can start building wealth through real estate.

Another thing that makes this platform stand out against others is that you can pick and choose your individual investments rather than investing in an entire fund. I like that you get more control of your investments and you can track how each one performs.

They charge a small 1% management fee, which is less than other platforms and it's super easy to get started. If you haven't signed up for Arrived yet, I highly recommend it.

-

$100 minimum investment so anyone can get started

- Access to individual properties so you can pick and choose which properties to fund

- Quarterly payouts depending on your properties performance

- Open to both accredited and non accredited investors

- Minimal 1% management fee

- Some offerings are funded quickly

Crowdfunded Real Estate

Crowdfunded real estate can be a simple and easy way to grow your passive income portfolio and build your monthly income streams.

Real estate crowdfunding websites like Realty Mogul will pool together month from investors to purchase properties and manage them.

These real estate investments can be a good choice for any real estate investor who doesn't want to deplete their savings account but want to earn passive income.

The amount of money you can make is strong with historic returns averaging around 10% annually.

It's a super easy way to diversify your portfolio and maximize returns.

My favorite platform is Realty Mogul – but the minimum investment is $5,000.

Commercial real estate is another option to earn monthly investment income.

Where some platforms focus more on multi-family residential real estate, platforms like Streitwise or Equity Multiple focus on commercial real estate investing.

This means you can invest in office buildings, strip malls, and other commercial properties without needing millions of dollars to get started.

The amount of money you can earn will vary depending on the market and current economic conditions but platforms like Streitwise or EquityMultiple have historically averaged around 10% to 12% annually.

Commercial real estate offers several advantages over residential offerings.

First, they tend to have longer term leases. It's not uncommon to see lease agreements for over 5 or 10 years.

Secondly, the tenants have an interest in maintaining the property to keep it nice. Because they want to attract new customers to their business, having a well-maintained property is essential to them.

Lastly, commercial properties can be a tremendous hedge against soaring inflation. In short, this means your investments will rise more than the rate of inflation.

If you want to diversify your portfolio and get monthly returns, using a commercial real estate platform like Streitwise is a great option. You can also check out my full Fundrise vs Streitwise breakdown here!

