Real estate investing is an amazing way to build wealth and grow your net worth.

If you want to invest in real estate there are plenty of options to grow your money.

In this post, I'll explore how to invest $10k in real estate, how much money you can make from your investments, and more. Let's get started!

Best Ways to Invest $10k Real Estate

Below are some of the best options to start real estate investing with $10,000. Becoming a real estate investor is an excellent way to diversify your income and investments – so what are you waiting for??

Invest with Fundrise

Fundrise is my favorite real estate investing app you can use to build wealth and invest in real estate properties.

One of the main reasons I love Fundrise is the low initial investment to get started. You can get started with just $500 (much less than the $10k you're looking to invest).

With this real estate crowdfunding platform you can invest in a wide variety on assets that you might not otherwise have access to.

For example, if you want to invest in apartment buildings you might not have the funds for a multiple 6 figure down payment on your own, but with the help of others you can invest in a smaller portion of the complex to grow your money.

Fundrise has an extremely low management fee at less than .5% – which is less than many ETFs or index funds.

Register for Fundrise below to get started!

Invest with Peerstreet

Peerstreet is another great real estate crowdfunding platform you can use to invest in real estate assets to build wealth.

With Peerstreet you can invest in a variety of ways, whether you want to become an actual “property owner” or simply loan money to real estate investors who are looking to build wealth.

For example, if you want to be an actual property owner with Peerstreet you can choose between real estate crowdfunding opportunities like apartment buildings, commercial real estate, single family houses and more.

Peerstreet allows you to be hands-on or hands-off when it comes to your investments. You can choose to invest in real estate assets that meet your minimum criteria or you can have your money automatically invested for you.

You can actually get started investing in Peerstreet for as low at $1,000. Register with the link below to get started!

Try RealtyMogul

RealtyMogul is another real estate crowdfunding platform to grow your passive income streams through real estate investments.

Just like with Fundrise and Peerstreet you can invest in online real estate ventures without a massive amount of cash.

The minimum investment amount for RealtyMogul is just $1,000 and with low management fees you can keep more money in your pockets.

You can invest in commercial real estate like office buildings and more.

Register for RealtyMogul below to get started!

Purchase a Rental Property to Invest in Real Estate

Purchasing rental properties is an excellent way to build passive income each month however it comes with more responsibility than some of the other methods on this list.

Purchasing a rental property will require more money to get started because you’ll need to have money down to cover closing costs and your down payment.

In addition to these costs, you’ll want to consider any home improvements that might be needed before renting your property. Even if some of them seem small, they can add up.

If you want your investment property to be a form of passive investing – you'll need to hire a property manager to keep your operation running smoothly. There are many investment property management companies that will take a percentage of the renal price. If you're a regular investor and you want to invest $10k in real estate, purchasing an investment property is a great idea.

Unfortunately, finding a rental property is not a simple process. You’ll likely need to analyze many deals and possibilities to get the most for your money.

It’s important to know the estimated rental price of a potential home before making an offer. This can make or break a deal for you.

For example, if you’re analyzing a rental property that has a price of $150,000 and you can rent it out for close to $1,500 a month, this is likely a good sign.

On the flip side, if you find a property that costs upwards of $300,000 that you think you could rent for $1,700 this might be pushing your profits.

Rental properties make money in several different ways.

Between rental income, home appreciation, and rental appreciation or mortgage pay down, rental properties can be a great way to build wealth.

While you will only see your rental income – the other forms will be realized when the property sells.

Invest in a REIT for Passive Income

A real estate investment trust is a corporation that owns and typically operates income-producing real estate.

These companies do not own properties directly, but rather hold a portfolio of investments related to mortgages on the property or debt from other securities in which they can grow their money.

For example, they can invest in mortgages that are bundled together through a trust.

In general, REITS have less liquidity than other securities because their investments tend to be long-term and illiquid. They also pay out most of the income from these properties back to shareholders as dividends or distributions instead of keeping all of it for themselves like other companies.

