We all want compound interest, right?

You likely already know the benefits that compound interest can provide, but you might not know which types of accounts can help you maximize your earnings.

Compound interest can change your entire financial future and time is your greatest asset, so it's important to get started investing in these assets as soon as possible.

If you want to build wealth, get rich, and potentially become a millionaire – it all starts with compound interest.

In this post, I'll explore some of the best compound interest investments to grow your money and invest wisely and much more. Let's get started!

Some of the best compound interest investments include:

- Index fund investing with Acorns

- Real estate investing with Arrived

- Small business investing with Mainvest

- Opening a high yield savings account with CIT Bank

As with any investment, only invest what you can afford to lose and always consult a financial advisor before investing.

Top Compound Interest Investments to Grow Your Money

Using compound interest to grow your money is a no brainer. As you earn interest you will make more money that can be reinvested. Below are some of my favorite compound interest investments you can use.

1. Invest in Rental Properties with Arrived

My favorite compound interest investment is through a real estate investing platform called Arrived. I've been using this platform for months and love how simple and easy it is to start investing.

So what is it and how does it work?

Arrived Homes allows you to invest in individual residential rental properties with as little as $100. You'll earn money quarterly based on the income generated from the property (or properties) that you've invested in.

This is a trusted investing platform that has managed to amass a real estate portfolio of over $83 million since 2019. You can easily filter properties based on criteria that you choose and you don't need to be an accredited investor to get started.

If you want to make compound interest, I highly recommend checking out Arrived Homes.

- $100 minimum investment so anyone can get started

- Access to individual properties so you can pick and choose which properties to fund

- Quarterly payouts depending on your properties performance

- Open to both accredited and non accredited investors

- Minimal 1% management fee

- Some offerings are funded quickly

2. Invest in Index Funds

Investing in the stock market is one of the most reliable compound interest investments.

Investing in the stock market can be done through various methods. While the market consists mainly of individual stocks, it also offers other investments like mutual funds, index funds, and ETFs – which are a collection of individual stocks.

There are several types of index funds that can generate compound interest. These include:

- Total market index funds

- Broad market index funds

- Industry sector index funds

Index funds are known for their low fees and fantastic diversification. This means that they are a reliable compound interest investment that can bring return for many years to come.