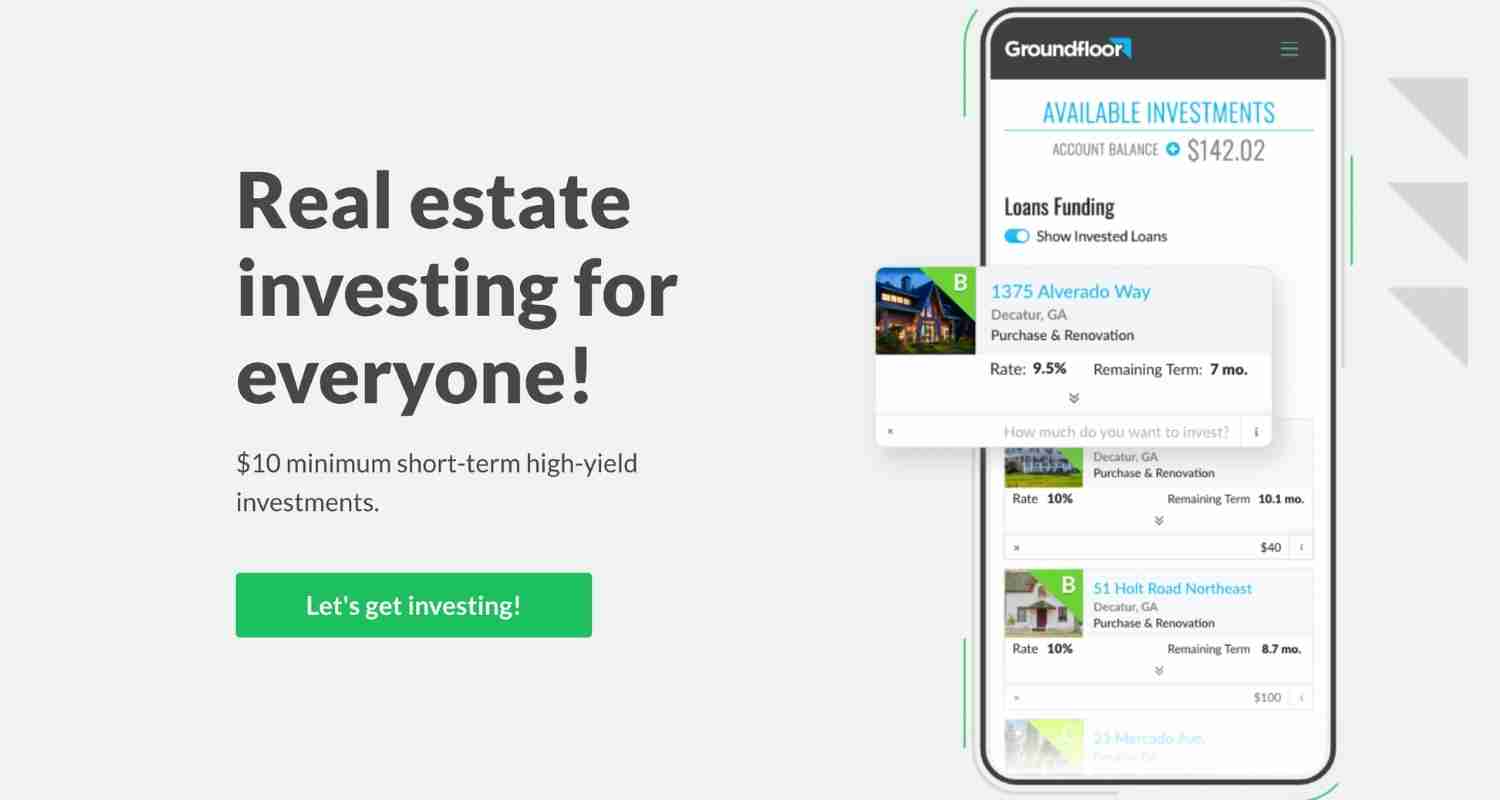

Real Estate Debts

Another great compound interest investment is short term real estate debts.

These debts are essentially short term loans that are made to real estate developers looking to complete a project.

For example, if an investor is looking to flip a house and they need an additional $10k to complete the flip, they might use a platform like Groundfloor to find investors.

By using Groundfloor, investors can make solid returns of around 10% annually and you only need $10 to get started. Create your account below to get started!

Purchase a Rental Property

Rental properties are one of the most common forms of real estate investing that pay monthly income.

With a rental property, you'll collect rental income each month from your tenants whenever your property is occupied.

A rental property can be a great investment to grow wealth because it makes money in two main methods: rental income and appreciation.

Because real estate is an appreciating asset, it will commonly increase in value over time. While the amount of increase will fluctuate and vary depending on your location and market conditions, in many areas its typical to grow in value by 2% annually.

In addition, your tenants will pay you monthly income in the form of rent payments.

When considering purchasing rental properties, you'll also want to consider the risks and costs involved.

Here are some things to consider:

- Vacancy costs

- Mortgage costs

- Home repairs and maintenance

- Property management

- Realtor fees when selling

There are also many advantages that come with real estate. Specifically the tax advantages.

Within rental properties, there are multiple classes you can opt to buy. For example, residential real estate is the most common. However, you can also purchase commercial real estate or apartment buildings to rent out for passive income.

While there is no true advantage to one class over the other, I recommend sticking to whatever you are most comfortable at first. Once your portfolio begins to grow, you might consider purchasing other classes to remain diversified and limit risk.

I have owned a rental property for over a year now and it certainly comes with ups and downs. Some months are filled with maintenance requests while others are completely passive. Overall, it's been a solid investment that I would 100% do again if given the choice.

Short Term Rental Properties

Outside of traditional long term rental properties, you might consider starting a short term rental to grow your wealth. This can be a property like a vacation rental or tourist destination.

These properties can be listed on sites like Airbnb or VRBO for people to rent for a few days or weeks at a time rather than a monthly commitment.

Some people might choose to rent their own property first to get a better understanding of how the platform works and how much money they can make. You can also choose to rent a single room in your home.

Check out the video below about making money with short term rentals!

REITs

A real estate investment trust is another real estate investing option that pays monthly income.

You can think of a REIT as a group of real estate assets that are managed by a company that you can invest in.

This is a more passive method to invest in real estate because you won't need to manage individual properties like you would with a rental property.

