It’s never easy to make money. There is a ton of competition in any market where money is available to be made, so you have to work harder than the rest if you want to come out on top. Once you make some money, it’s tempting to just let it sit in a savings account as you actively try to earn more.

But is that the best strategy?

What if the money you have already made could work for you, earning even more as time goes by?

This is what most people refer to as investing, as it’s a strategy that you should consider as part of your overall approach to money management.

In this post, I'll explore how to make your money work for you, ways you can make your money work for you, and how you can get started investing. Let's get started.

What Does It Mean to Make Your Money Work for You?

Before we dive into our list of ideas on how you can make money work for you, we first need to define this topic a bit more clearly.

If you have never before entered the world of investing, it can be rather intimidating as you try to get started.

First, the expression ‘making your money work for you’ means nothing more than attempting to use your money to make more money.

This is in contrast to a typical labor arrangement, where you do some kind of work in exchange for money. If you go to your job and work for 8 eight hours, and you are paid $20 per hour, you have traded 8 hours of your time (and effort) for $160.

Using your money to make money is a little different.

Rather than working, you pick an area to invest money you have already earned in the hopes that more money will be returned to you at a later date.

The possibilities for investments are nearly endless, and we will get into many of those later in this article.

To make sure we are perfectly clear on what it means to have your money work for you, we can use one specific example – gambling. If you go to a casino and put $100 down on the roulette table, you are attempting to use that $100 to win more money. After the wheel spins, you will either have lost your $100, or you will have won an amount in excess of $100 (depending on the type of bet you placed).

Of course, simply gambling at a casino is not an advisable investment strategy, but the concept is the same. You are using money you have in an attempt to get more money. It is simple enough in theory, but the practice of investing can get extremely complicated.

If you've ever heard of the phrase “passive income”, that's exactly what making your money work for you is.

18 Ways to Make Your Money Work for You

With the definitions out of the way, let’s get down to the business of identifying some popular investment strategies and some of the best compound interest investments.

Before getting started with any new investment, be sure you understand what you are doing and consider getting professional help if you are confused about any aspects of the investment.

Also, it’s a good rule of thumb to only go into investments with money that you can afford to lose. Even relatively safe investments do carry some degree of risk.

Invest in the Stock Market

This is what most people think of first when they think about starting to invest. By purchasing some shares of a given stock, or a collection of stocks, you can tie your profits and losses to the fortunes of specific companies. It’s possible for you to own a small piece of any publicly-traded company – including some of the largest corporations in the world.

There are pros and cons to investing in the stock market as an individual. On the plus side, it is possible to make significant gains over the long run – and you might even record some big gains on a relatively short timeline.

With that said, the stock market is notoriously volatile, and the welfare of your stock investments can be influenced by factors completely outside the control of the businesses you choose.

For most people, it’s best to invest in the stock market with a long-term perspective in mind. If you are only wanting to be invested for the next couple of years before taking your money out of the market, stocks might not be right for you. You'll want to know your risk tolerance before you start investing.

It’s entirely possible that the stock will decline in the short term, even if it does end up making gains in the long run. So, you could go to retrieve your money in a couple of years only to find that there is less available than when you started.

One of my favorite ways to make money in the stock market is by investing in mutual funds or index funds. These investments can be thought of as a group of well-diversified stocks and other holdings that appreciate over time. Mutual funds are a great option for rookie investors to generate passive income because they don't require much thought to get started.

My favorite platform is Acorns. With Acorns you can have money automatically invested for you so you don't have to do any work. Use the link below to claim a free $20!

If you aren't sure what to invest in, check out these ways to invest and make money daily!

Invest in Real Estate to Make Your Money Work for You

Real estate is another popular investment class and a prime example of an appreciating asset.

Some people prefer real estate for the simple reason that it is a tangible investment – if you buy shares of stock, you never actually hold anything in your hands. It is just numbers on a computer screen from the time you buy to the time you sell.

With real estate, you can stand on your property, make improvements, etc. It feels like you own something real, because you do.

Also, real estate does tend to appreciate over time. If you are a homeowner, you have already invested in real estate, even if you saw that transaction more as acquiring somewhere to live rather than a financial planning move. There are never any guarantees in real estate investing, but properties often gain value over time.

The major hurdle to deal with when talking about real estate investments is the cost.