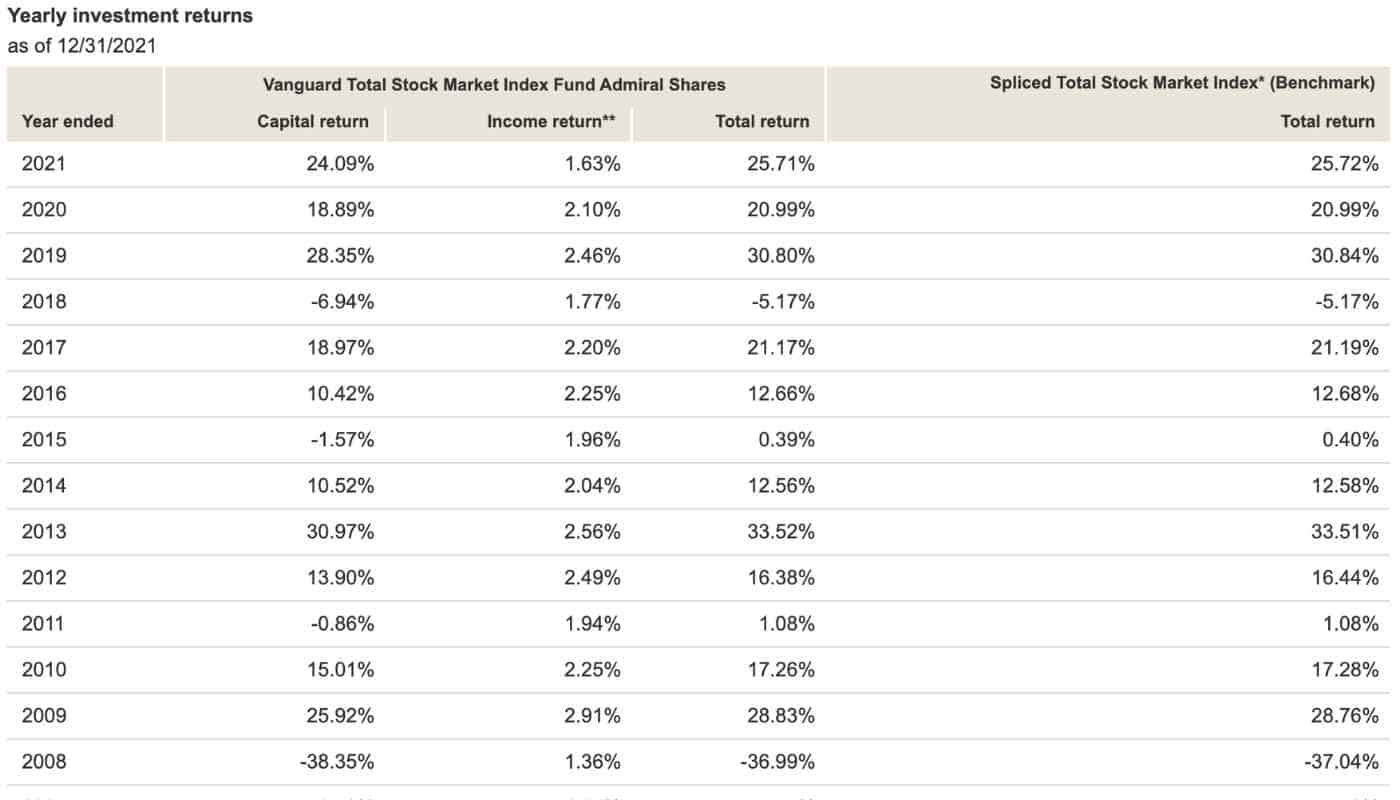

Take a look at the returns for one of the most popular index funds, the Vanguard Total Stock Market index fund.

An index fund can be a good investment for beginners just looking to get started with the power of compound interest.

For many index funds and stock investments, you can assume a 7% annual return on investment that compounds each year.

If you want to invest in the stock market and grow your money, I always recommend Acorns. Here's why:

- Low initial minimum investment of just $5 – making it a perfect option for beginners

- Get $10 free to invest – who wouldn't want free cash to invest?

- Fractional shares – don't have a fortune to invest? You can still purchase portions of a stock to fit your investments.

- Easily invest with automated tools to reach your goals.

3. Crowdfunded Real Estate with Realty Mogul

Crowdfunded real estate platforms are my favorite method to invest in real estate because you can get started without needing a fortune and it's completely passive.

This form of investing works by pooling money together from many investors to purchase large real estate deals that you'll own a small portion of. This means you don't need millions to get started apartment investing.

My favorite platform is Realty Mogul. They've been around since 2013 and have thousands of users. You can expect returns greater than the stock market which is attractive for many investors looking to grow their money.

- Easy diversification across many properties and asset classes

- Open to both accredited and non accredited investors

- Strong team that does great due diligence

- Higher minimum investment of $5,000

- 1% – 1.25% management fee

4. Generate Compound Interest with Small Business Investing

Investing in small businesses can be a tremendous way to build your compound interest.

But usually it comes with a significant amount of work to get started. Not anymore!

Thanks to platforms like Mainvest, you can invest in small businesses easily. With as little as $100, you can grow your income while helping small business owners grow their companies. Mainvest is completely free to join and there are no fees to invest. Create your account below to get started or check out my full Mainvest review here!

5. Real Estate Investment Trusts (REITs)

Real estate investment trusts are a simpler option to get started in the world of real estate investing.

In short, real estate investment trusts act similar to many stocks except that their main business is in real estate. Instead of having to manage property, collect rent, and maintain a property, this is all completed for you.

REITs can own hundreds or thousands of different properties so your money isn't tied up into a single property.

When you invest in a REIT, you’ll receive a portion of the profits similar to a dividend stock. REITs are lower risk investments that can be a great way to further diversify your investment portfolio.

REITs are traded on the stock market meaning you can use an investing app like Acorns to make this investment and generate compounding returns.

6. Invest in Real Estate Debt

This type of real estate investing often gets overlooked but it can be a tremendous way to diversify your portfolio and earn compound interest.