One of the benefits to investing in a REIT is that it requires much less capital than buying an entire property yourself and you’ll still earn some money through dividends or distributions.

This might be an option for you if you're looking to build wealth but don't have the money for a large down payment.

Some examples of real estate investment trusts include:

- Equinix Inc. (ticker: EQIX)

- Americold Realty Trust (COLD)

- CyrusOne Inc. (CONE)

Just like mutual funds, real estate investment trusts are publicly traded and can be bought and sold on stock market exchanges just like other investments and they are accessible to non accredited investors.

With no minimum amount to invest, this is a great option to invest $10k in real estate.

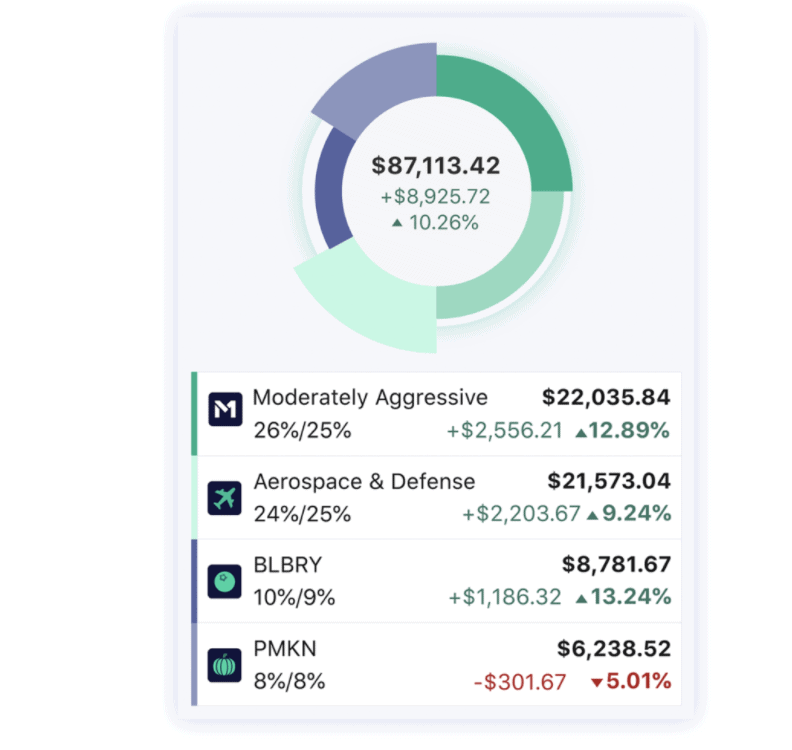

Invest in REITs with M1 Finance

M1 Finance is a great way to invest in a REIT without the hassle of managing an investment property. With just a $10 minimum investment, this compound interest account is the perfect way to build wealth and grow your money.

Register below to claim an exclusive sign up bonus!

Consider Real Estate Wholesaling

Real estate wholesaling is a good way to build your income but you're going to have to do some work with this method.

In short, wholesaling works similar to flipping. You'll buy a contract on a home and sell the contract for a profit. Wholesaling in real estate can be difficult because of the time it takes to find a good home.

With wholesaling you'll always need to be on the lookout for target investment properties. It can be hard to find a particular property but that's where the money is made.

One of the reasons many investors try wholesaling is because of the extremely low minimum investment.

Flip Houses for Income

Flipping houses can be a lucrative way to start investing in real estate if you have $10,000 to get started with a down payment.

You can make anywhere between $30,000 and $100,000 on a single house.

For example, let’s say you buy a home for $200k that needs some work done to it – maybe the kitchen has been gutted or there are several broken windows throughout the property. You spend about six months renovating this property and you end up selling it for $280,000.

That’s a profit of about $80k on one transaction. Not bad!

Many real estate investors shy away from flipping because it can come with the most risk. However, if you plan accordingly and have experience you can better judge whether a home is a good candidate for flipping.