Real estate investment trusts can be a great option for real estate investors with some capital to get started.

You can invest in a REIT with an app like Acorns. Claim your free $10 below!

Private Real Estate Syndication

Another real estate investing option is through private syndications. These deals are usually limited to accredited investors but they can be very profitable and a great way to get monthly returns on your investment.

You'll need to do some research to find deals you might want to invest in, but it can be time well spent.

Because you'll own a small portion of each deal, you'll have more control over your investment compared to other options.

Invest in Index Funds

Index funds are another great way to earn monthly income from your investment.

Index funds are a type of fund that seek to track the performance of a specific market index. The most common index fund is the S&P 500 which tracks the largest 500 companies in the United States.

When you invest in index funds, you're investing in a basket of stocks that will offer stability and potential growth.

Index funds are passively managed which means that there is little buying and selling of stocks. This allows for lower fees and expenses for the fund.

You can invest in index funds through an app like Acorns or M1 Finance to get started!

Growth Stocks

A growth stock is a stock in which the company is still in early stages of growth. During these periods, the executive team puts an emphasis on using profits to further grow the company and, in return, the stock price.

Tech companies are common growth stocks that you can use to grow your passive income each month and make money.

Growth stocks are a great option to grow your monthly income even though you won't get a cash payment each month.

In essence, your investment will increase in value each month that will be recouped when you sell the stock.

Growth stocks can be a great way to grow your investment income over time. Like many other investments, you'll need to give them time to grow to reap all of the benefits.

Dividend Stocks

Dividend stocks choose to disperse their profits to investors in the form of cash payments also known as dividends. These stocks are typically in more mature phases of growth so there is less benefit of using the capital to grow the business.

Some stocks will pay monthly dividends while others might offer semi annual or annual dividend payments. While monthly dividends aren't the standard, they can be a great way to make passive income each month. The most common payment schedule are quarterly dividends that are paid after the close of the previous quarter.

Realty Income is a great example of a dividend stock that pays a great dividend with 612 consecutive months of paid dividend.

When choose dividend stocks that pay monthly income, you'll want to find companies that have reliable sources of income and growth.

ETFs

Exchange traded funds, also known as ETFs, can be a great passive income investment that is well diversified for optimum growth.

You can think of an ETF as a large group of various stocks bundled together that you can easily invest in.

Because the ETF likely contains a mix of growth and dividend stocks that pay monthly, you can generate income that will grow exponentially.

Mutual Funds

Just like ETFs, mutual funds can be an excellent method to make a monthly income when you invest money.

Mutual funds are very similar to ETFs in that they can be thought of as a group of stocks and investments that make money each month.

The average yield for a mutual fund is around 7%-8% – which is a great start depending on how much money you want to make each month.

Mutual funds are a great option to build retirement income for any investment portfolio.

Invest in Small Businesses

Investing in small businesses can be a profound way to start making money monthly from your investments.

By using a platform like Mainvest you can easily invest in small businesses around the country without having to deal with the day to day operations of the company.

These investments earn higher returns but they also come with more risk than other options. They have target returns between 10% and 25%, so it's worth considering adding to your portfolio.

You can start investing with a small amount at just $100 making it a great investment for both novice and experienced investors. Create your free account below to get started! As a bonus, you'll get $10 free!

Invest in Cryptocurrency

While some people may not consider cryptocurrency as a true investment, it's certainly an alternative investment that should be considered.

While I wouldn't recommend investing all of your money into crypto, there's an argument to be made that a small portion of your holdings should be allocated to this asset class. After all, it's hard to deny some of the gains major currencies have had.

If you're looking to invest in cryptocurrency like Bitcoin or Ethereum, I recommend using Binance.

Peer to Peer Lending

Peer to peer lending can be another great way to produce monthly income if you have some capital to get started.

When you lend money you can expect to receive regular payments that include interest payments in addition to the money being paid back.

You'll want to consider the risks when you lend money. Interest rates will depend on market conditions and the borrowers credit history.

Higher interest rates tend to come with more risk than those that pay lower interest.

Some of the best peer to peer lending platforms include:

- Prosper

- Upstart

It's possible to earn anywhere from 5% to 10% with many peer to peer lending sites depending on the risk you're willing to take.

Invest in Wine

Looking for an alternative investment to help balance your portfolio?