Unlike with stocks, where you could get into the market for a small initial investment, buying real estate is a different matter. While you can have multiple mortgages, you’ll need to invest significantly to buy land or a building, and there are plenty of other related costs to consider. This strategy is really only viable for someone who is already in a strong financial position.

With that said, if you can afford this method of investing, the rental income you generate can drastically improve your financial situation.

Investing in real estate has become much more accessible in recent years with the ability to invest in crowdfunded real estate assets using various platforms to earn money and grow a passive income stream.

Some of my favorites include Arrived, Realty Mogul, and Peerstreet. With these platforms, you can put your money to work in real estate without having to take on a mortgage, come up with a down payment, or deal with the headache that comes with tenants.

Investing in real estate is an awesome way to earn interest on your money and reach your financial goals. When compared to other ways to grow your money, real estate tends to have stronger returns and is a great long term strategy to build your portfolio.

There are plenty of options when it comes to real estate investing. You could choose to invest in a single family home, apartment complex, or commercial real estate to build real wealth.

Invest in REITs

A REIT, or real estate investment trust, is a for of real estate investing in which properties are managed by a company that you invest in.

The company will use your capital to invest in new properties, perform maintenance on current properties, or complete a variety of other tasks.

REITs are a great option for those looking to grow their money who don't a significant source of cash to invest.

You can invest in many REITs for less than $50, making it a great method for your money to work for you and they are a great income producing asset you should consider.

Invest in Art to Earn Residual Income

Art investing is a newer form of investing that can be a great way to earn money and grow your investment accounts while also diversifying.

With platforms like Yieldstreet, your portfolio can grow exponentially thanks to the returns from your investment.

Use the link below to create your account and get started art investing today!

Open a Cash Back Credit Card

There's no easier way to make your money work for you than by earning cash just by spending the money you normally would.

By opening a cash back credit card, you can earn a couple of hundred dollars per year in rewards for your normal spending.

There are many credit cards available, most of which will offer some percentage of cash back. It is common to earn anywhere from 1% to 2%. Some credit cards may offer rotating categories in which you can earn 5% cash back for spend on select purchases. If you can find a card with categories that you spend a significant amount in, this might be a perfect option.

Budget Your Money

Budgeting is the first step in making your money work for you. After all, if you spend every dollar you have, you can't make it work for you!

Budgeting starts with analyzing your finances to better understand your income and expenses. Once you have mapped out where your money is going, you can opt to cut back in certain areas to save money.

If you go to your job and work for 8 eight hours, and you are paid $20 per hour, you have traded 8 hours of your time (and effort) for $160.

This savings can then be invested so that it works to make more money for you!

Invest in a Small Business

If you would like an active approach to investing, consider investing in a small business. This could mean starting your own business on the side of your regular job, or it could be investing in a business owned by someone else (perhaps a family member or friend).

One of the exciting things about investing in a small business is the opportunity to have an impact beyond just a financial gain.

You’ll still want to make money, of course, but you might be able to do so while doing something that helps put others to work, improves your community, etc. If you can manage to get involved with a business venture that both makes money and is related to a personal passion or hobby, that would be a win-win situation.

Starting a business is an excellent way to develop a new income stream to make your money grow. Depending on the amount of cash flow your business produces, you can consider putting some of your profits in an investment account to make your money work for you even further.

Invest in Retirement Accounts

This is a great place to get started with your investment experience.

Retirement accounts including a 401k or IRA are an attractive option for many people because they are low risk as compared to other options, there are often tax benefits available, and they can help set you up for an improved quality of life later on.

If you have never been involved in any other kind of investment, starting with a retirement account is a great way to go.

You won’t have to learn a lot of complicated jargon to get started, and you will be establishing something that can serve as the base for your overall investment strategy as you continue on. Even if you decide to try some riskier types of investments later with some of your funds, you will want to continue to build these retirement savings in the background.

The notable drawback here is the limited return on your investment. Simply put, you aren’t going to get rich overnight by investing in your retirement accounts.

That doesn’t mean you shouldn’t do it, but you do want to manage your expectations and know how these accounts are likely to play out.

Instead of looking for a windfall, you should be using these accounts for steady, long-term growth that can augment other types of investments.