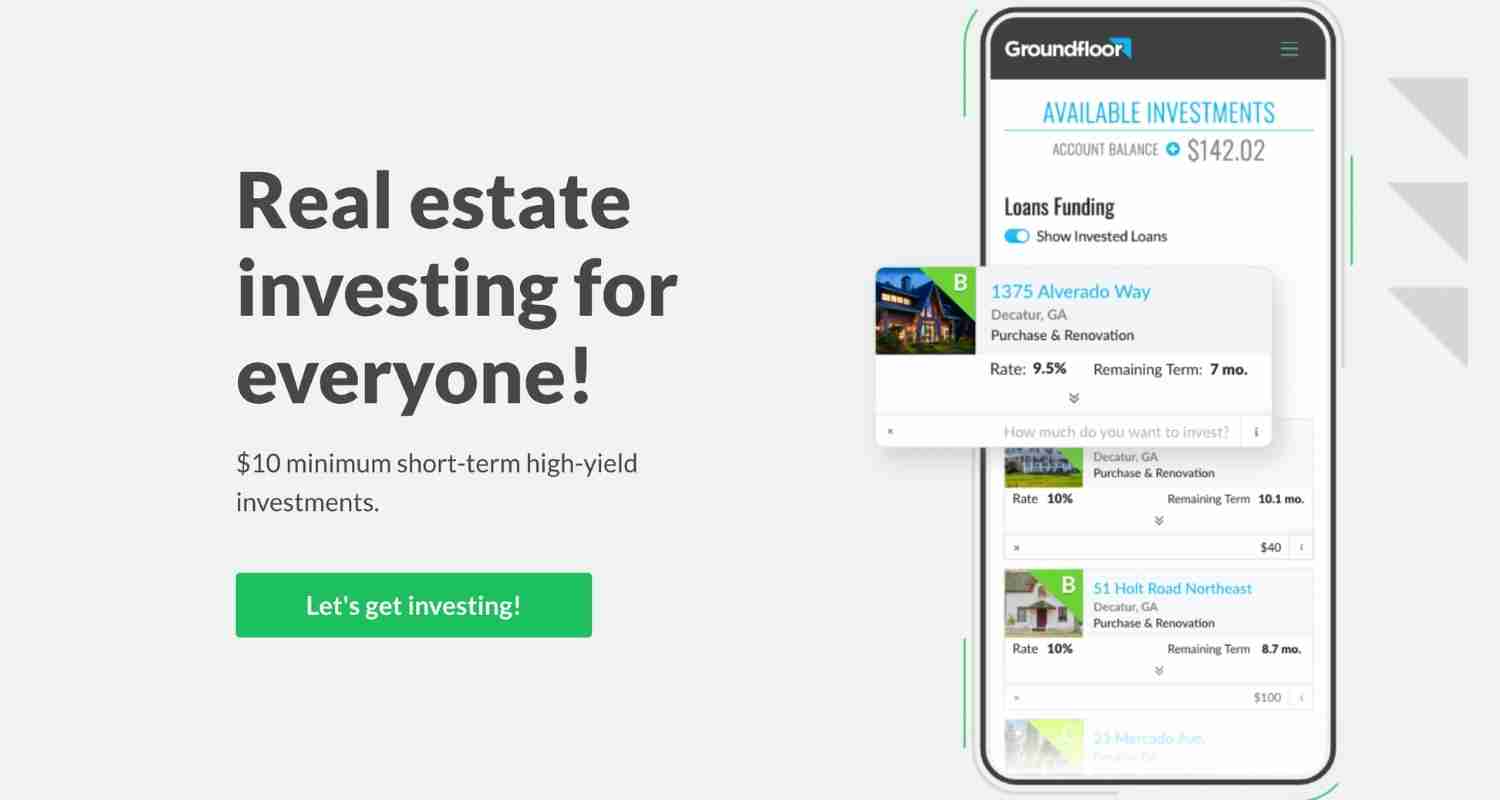

By using a platform like Groundfloor, you can invest in short term real estate debts.

These debts are used to help complete a real estate investment. These are primarily used for flipping houses or other properties. For example, if you are trying to flip a property but come up shirt $10,000, you might use a platform like Groundfloor to get the money you need to complete the job.

For investors, this can be an awesome avenue to grow your money. You can get started with as little as $10, making it a solid option for any investor looking to make compounding interest. Create your account here to get started!

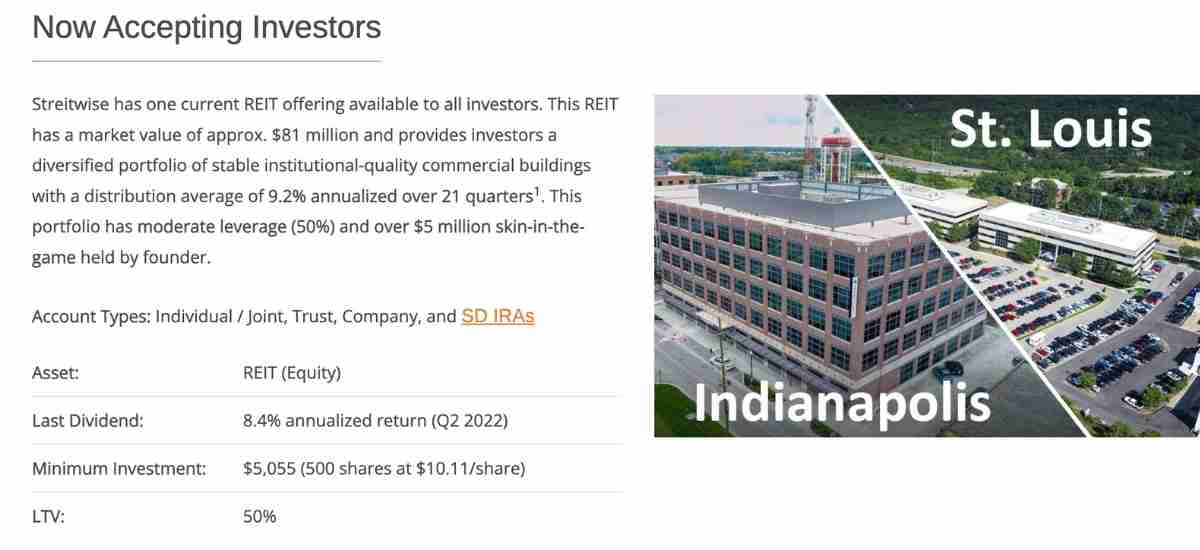

7. Commercial Real Estate Investing

There are two main types of real estate investing: residential and commercial. Residential deals with properties that are lived in by people. Commercial deals are buildings that are rented by businesses.