With this investment, you can make money monthly as the value of wines increases. There are plenty of reasons wine investing can be a good idea including:

- Offers great downside protection with low volatility

- Limited supply

- Not correlated with other investments

If you're looking to invest in wine, using a platform like Vint is a great option. They have over $1.25 million in assets under management and it's completely free to get started. You can start investing in wine with Vint for as little as $50. Create your account below!

High Interest Savings Accounts

Opening a high yield savings account is probably the safest and easiest ways to make reliable monthly income without a fortune to invest.

These accounts are free to open and are an excellent place to store your emergency fund or other cash savings because they pay interest each month.

One of my favorite accounts, the CIT High Yield Savings Accounts offers 50 times the amount of interest as some competitors.

If you're looking for a way to make a regular monthly income from your money, a high yield savings account is a perfect option.

Consider Art Investing

If you want monthly returns, art investing can be another option to grow your money. My favorite thing about art investing is that it is an excellent way to diversify your portfolio to optimize returns.

My favorite platform is Yieldstreet. They have historically strong returns and it is a simple to use platform. Register below to become an art investor today!

Grow an Online Business to Make Monthly Income

If you're looking for an idea that pays monthly and can make a significant income, growing an online business could be the best option for you.

With an online business, you can make money on a monthly basis from your assets that can grow exponentially.

So what exactly is an online business?

An online business can be one of several “things”. It could be a blog – like that you're reading now. Or it could be a digital product business. There are several digital real estate options to grow your passive income streams and make money every month.

For example, my blog currently generates a few thousand dollars of passive income each month. Considering how much I originally invested, this is a massive return on investment that I am extremely pleased with.

To start a blog, I recommend using Namecheap to purchase your domain name. It's super cheap and easy to get started.

Next, I recommend using SiteGround for your hosting provider. They offer superior customer service and very affordable prices.

Finally, you can install WordPress (or another CMS) on your site and start creating content for your readers.

It can take some time to build your blogs readership, but it is extremely worthwhile. After a year you can start to see significant growth (and income!)

Start a Small Business

Starting a business can certainly be thought of as an investment.

Just as buying stocks allows you to purchase a small portion of a large company, starting a small business allows you to own a large portion of a small company.

While starting a business comes with many other challenges that other investments are shielded from, a business can also have the largest potential.

Many small businesses are capable of extreme growth in its early stages. When you compare this to the average market return of around 7% to 8%, the opportunity with a small business can be much larger.

You'll need to have the funds and time to grow your business, however.

Starting a business is not technically passive unless you have staff in place to complete the operations for you.

Some of my favorite business to start include:

- Power washing business

- Painting business

- Lawn care business

- Auto detailing business

- Rental businesses

Bonds

While bonds might not be the most attractive investment option that pays monthly, it can be an easy and reliable way to grow your monthly passive income.

If you don't want to pick an individual bond, you can invest in a bond fund that is more diverse and less risky. With a bond fund you'll be investing in a group of bonds that pay monthly. For those looking to make extra money fast, you might consider a short term bond fund to earn passive income.

There are several types of bonds to invest in: treasury bonds, corporate bonds, foreign bonds, and government bonds. Each types has advantages and disadvantages.

For example, government bonds from the United States are thought to be the safest investment option to make extra income but the average yield is quite minimal.

Treasury bonds and corporate bonds can make more money, but there comes slightly more risk.

International bonds can have the highest yields, but are often the highest risk.

Bonds will pay interest every month making them a great investment to make passive income.

Invest in a Private Company

If you're looking for higher returns, investing in a private company can be a lucrative investment to earn money monthly.

You'll have to do some digging to find private deals, but if you can find the right company – you can make a steady income and reach an early retirement.

Certificate of Deposit

Some financial institutions offer CDs with favorable rates compared to traditional savings accounts.

These accounts pay interest each month for the money you have decided to invest.

While other financial institutions may not offer strong CDs, there is often a better option than these accounts.

Money Market Accounts

Money market accounts are extremely similar to a traditional savings account or a CD. These accounts offer a fixed interest rate on your money.

Money market accounts are a super easy way to earn income and diversify your investments with another asset class. CIT Bank has some of the best money market accounts available, so check them out.

Investing in Yourself

Okay, so this isn't a traditional investment that you might consider but investing in yourself can pay large dividends.