When you put your money into a 401 k, you can often get free money through a company match. Many companies will offer a 401 k match to incentivize employees and retain them. Depending on the company, it's possible to get anywhere from a 50% to 100% match on your 401 k contributions.

If your company doesn't offer a 401k plan, but you still want to invest in a retirement account, opening a Roth IRA is a great option. With this account, you'll contribute post-tax income that will grow tax-free. You can open a Roth IRA through many common brokerages.

Unfortunately, both Roth IRAs and 401ks have a contribution limit. These limits change each year and can be found on the IRS website here.

Deposit Money into a High Yield Savings Account

Another low risk option as you get started in investing is to put money into a savings account with a relatively high yield.

These days, if you keep your money in your standard savings account that comes along with your checking account at the bank or credit union, you are probably getting almost no return. Those kinds of savings accounts used to offer a pretty good yield, but that is no longer the case.

With that said, you can find some offers for savings accounts that bring you a respective return each year with higher interest rates. Just like with retirement accounts, this is not a strategy that you’ll use if you are hoping to get rich. It is, however, another ‘building block’ that you can use to solidify your financial life and expand your portfolio of accounts.

Depending on current market conditions, you might be able to get higher interest rates than your 30 year mortgage.

Gradually adding money to a high yield savings account every month is going to allow that balance to grow and hopefully reach the point where it is a meaningful part of your overall collection of assets.

A savings account is the perfect place to store an emergency fund because of its security.

My favorite bank account to grow your money is through CIT Bank. You can earn as much as 10 times a traditional savings account with very little effort. Register below to open your free account!

Open a Money Market Account or CD

For this point, we are continuing with the theme of investment strategies that fall into the category of lower risk. Opening a money market account, which has features from both savings and checking accounts, may yield a slightly higher return than your standard account, while still keeping your money available.

A CD – or certificate of deposit – is a little different. With a CD, you commit to tying up your money for a set period of time in exchange for a return. These days, CDs offer pretty modest returns, but they are a place to park money that you don’t plan to use anyway over the given time period.

Open a Bank Account That Pays Interest

This might seem crazy, but there are some bank accounts that pay you interest on your deposits every month.

My favorite is SoFi. With my SoFi checking account, I earn free month every month – making it a perfect way to make passive income.

Pay Off Debts

Sometimes, the best way to invest money you have available is to pay off debts that are weighing down your financial life. For instance, if you are carrying a balance on one or more credit cards, or if you have a loan out on a car, you might wish to pay off that debt before thinking about any other investments.

The key here is to weigh the cost of your debt against the return of a potential investment. If we are talking about credit card debt, you’ll almost certainly be better off paying down the balance than taking another investment opportunity. This is because credit cards come with very high rates of interest, making it very difficult for your investment to return more than would have been saved by paying off the card balances.

You might find that the math is a little different with something like a car loan, however. If your loan only has a rate of 3%, and you expect a given investment to return a rate of 5%, it may be better to take the investment opportunity and keep paying on your car loan monthly. Before paying off any debt, do the math and determine what is the best path forward.

When it comes to personal finance, you need to know what works best for you. Paying off debts is a great option for many people. With the rise of student loans, paying off debt is vital.

Invest in Gold

For a traditional investment strategy, you can always look toward gold. This is one of those assets, like real estate, that tends to appreciate steadily over time. Also, if you choose, you can purchase gold that you can actually hold in your hands, which might be appealing if you tend to prefer tangible assets.

As you think about investing, it’s always good to think about an overall portfolio, rather than just one specific investment. This is where gold can be a great piece of the puzzle, as a piece of your bigger investing plan.

You probably won’t want to sink all of your available investment funds into gold, but it can plan an important role in the portfolio that you start to build.

Invest in Bonds

When you invest in bonds, you are basically offering a loan to an organization that has agreed to pay back that debt on a specific schedule. Bonds can be sold by businesses, and they can also be sold by government agencies. Commonly, bonds will pay out twice per year, so you’ll get a predictable stream of income from this investment until the bond reaches maturity and the debt is repaid.

It is the predictable nature of bonds that makes them an attractive addition to a portfolio. If you choose to participate in some more volatile investments that come along with a significant degree of risk, bonds can be a good way to offset that risk and add something more reliable.

The potential gains from a bond investment won’t rise to the level of your riskier ventures, but they can serve as a good foundation for an overall strategy.