Each type of investing can make you compound interest. And by having a mix of both investments, you'll add some diversification to your portfolio.

You can invest in commercial real estate with a platform like Streitwise.

With Streitwise you'll need $5,000 to get started, but they have produced strong returns over 8% annually, making it one of the most profitable investments for many people.

8. Rental Properties

Investing in real estate comes with many options to grow your wealth. Real estate is a great way to diversify your investment portfolio and hedge against inflation.

As home prices soar, real estate investors have made fortunes and you can do the same.

Purchasing a rental property is one common method to investing in real estate. This method will require the most capital and work to get started but it is also one of the more profitable methods.

When you start investing in rental properties, you’ll want to be sure you have the capital and skills to create the value you’re searching for.

You’ll need to analyze how much capital you have to invest, research where you want to purchase your property, and understand the rental rates in the area for a property of similar value.

When you own properties you can choose to hire a property management company to help you keep up with maintenance and other requests.

Rental properties come in all shapes and sizes. You can opt for a residential property like a single family home or duplex, or you may consider commercial real estate to build wealth. Either way, real estate investments can be a great method to compound your money and make 6 figures.

9. Exchange-Traded Funds (ETFs)

ETFs feature some of the lowest management fees investors can get but they come with a few other benefits.

This investment is similar to index funds in that they are extremely diversified which limits risk. Another great benefit is the lower initial investment. While some index funds can cost thousands of dollars to invest in – most ETFs will cost less than a few hundred dollars. Even better – many online brokerages will allow you to purchase fractional shares to lower the cost even further.

You can find ETFs in many different sectors such as commodity ETFs, bond ETFs, international ETFs, and many more.

The average ETF return is around 10% annually, making it one of the best compound interest investments to grow your money in the stock market.

Some of the top ETFs include:

- Vanguard S&P 500 ETF (VOO)

- Vanguard FTSE Developed Markets ETF (VEA)

- Vanguard Dividend Appreciation ETF (VIG)

You can easily invest in ETFs with Acorns. Claim your free $10 to invest here!

10. Mutual Funds

Another stock investing option includes mutual funds. These are extremely similar to index funds and ETFs but they typically have somewhat higher fees. They can also contain other assets such as real estate.

Mutual funds tend to be more actively managed. This means that they have a fund manager who actively makes decisions on which investments to include in the fund and which ones to sell. The goal of the fund manager is to outperform average returns. Most of the time, the increased returns will be offset by additional fees.

That said, mutual funds can still be one of the best compound interest investments you can find.

11. Dividend Stocks

When picking individual stocks, you might consider investing in dividend stocks to grow your compound interest.

Dividend stocks are different than other stocks in that they tend to be more mature and are often less sexy when compared to growth stocks.

When a company has reached it's peak and its growth slows, many companies will begin to distribute the companies profits to shareholders in the form of a dividend.

Dividends can be paid regularly to shareholders depending on how the company performs. Most commonly dividends are paid quarterly but there are some stocks that pay dividends monthly or annually.

Dividend stocks can be an excellent compound interest investment if you structure your portfolio correctly. When purchasing a stock you can choose to reinvest dividends. This means that whenever a company pays you a dividend, that money goes toward purchasing more stock at equal value to your dividend payment.

If you aren't sure which dividend stocks to pick, you could choose to invest in a dividend ETF to stay diversified. Whether you want to make $500 a month in dividends or make $1,000 a month dividend investing – they are a great addition to any investment portfolio.

12. Growth Stocks

A publicly traded stock that is still in the earlier phases of its life is known as a growth stock. These investments have a strong outlook for years to come.

Many tech stocks are considered growth stocks because they still have a large growth potential. These stocks tend to be more expensive because of their potential.

Unlike dividend stocks, these investments often do not pay dividends to shareholders because they would rather use the capital to further grow the business. This means you won't see any returns until you decide to sell your shares.

13. CIT Bank Savings Accounts

A high interest savings account is a great way to grow your compound interest each month. And because a savings account is very low risk, it's also extremely safe.

There are many online savings accounts that you can use to generate compound interest.

A high yield savings account will often pay around 10 times what standard savings accounts will offer, so why not register?

The national average interest rate for most savings accounts is a measly .06% according to Bankrate. This means that if you hold a balance of $10,000 for one year – you would earn just $6 in interest. While this is essentially free money, you would be “losing” money to the rate of inflation.

You can easily connect your savings account to your bank account to transfer money to and from both accounts.

While the accrued interest you'll make from a savings account isn't the largest, it's a safe option to grow your money.

One of the down sides of savings accounts is that the interest rates they pay can fluctuate. Depending on market conditions and the bank you work with, it's possible for them to lower the amount of interest you'll make.

Some savings accounts might also have fees. While the majority don't – always be on the lookout for hidden fees. Most of the time these fees are avoidable and might not impact your finances, but it's always beneficial to find out beforehand.

Many savings accounts also offer lucrative sign up bonuses that can amount to over $1,000 in free money. Be sure to browse around if you haven't already.