While you won't receive a direct check in the mail by investing in yourself, you might find that your other sources of income will increase from it.

For example, expanding your skillset can be a great way to land a new job that pays significantly more. While some people might not consider a job an “investment” I think it should be.

Check out the video below to learn more about investing in yourself!

Write a Book

Authoring a book can be a great investment that pays month after month with royalties.

Just like a new job, authoring a book isn't considered an investment by many however, I think that it can be.

If you can invest your time and skills into writing a book, you can make a large income every month by selling it.

Can I Make Monthly Income Without a Large Investment?

There are some investing methods that won't require a large amount of money to earn monthly income. While the amount of monthly income you make will be less than other methods, it's still a great way to increase your monthly passive income that increases over time.

Whether you're looking to invest $500k or invest $150k – it's possible to make money every month from your investments.

Some of the best low cost monthly income investments are:

- Stocks with Acorns

- Bonds

- REITs

- Blogs

These are easily accessible for investors without large sums of money to invest.

If you're eager to earn more money, you might raise capital to invest more money.

Don't worry – we hate spam too. Unsubscribe at any time.

How Long Does it Take to Make Monthly Income?

Some investments will require large amounts of cash upfront if you want to make a serious income from your money.

Depending on just how much money you want to make, it's possible to reach your goal in less than one months time.

If you have larger goals, it might take several years.

For example, if you want to turn $10k into $100k, this could take more time than other goals.

How to Purchase Investments That Pay Monthly?

Depending on the investment you're interested in, there are several ways to purchase them.

For example, if you're looking to purchase stocks or invest in the stock market, using Acorns is one of my favorite methods. The app allows you to easily get started investing without the hassle and confusion that other platforms have. Plus, when you sign up below you'll get $10 free to start investing!

If you're looking to invest in real estate, using Arrived is my recommended platform to grow your money. With Arrived you can invest in real estate without the headache that comes with managing individual properties. Sign up below to get started!

To open a high yield savings account, I recommend using CIT Bank. Their accounts is completely free and pay much more interest than a traditional savings account. Sign up below to get started!

Tips for Investing for Monthly Income

There are some considerations you'll want to take into account before you start investing.

Risk

The most obvious consideration is your risk tolerance. When making any investment, your return is not guaranteed. In fact, you could lose money with some investments like a small business.

Typically, the riskier the investment, the larger return it will yield if successful.

To manage risk, you'll want to diversify your investments so you don't have all of your eggs in one basket. This means investing in various types of assets.

Liquidity

Some investments are easier to sell and get your money out of than others. This concept, known as liquidity, might be important to some individuals.

For example, if you invest in a small business or purchase rental properties, it will be much more difficult to get your cash back out of the business when compared to investing in stocks.

If you are investing for the long term, this will matter less.

Personal Finances

For those with large amounts of debt, it's not recommended that you go an invest large sums of money before paying off these debts.

If your debts are limited to your mortgage or another low interest debt, some personal finance experts might advise that you do start investing. Otherwise, it's smart to work on paying off debts before you begin to be fiscally responsible.

Do I Need to Hire a Financial Advisor?

While it is not required, some people might choose to hire a financial advisor to manage their retirement accounts and other investments.

If you have enough knowledge, you may not need a financial advisor to make investment decisions for you.

Final Thoughts on the Best Investments that Pay Monthly

There are many investments that pay monthly income. You might consider real estate investments, investing in index funds, or maybe even opening a high yield savings account.

The most important part of growing your wealth and monthly income is to get started. No matter which choice you select, reaching financial freedom or an early retirement will be much easier by making smart investments over time.

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

How to Invest 500k: 24 Safe Methods (2024 Guide)

Want to learn how to invest $500k? Explore these 24 best ways to invest $500,000 to build wealth and make money!

15+ Best Real Estate Investing Apps (Ultimate 2024 List)

Check out these real estate investing apps to start growing your money and managing your properties with ease!

How to Invest 10k in Real Estate – Simple & Easy Methods (2024)

Looking to invest $10k in real estate? Check out these simple real estate investments to grow your wealth and make money!

How to Turn $10K into $100K – 20+ PROVEN Methods (2024 Guide)

Learn how to turn 10k into 100k quickly and effectively with this guide to investing your money. Read now!