House flipping has a larger minimum investment than other real estate investments. It can be more difficult to receive a mortgage for a distressed property because the bank has difficulty placing a value on the property and they incur more risk.

House flipping is all about finding a good deal. Because you'll be competing against other home flippers in your area, you'll want to make sure your offer is strong but still has room for your own profits.

Try Real Estate Syndication

Real estate syndication is a great way to get involved with real estate investing without having the time or money it takes to purchase and manage your own rental properties.

The pros of this option is that you can diversify investments across many different types of rentals, which helps mitigate risk in case one property doesn't perform well for some reason.

The cons are that it will be difficult to get control of the properties you own, which could affect your bottom line. Because properties are owned by the group, you don't have much control of your money.

Syndicated real estate often has multiple projects going at once that several investors have stakes in.

Real estate syndication does come with less risk than some of the other methods on this list, but it does often require more money to get started.

How Much Money Can You Make Investing in Real Estate?

When you decide to invest in real estate, you might be wondering how much money you can potentially make.

Unfortunately, the answer isn't as straightforward as you might hope. Ultimately, it will depend on numerous factors like what kind of real estate investing are you taking part in, what is your level of risk tolerance, and many other items.

On average, it's possible to make upwards of 10% annually investing in real estate with a REIT. For other forms of investing, like real estate crowdfunding, you might see returns as high as 15%.

Related: How to Invest 500K

Don't worry – we hate spam too. Unsubscribe at any time.

Advantages of Investing in Real Estate

Real estate provides many benefits for investors looking to grow their money.

Tax Advantages

The tax implications of many real estate investments are substantial, in a positive way.

Some of the tax benefits include:

- You can deduct expenses related to your investment property

- You can depreciate your rental property value

- You can deduct property taxes (if applicable)

- Potential for tax deferrals

- Lower long term capital gains tax rates

Portfolio Diversification

Keeping your investment portfolio diversified is essential if you want to maximize your returns and limit potential losses.

Real estate can help to diversify your portfolio by offering a unique asset class that isn't like others. Owning investment properties in addition to other investments like stocks, bonds, and even cryptocurrency is a great way to balance your portfolio.

Relatively Low Risk

Many investors view real estate as low risk for several reasons.

At the end of the day, everyone needs their own home to live in. For that reason, some investors prefer residential real estate because it is a tangible investment that will always be needed.

However, this doesn't always mean it's risk free. Remember 2008??

Protection Against Inflation

Building wealth with real estate is actually more easy than you'd think, especially with platforms like Fundrise.

There are many investment opportunities to consider, but I love real estate because it offers a great hedge against inflation. Whenever inflation is rampant, home prices and the housing market are likely to rise in a similar fashion. While this can make it tough for many home buyers, it's a good thing for your investment properties or rental home.

Potential Full Time Income

One of my favorite things about real estate is the income opportunities it provides.

If you hate your job and don't want to work anymore, purchasing investment properties can be a great way to escape your 9 to 5.

But even if you're not ready to commit to real estate full time, it is a great side hustle that can be done in addition to your employment.

Final Thoughts How to Invest $10k in Real Estate

Investing $10k in real estate is a great way to grow your wealth and reach financial freedom.

Whether you choose to earn passive income from real estate crowdfunding sites or via a real estate investment trust – you can begin investing in real estate quite quickly.

If you're looking to maximize your returns, you might consider a real estate partnership to buy and flip houses.

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

27 Best Appreciating Assets (Ultimate 2024 List)

If you're looking to grow your wealth and net worth, investing in appreciating assets is critical. Learn how to to get started!

How to Invest $25k: 19 Safe Methods (2024 Guide)

Want to learn how to invest $25k? Check out these best investments to make money and build wealth easily!

24+ Best Investments That Pay Monthly (Ultimate 2024 Guide)

Looking for investments that pay you every month? Check out this complete list of investing options to consider.

How to Invest and Make Money Daily + Fast (21 Legit Ways in 2024)

Looking for places to invest to make money daily? Give these easy options a try to make money investing today!