Savings accounts are great options for people with a low risk tolerance and need their money in the near future.

If you're saving up for a new car or down payment for a home – opening a high yield savings account with CIT Bank is a no brainer.

14. Invest in Venture Capital

If you're looking for a more lucrative investment and don't mind additional risk, investing in venture capital opportunities can be a great option.

Venture capital investing allows you to invest in startup companies that have tremendous growth opportunities.

For example, companies like Alphabet, Airbnb, and many others have raised money through venture capital that have gone on to become billion dollar companies.

As an investor – this can be a great way to invest for potentially massive returns amount to over 1000%.

But it's certainly more risky than other investments.

To get started, I recommend using Titan.

Titan is an investing platform that allows you to invest in everything from stocks, to real estate, venture capital, crypto, and more. You can start investing with just $100 – so create your account below to get started!

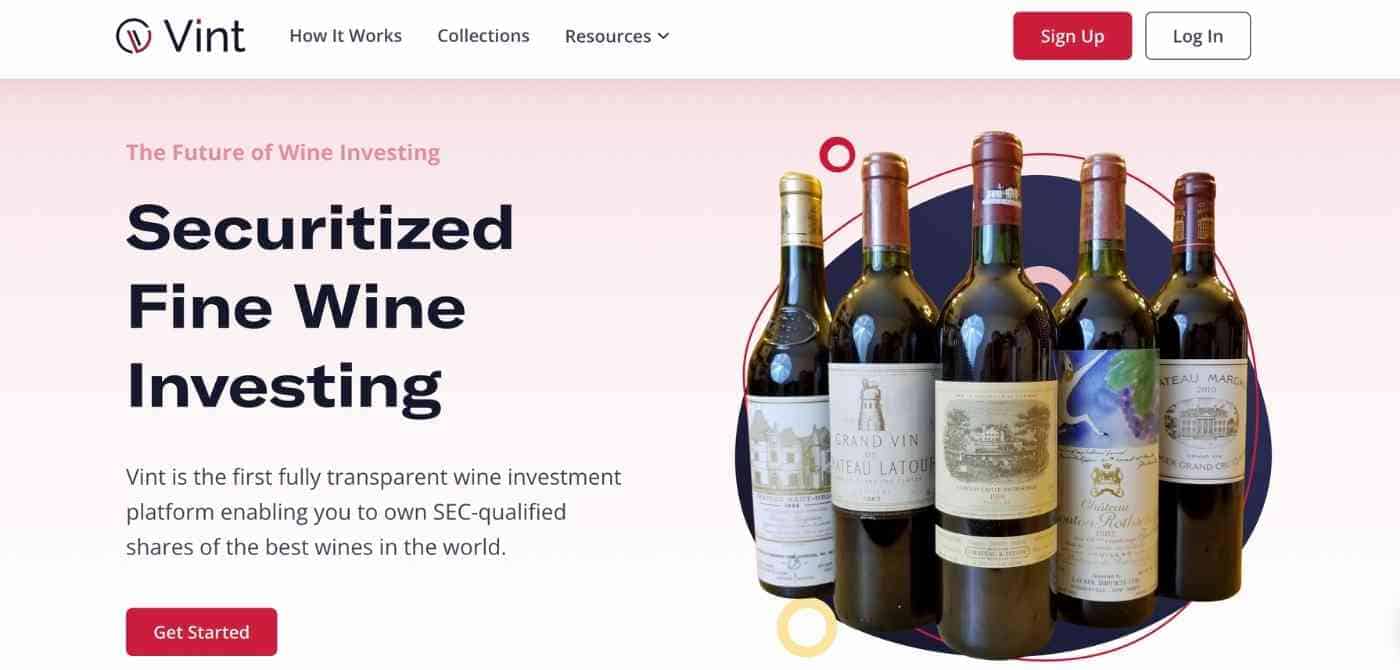

15. Consider Investing in Wine

You read that correctly, investing in wine can be a great way to diversify your portfolio and earn compound interest.

There are a few key reasons why win investing is a solid investment option.

- Offers great downside protection with low volatility

- Limited supply

- Not correlated with other investments

Curious how it stacks up against other investments? Take a look at how it compares to the S&P 500 below!

If you're looking to invest in wine, using a platform like Vint is a great option. They have over $1.25 million in assets under management and it's completely free to get started. You can start investing in wine with Vint for as little as $50. Create your account below!

16. Grow Your Money With Art Investing

One of the newer forms of investing includes artwork. While art has been around for ages, it's now being used as a place for investors to generate compound interest.

By using the platform Yieldstreet you can invest in many different famous pieces of artwork to grow your money.

Since it's inception, Yieldstreet has had an average return of 15% annually which is a great investment.

Register below to create your Yieldstreet account!

17. Bonds

Bonds are a simple way to generate compound interest with low risk.

There are several types of bonds you might consider including treasury bonds, municipal bonds, or corporate bonds.

Government bonds are considered the safest but also have the lowest interest rates. Municipal bonds are also on the safer side but have low yields.