Invest in Peer to Peer Lending

Peer to peer lending can be a great way for your money to work for you. Why? Because there is no work involved at all!

Just loan some of your money out to a peer and you'll accrue interest over time. To invest in peer to peer lending, there are several platforms available.

The amount of money you can make with peer to peer lending depends on how much money you have to invest and your risk tolerance. Those who are deemed more risky will offer a larger interest rate than a safer borrower.

Invest in Cryptocurrencies

Cryptocurrencies are considered by some to be an investment but others deem is as a speculative holding.

At the moment of writing this post, Bitcoin (the most popular cryptocurrency available) has toppled $41,000, an increased of 918% over the previous year.

However, investing in cryptocurrency comes with high risk. You've probably heard wild stories of how much money people have made or lost with cryptocurrency. In 2017, this man invested much of his his life savings into cryptocurrency, before losing the majority of it in the crash of 2018.

Bitcoin and other cryptocurrencies routinely trade with swings of 10% or more throughout the day.

As cryptocurrencies gain adoption, many people think that it will continue to increase in value giving you the potential to invest and make money daily.

If you're ready to get started, I recommend using Binance. It's free to open an account.

Invest in Yourself

This last point on our list is a different kind of investment – but it could potentially offer the biggest payoff of all.

Instead of parking your money in one of the investment categories we’ve talked about above, you could use those funds to pursue personal development in the form of new skills or certifications.

Expanding your skill set can pay dividends for your future.

For instance, if you are already working in a steady career – but you have gone as far as you can go without gaining new skills – spending money on training might offer a better return than any other type of investment. If the money you spend on training or education leads to a much larger salary in the future, that could be an outstanding investment.

In other words, it's important to make investing in yourself a priority to achieve financial freedom.

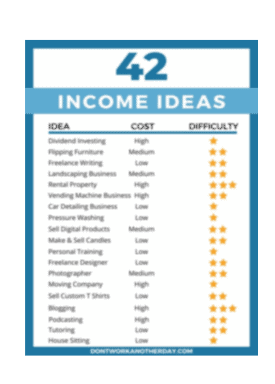

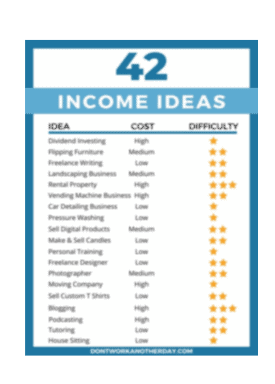

Start a Side Hustle to Build Wealth

While a side hustle isn't technically a way to make your money work for you, you can use the additional income to invest or pay down debt.

There are many side hustles to boost your retirement fund, reach financial stability, and pay down credit card debt.

For example, registering for survey sites like InboxDollars or Swagbucks will give you essentially free money that you can use to earn residual income.

Some of my favorite side hustles include:

- Making money with your car or truck

- Starting a blog

- Freelance writing

Don't worry – we hate spam too. Unsubscribe at any time.

How Much Money Do You Need to Start Investing?

It’s a commonly held belief that you need to have a large sum of money available before you start investing. That’s simply not the case.

Now, more than ever before, there are many different investment options available to you for a small initial commitment. In fact, there is no limit on the low end – whatever money you have that you would like to invest, you can find a way to put that money to work.

Of course, you can’t expect to make huge gains by only investing a small amount.

If you invest $100 and get a return of 10% in the first year, that’s a good performance – but you will only have made $10. If you are going to start small, consider setting aside an amount that you can afford each month to add to your investment.

Over time, by adding small amounts months after month, you can build up a meaningful investment that could impact your financial life in a positive way.

Final Thoughts on How to Make Your Money Work for You

The power of investing is an amazing thing, but it won’t go anywhere until you get started. If you aren't quite sure how to make your money work for you, there are plenty of options.

Each day that goes by may be a missed opportunity to grow your money. Most investments take time, so getting started as soon as possible is essential to making your money work for you.

Only choose investment strategies that you are comfortable with, and that you understand. A smart financial plan doesn’t involve taking on crazy amounts of risks – it’s all about careful planning and charting a path toward a solid financial future.

There are plenty of options to grow your money between investing in stocks, high yield savings accounts, and real estate. What're you waiting for?

Don't worry – we hate spam too. Unsubscribe at any time.