Corporate bonds will offer a higher interest rate but also have the most risk.

For diversification purposes, I suggest a variety of government bonds and corporate bonds. Just like an index fund, you can also invest in a bond fund to build your passive income and generate compound interest.

Check out the video below for more information on bonds!

18. Money Market Accounts

Just like a high yield savings account, a money market account has an annual interest rate much greater than a traditional savings account.

Money market accounts are perfect for those with a small risk tolerance because of how safe they are. You can open a money market account through almost any banking institution so check your local bank to see what they offer.

19. Certificates of Deposit

CDs are a rather safe investment that are similar to both money market accounts and savings accounts. With this investment option your money will be deposited into your account and grow exponentially.

There is one main downside to CDs, however. In most cases, your money cannot be withdrawn penalty free before the maturity date.

The interest rates on CDs tend to be lower than some of the other compound interest investments on this list, but they are also extremely safe so you won't have to worry about losing your money.

20. Investing in a Business

While this compound interest investment often gets overlooked, it has some serious potential. Starting a business can be a great way to grow your wealth and earn extra money each month.

When you invest money in a business, your returns can be extraordinary. While you won't receive a direct interest payment that you would from say, a savings account – you'll instead build equity in your business that can be worth much more over time.

How Can You Invest in a Small Business?

My favorite way to invest in small business is by starting your own. This gives you the most control of your venture and allows you to make smart decisions to grow your company.

If you don't want to start a new business, you might consider purchasing an existing business to grow your money or using a platform like Mainvest. This comes with a few additional challenges.

If you're purchasing a business that has strong cashflow, you'll pay a premium for the work the current owner has done. But this business will have less risk because it is already established.

Types of Businesses To Invest In

My favorite types of business to generate compound interest are rental businesses or small service businesses.

With a rental business, you’ll generate passive income each time you rent out your property.

With a service business, you can get started for cheap. For example, a starting a painting business can cost less than a few thousand dollars and provide great returns on your money.

21. Invest in Tangible Assets

There are many tangible assets you can invest in to build wealth. For example, investing in a historic vehicle that increases in value can generate compound interest for years to come.

While you might not see the compound interest paid directly to you each month, when it comes time to sell your asset – the capital gains you make will reflect the compound interest generated.

Other tangible investments can include:

- Sports cards

- Collectables

- Coins

22. Invest in Cryptocurrency to Get Compound Interest

Cryptocurrency like Bitcoin can be another compound interest account with the potential of generating massive returns.

While cryptocurrency is debated among the personal finance community, many investors see it as a long term play to grow their net worth.

Many coins have seen triple digits growth over the past few years resulting in many crypto millionaires. However, it's not always the case. Some coins have seen the opposite effect plummeting double digitals and losing tremendous value.

When it comes to investing in cryptocurrency, be sure you have the money to lose. It can be easy to get caught up in the hype that surrounds this piece of digital real estate – but be careful!

My favorite platform to invest in crypto is Binance. Register below to create your free Binance account and start making compound interest with as little as $10!

Still not sure? Check out this video below that explains what Bitcoin is and more!

23. Invest in Retirement Accounts

While this is not specifically an investment, it's a great way to grow your money and generate compounding returns on your money.

By utilizing a 401k or IRA account you can not only grow your money but you can also take advantage of tax benefits that accompany these accounts.

It's important to keep in mind that these accounts can only be used to save for retirement and you'll face strong penalties if you withdraw money from them before retirement age.

There are also limits to the amount of money you can contribute to these accounts.

For 2022, the IRS limits IRAs to $6,000 for individuals under 50 and $7,000 for those over 50. For 401ks, you'll be limited to $20,500.

What is Compound Interest?

Before going into the details of which compound interest investments are better than others, you must first understand what exactly compound interest is.

According to Investopedia, compound interest is “the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods.”

A great compound interest example is a savings account. Each month you are paid a small amount of interest on your money. The second month, not only will you make compound interest on your initial investment, but your interest will also generate interest.

Another compound interest example would be the stock market. Each year, traditional stock investments like an index fund will increase in value by around 7%. The second year, your additional 7% will also increase by 7%.

There are many investment options you can use to increase your compound interest earnings that I’ll cover below.

What is Compound Interest Investing?

Compound interest investing is the process of investing in assets that routinely pay you and grow exponentially.

Investing your money in things like an index fund, mutual fund, or treasury securities are all examples of compound interest investing that can turn your money into more money.

When you invest in compound interest, your money will grow exponentially and allow you to build wealth from nothing.

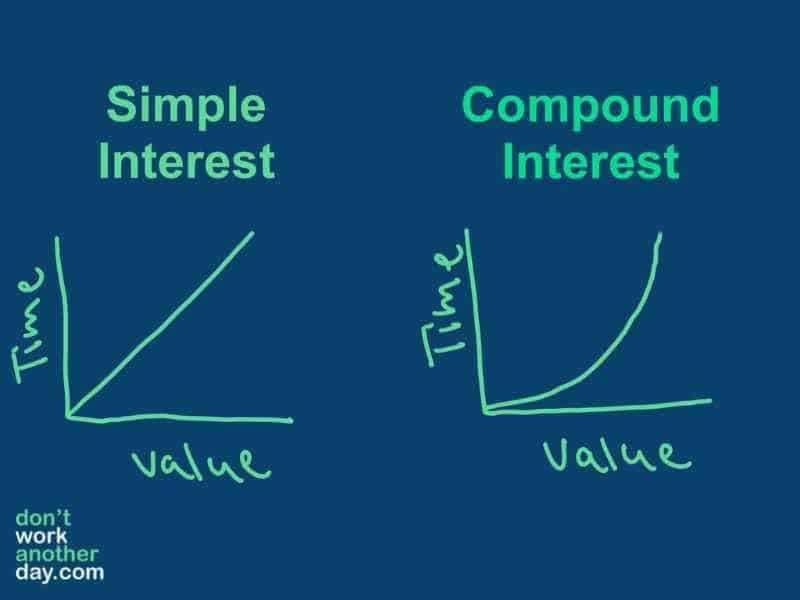

Simple Interest vs Compound Interest

There's a big difference between simple interest and compound interest. The obvious difference between the two is that you won't see the exponential growth that compound interest provides.

With simple interest, you'll see a straight line slope of your money. With compound interest, your growth chart should have a large curve towards the end.

With simple interest, you only generate interest of the money you originally invested. With compound interest, you'll earn money on the money you invest plus you'll earn interest on the interest you earn.

How to Earn Compound Interest Daily

There are many investments that pay compound interest daily.

The safest and easiest account is a high yield account through Tellus. You'll earn interest daily at an attractive rate and you can get started with just $100.

Earning compound interest daily can help you reach your financial goals much quicker.

What Investment Has the Highest Compound Interest?

Some of the highest compound interest investments include:

- Crowdfunded Real Estate

- Rental Properties

- Index Funds

- ETFs

- Mutual Funds

While there are many other options to consider, these account have the highest compound interest.

How to Manage Your Investment Portfolio for Good Returns

When it comes to managing your investments, it’s all about risk verse reward. For investments with lower risk, you’re likely to see smaller returns. As an investor, your goal is to find investments that maximize your returns while limiting risk.

The best way to limit risk is through diversification.

In simplest terms, this means not putting all of your eggs in one basket.

When investing, this means using a variety of investments in the case that one specific investment fails, your others will be there to prop up your entire portfolio.

By combining safe and volatile investments, you’ll get the best of both worlds.

A well-diversified portfolio will feature a variety of asset classes and investment choices that I’ll explore below.

It's also essential to track your performance when making any investment. I recommend using a free platform like Personal Capital to manage all of your investments in one dashboard.

- How to Turn 10k into 100k

- How to Live Off Dividends

- Best Tangible Investments to Build Wealth

- Best Appreciating Assets

- How to Invest $100k to Make $1 Million

How Much Money Can Compound Interest Make?

Depending on your initial investment, you can generate thousands of dollars each month in compound interest.

Compounding interest takes time. The longer you let your money grow, the more money you will generate.

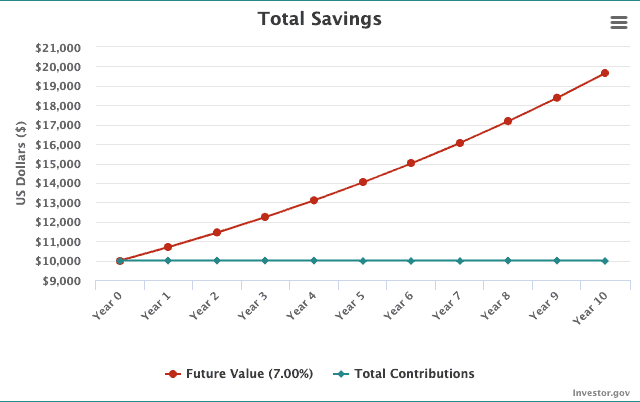

Take a look at this chart to see the true power of compound interest. You’ll notice that the increase is small at first, but accelerates exponentially in later years. The accumulated interest in the later years is worth the entire portfolio at the beginning.

Depending on your financial goals, it’s possible to make millions annually in compound interest alone.

But remember, past performance is no guarantee of future results. You should only invest what you can afford to lose.

Need more help?

Let's take an example to help you better understand how compound interest can help you get rich.

Let's say you invest $10,000 into a a well-diversified index fund. Assuming a 7% annual interest rate, after the first year, your account would be worth $10,700. Not bad!

But where the magic really happens is after the first few years.

After the second year, your account value would be $11,449. Remember – you only invested $10k meaning you've made $1,449 in interest alone.

After the third year, your account would be valued at $12,250. You’ve now generated $2,250 in compound interest.

Can You Get Rich Off Compound Interest?

Yes!

Compound interest is one of the smartest financial moves you can make to get rich and build long term wealth.

Because your money will grow exponentially over time, you can make a tremendous amount of money from your compounding interest.

Where Can I Put My Money to Earn the Most Interest?

Wondering which accounts will earn the most compound interest?

Acorns is one of the best investments you can make to earn interest. With a Acorns account it's possible to earn over 10% annually from your investments. As a bonus, you'll get $10 completely free to invest when you create a new account.

Another great place to put your money to earn interest is in Acorns through an index fund or ETF. This investment will return around 10% annually, making it a great option to earn interest and grow your net worth.

How to Calculate Compound Interest

The formula to calculate your compound interest is:

A = P(1+ (r/n))^nt

P = the principle investment

R = the interest rate of your investment

N = the number of times per period your investment is compounded

T = the number of time periods

Now let's put the formula into action.

Let's say you invest $5,000 in the stock market with an average return of 8% annually and you keep your money invested for 5 years.

Our formula would look like this:

5,000(1+.08/1)^(5*1)

After doing some math, your compounding returns would equate to $7,346.64.

Accounts that Pay Compound Interest

Not all of the methods listed above pay strict compound interest. For some of them, the gains are made through increase in value. Below are some of the best compounding interest investments that pay interest.

- High yield savings account

- Money market accounts

- Certificate of Deposits

- REITs

- Bonds

Do Banks Offer Compound Interest Accounts?

Many banks will offer a compound interest account like a savings account for you to open. My favorite bank account is through CIT Bank where you can earn as much as 10 times the national average in compounding interest.

Why You Need Compound Interest Investments

Some personal finance experts harp on the benefits of compound interest. And for good reason. It's a great way to build wealth and make money doing nothing.

Reach Financial Freedom

If you're on a journey to financial freedom – compound interest investments will be critical to reaching your goals.

Making routine monthly contributions to your investing accounts will be essential to build wealth.

Because your investments will fuel your future life, investing in compound interest assets is vital to your success.

To reach financial independence, you should assume a 4% withdrawal rate each year from your investments to live off of.

Related: Best Ways to Invest $500,000

Save for Retirement

Another reason you need compound interest is for your retirement savings.

Each time you deposit money into a retirement account your future self will thank you.

Between an individual retirement account and a 401k – you have a few options to for your retirement savings to grow your money.

Build Passive Income

Maybe your financial goals aren't necessarily to retire early or save for your retirement, but you just want to make more money.

By building passive income streams you can earn cash each month without having to work for it. This is a great example of making your money work for you.

The interest you can make from your investments can be enough to buy a new car, perform a home upgrade, or something else.

Where to Invest for Compound Interest

Some of the best places to get compound interest include real estate investing with Realty Mogul, investing in dividend stocks with Acorns, opening a high yield savings account with CIT Bank, and investing in small businesses with Mainvest.

How to Invest in Compound Interest

There are many different ways you can invest in compound interest. Here's exactly how to get started with real estate:

- Open a free Realty Mogul account

- Make your initial deposit and invest in a REIT

- Watch your compound interest accumulate!

If you want to invest in compound interest through the stock market, here's how to get started:

- Open an account with Acorns or M1 Finance

- Make an initial deposit

- Invest your money into an index fund or ETF

- Watch your wealth grow over time!

Best Compound Interest Stocks to Consider

Stocks can be an excellent compounding interest investment that you should certainly consider for your portfolio.

While I always recommend investing in more diverse assets like an index fund or ETF, there are a few stocks that are great for earning compound interest.

Some of the best compound interest stocks include:

You can purchase all of these stocks with an app like M1 Finance or Acorns. Don't forget to claim your free welcome bonus to get started!

Best Compound Interest Mutual Funds

Just like investing in individual stocks, there are also many great mutual funds to earn compounding interest when you invest.

Some of the best compounding interest mutual funds include:

-

Fidelity 500 Index Fund (FXAIX)

-

Fidelity Growth & Income (FGIKX)

-

Schwab Fundamental U.S. Large Company Index Fund (SFLNX)

Don't worry – we hate spam too. Unsubscribe at any time.

Final Thoughts on the Best Compounding Interest Accounts

Investing your money into compound interest accounts is like making free money.

There are many types of compound interest investments, but my favorite is investing in stocks. There is not one right answer for each individual, however. You'll want to consider your personal situation before choosing an option.

The best compound interest investments include:

- Index funds with Acorns

- ETFs

- Crowdfunded Real Estate with Realty Mogul

- Alternative Investments

- Rental Properties

- Commercial Real Estate

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

How to Invest 10k in Real Estate – Simple & Easy Methods (2024)

Looking to invest $10k in real estate? Check out these simple real estate investments to grow your wealth and make money!

How to Invest $25k: 19 Safe Methods (2024 Guide)

Want to learn how to invest $25k? Check out these best investments to make money and build wealth easily!

24+ Best Investments That Pay Monthly (Ultimate 2024 Guide)

Looking for investments that pay you every month? Check out this complete list of investing options to consider.

How to Make $500 a Day – Legit Methods (2024 Guide)

If you want to make $500 a day, give some of these creative ideas a try to grow your income and make more money.